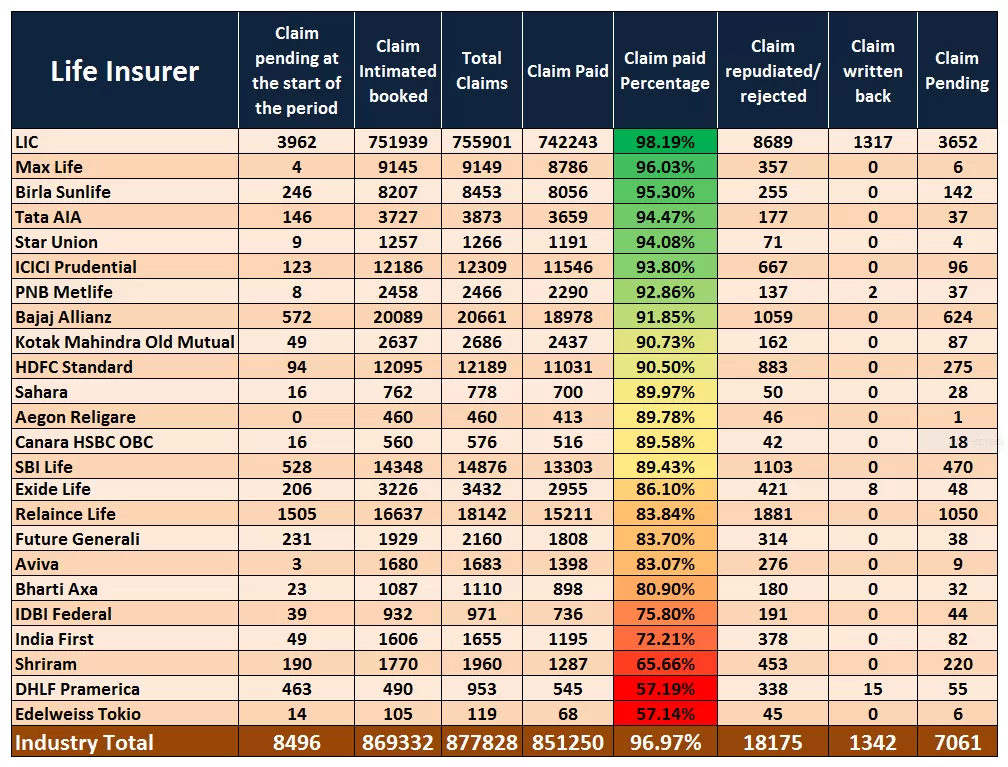

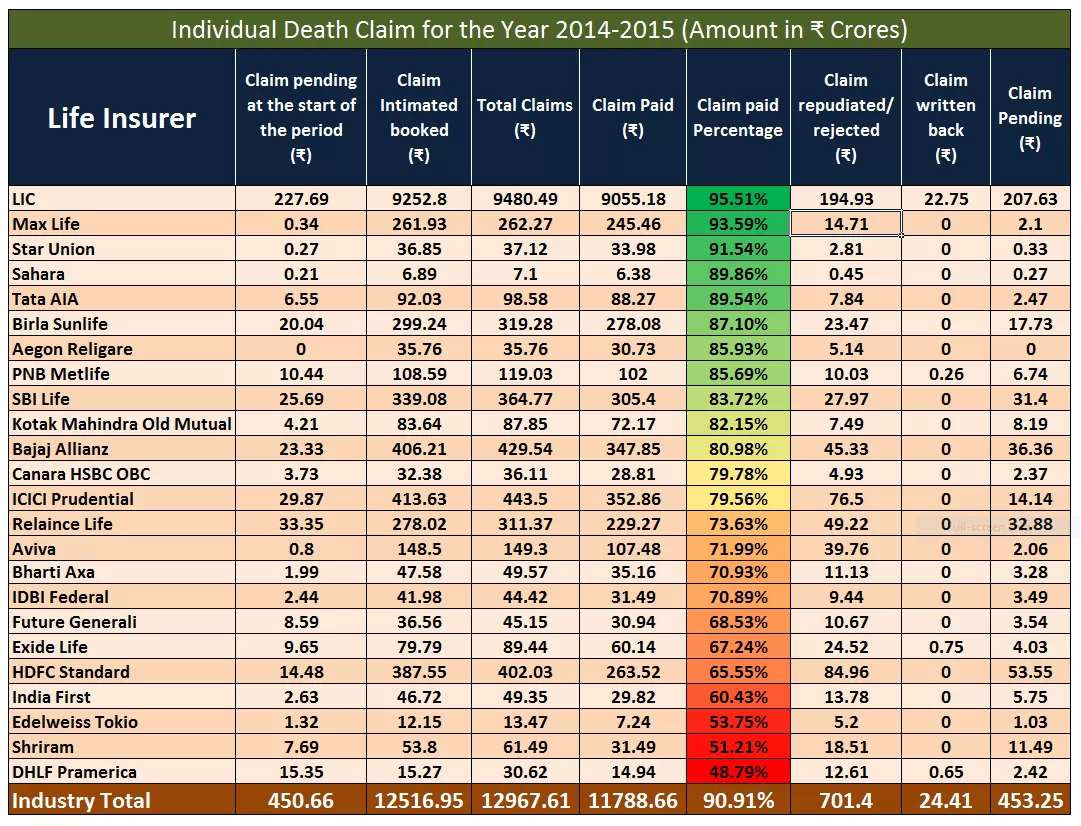

Insurance Regulatory and Development Authority of India (IRDAI) have published its annual report of year 2014-2015 on 19/01/2016. Along with all the other data related to life insurers, general insurers and health insurer, IRDAI have also published the data related to individual death claim settle by all the 24 Life Insurance companies in year 2014-2015.

Individual death Claim Settlement Ratio of Life Insurers

Death claim settlement ratio is the percentage of claim settled by a life insurer out of the total claim raised in a particular year. In year 2014-2015, the industry average of death claim settlement ratio was 96.97% in numbers and 90.91% in amount. If we look at the private life insurers the average was 89.40% for numbers of claim settled, while 78.39% of claimed amount paid by private life insurers. Claim settlement ratio of state owned insurer, Life Insurance Corporation of India (LIC) was 98.19% of number of claim paid and 95.51% of claimed amount paid in year 2014-2015.

Top Insurers on basis of higher death claim settlement ratio

In year 2014-2015, the industry average of death claim settlement ratio was 96.97% in numbers and 90.91% in amount. On number basis only one insurer ie LIC of India is above the industry average with 98.19% death claim settlement ratio after that, in top five are Max Life (96.03%), Birla Sunlife (95.30%), Tata AIA (94.47%) and Star Union (94.47%).

On the basis of amount of claim settled, industry average was 90.91%, and among the all insurer top five are LIC of India (95.51%), Max life (93.59%) and Star Union (91.54%) which are above the industry average, while other two in top five are Sahara (89.86%) and Tata AIA (89.54%)

How does death claim ratio help policy holders?

Ultimate motive of buying a life insurance by a customer is to provide a financial security to his/her dependent after untimely demise of the life assured. Death claim ratio provide a view about a insurers ability to pay the claim and its ratio of rejection of claim. Though majority of claims which are repudiated are due to suppression of material facts by life assured at the time of taking policy, but higher rejection ratio reduces the credibility of insurer. A low rejection and outstanding in number but higher in amount show that an insurer is not able to pay claims of higher sum assured policy on time. This ratio help the policy holder to choose a good life insurer for taking a life insurance policy.

To download the full annual report of IRDAI please Click Here