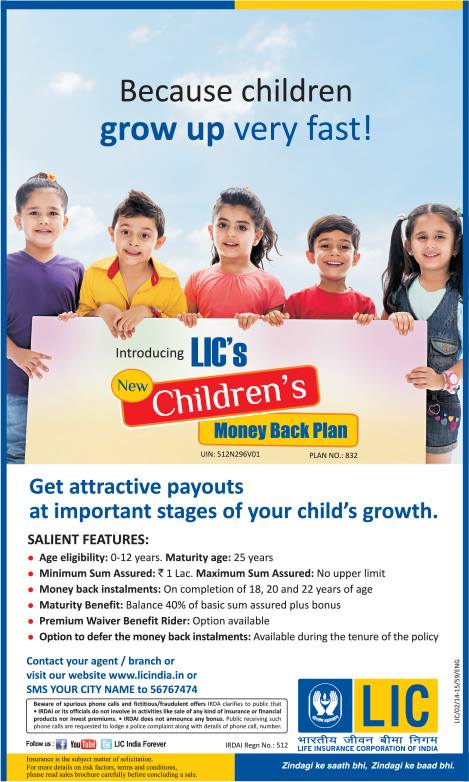

LIC of India’s new plan Children Money Back Plan (Table No. 832) provides money back at policy anniversary coinciding are falling after 18th, 20th and 22nd birthday. Money back is equal to the 20% of the basic sum assured in the policy. But many people don’t like the money back policy want the endowment plans so that they can get a lump sum amount after a fixed interval of time.

The New children money back plan has a unique feature to reinvest the survival benefit with LIC itself and later it can be taken with interest already decided by LIC.

Survival benefit can be differed up to the date of maturity or a period before that, period for interest calculation will be taken in full completed months. To reinvest the survival benefit, customer has to give his/her consent for reinvestment of survival benefit before 6 months of survival benefit due date. Customer will not have to mention deferment period before, he/she has a option to take the survival benefit when ever they want but before the date of maturity, and if not taken back before date of maturity it will be paid back (with interest) with maturity value.

All the three survival benefits can be differed, maximum deferment period for 1st survival benefit is 84 months, for 2nd 60 months and for 3rd survival benefit 36 months.

So if you want to buy endowment plan or a children money back plan for you child, you can buy the LIC of India’s New Children Money Back Plan (Talbe No. 832). You can also calculate the future value of your differed survival benefit provided calculator below.

Change the sum assured (in multiple of Rs. 10000) and month field to know the future value of differed survival benefit.

Hi