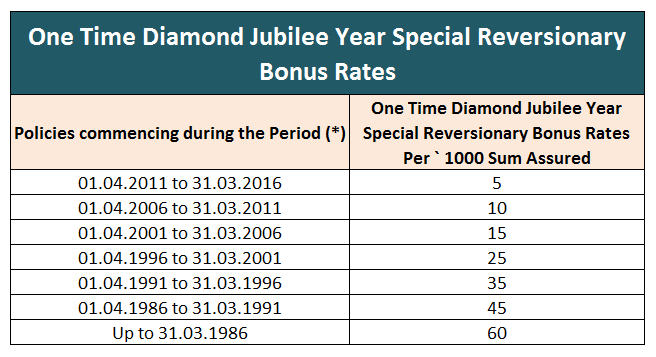

Life Insurance Corporation of India has declared the Bonus rates for the valuation period 1st April 2015 to 31st March 2016. Along with it, LIC has also declared the one time Diamond Jubilee Bonus for its policyholders. Diamond Jubilee Bonus is declared from Rs. 5 per thousand sum assured to Rs. 60 per thousand sum assured. It mainly depends on the time of inception of the policy.

Diamond Jubilee Bonus

Which policies are eligible for One time Diamond Jubilee Bonus?

The One Time Diamond Jubilee Year Special Reversionary Bonus Rates payable per Rs. 1000/- Sum Assured [Cash Option in case of New Jeevan Suraksha I (Plan 147) and New Jeevan Dhara-I (Plan 148), Death Benefit Sum Assured in case of Jeevan Madhur (Plan 182) & Premium Paid for Jeevan Amrit (Plan 186)] for policies in force as on 31.03.2016 and subject to below conditions are as under:

- The One Time Diamond Jubilee Year Special Reversionary Bonus Rates will be applicable for policies which were in force on 31.03.2016 by payment of full premium and eligible for regular reversionary bonuses and continuing in the books of the LIC of India on or after 01.09.2016. Therefore, One Time Diamond Jubilee Year Special Reversionary Bonus will not be payable to policies during the free cover period if free cover period started before 31.03.2016 even though policies are in force in such period.

- One Time Diamond Jubilee Year Special Reversionary Bonus will be decided in the same manner as simple Reversionary bonus rates are decided for the plan.

- One time bonuses (or their surrender value in case of surrender) will be payable under policies maturing or becoming death claim or surrendered on or after 01.09.2016. The date of death or the date of receipt of application of surrender will be taken to decide eligibility condition for One Time Diamond Jubilee Year Special Reversionary Bonus. The deaths occurring prior to 01.09.2016 and intimated later, policies maturing before 01.09.2016 and settled after 01.09.2016 and surrender applications received prior to 01.09.2016 but pending or settled on or after 01.09.2016 are not eligible for this One Time Diamond Jubilee Year Special Reversionary Bonus. Further, One Time Diamond Jubilee Year Special reversionary Bonus will not be payable for policies discounted back prior to 01.09.2016.

- Policies which are in paid-up condition or have lapsed without acquiring paid-up value as at 31st March 2016 will also be eligible for this One Time Diamond Jubilee Year Special Reversionary Bonus if they are later revived for full sum assured and otherwise eligible for reversionary bonus as per terms and conditions of the policy.

- The One Time Diamond Jubilee Year Special Reversionary Bonus is not payable to without profit policies, the policies under which guaranteed additions have been added during the inter-valuation period and policies under which loyalty additions are payable as per terms and conditions of the plan.

Disclaimer: For any ambiguity in details and confusion related to eligibility of one-time diamond jubilee bonus in your policy, please contact your concerned LIC servicing branch or contact any of these LIC Customer Zones.

Pl send me details

Dear Pawan Sir,

I had taken a policy in year 2003, Plan term was 75/20. The policy will mature in 2023. Will the Dimond Jubilee Reversionary bonus declared by LIC recently added to my Vested Bonus…….? Please guide me in this regard.

Dear Sir,

I have taken 2 policies for Rs.100000 each under Salary Savings Scheme in the Year 1995 date of Maturity was 23.02.2010 & 28.10.2010 Kindly let me know if I am eligible for the Special Diamond Jubliee Year bonus. I have also have a Master Policy No.GSCA 500973 I have been receiving of annunity after retirement from 01.02.2012 upto date is this policy eligible for the above said Jubliee year Bonus. Kindly guide me in this regard,Thanking you & Warm Regards

Whether the Jeeven Suraksha -Plan 122-E — policies are eligible for one time diamond jubilee bonus?

What is loyalty addition ? Whether the policy under the above scheme are eligible for it ?

JEEVANSHRI PLAN 112, 15-10; DECLAR DIMAND JUBILE BONUES ELIGABLE; MATURITY DTD DECEMBER 1916.oNE TIME BONUES ELIGABLE YES/ nO ?

jeevanshri plan 112, 15-10, declar dimand juble bonues eligable? my police maturity dt. 28 december 1916 one time bonues eligable as per declar lic 15% my police sum aassured amount not paid my final payment. police no. 870946512