On 15/12/2016 Insurance Regulatory and Development Authority of India (IRDAI) have published its annual report for the year 2015-2016. Along with all the other data related to life insurers, general insurers, and health insurer, IRDAI has also published the data related to individual death claim settled by all the 24 Life Insurance companies in the year 2015-2016.

Individual death Claim Settlement Ratio of Life Insurers

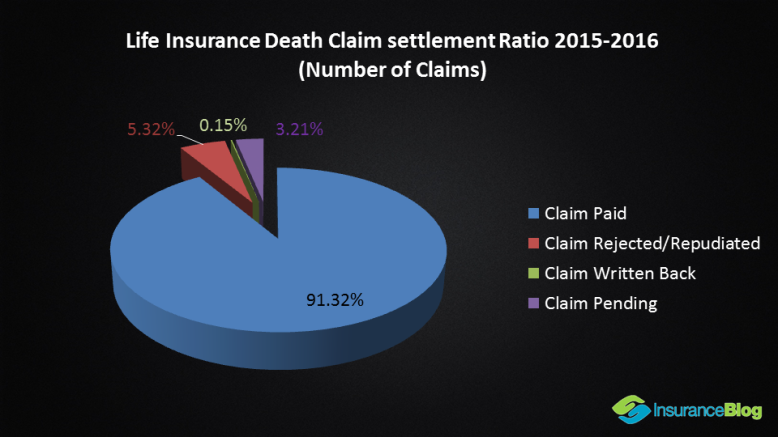

Death claim settlement ratio is the percentage of claim settled by a life insurer out of the total claim raised in a particular year. In the year 2015-2016, the industry average of death claim settlement ratio was 97.43% in numbers and 91.32% in amount. This year both the ratios are increased by.46% compared to 96.97% of last year in numbers and .41% increase in the amount paid compared to 90.91% of last year. In the financial year, 2015-2016 claim settlement ratio for private life insurers was 91.48% for numbers of claim settled, while 79.60% of claimed amount paid by private life insurers. Claim settlement ratio of the state-owned insurer, Life Insurance Corporation of India (LIC) was 98.33% of the number of claim paid and 95.59% of claimed amount paid in the year 2015-2016.

Life insurers having claim settlement ratio above industry average

In the year 2015-2016, the industry average of death claim settlement ratio was 97.43% in numbers and 91.32% in amount. Let us see how many companies were above the industry average:

In number of Claim settled in the year 2015-2016: Industry average- 97.43%

- Life Insurance Corporation of India (LIC): 98.33%

In Claimed amount settled in the year 2015-2016: Industry average- 91.32%

- Life Insurance Corporation of India (LIC): 95.59% (Rs. 9690.17 Crore)

- Tata AIA: 94.24% (Rs. 87.09 Crores)

- Aegon Religare: 94.16% (Rs. 40.15 Crores)

- Max Life: 93.19% (Rs. 261.91 Crores)

- Canara HSBC OBC: 91.37% (Rs. 30.05 Crores)

Claim settlement data of other life insurers is given below

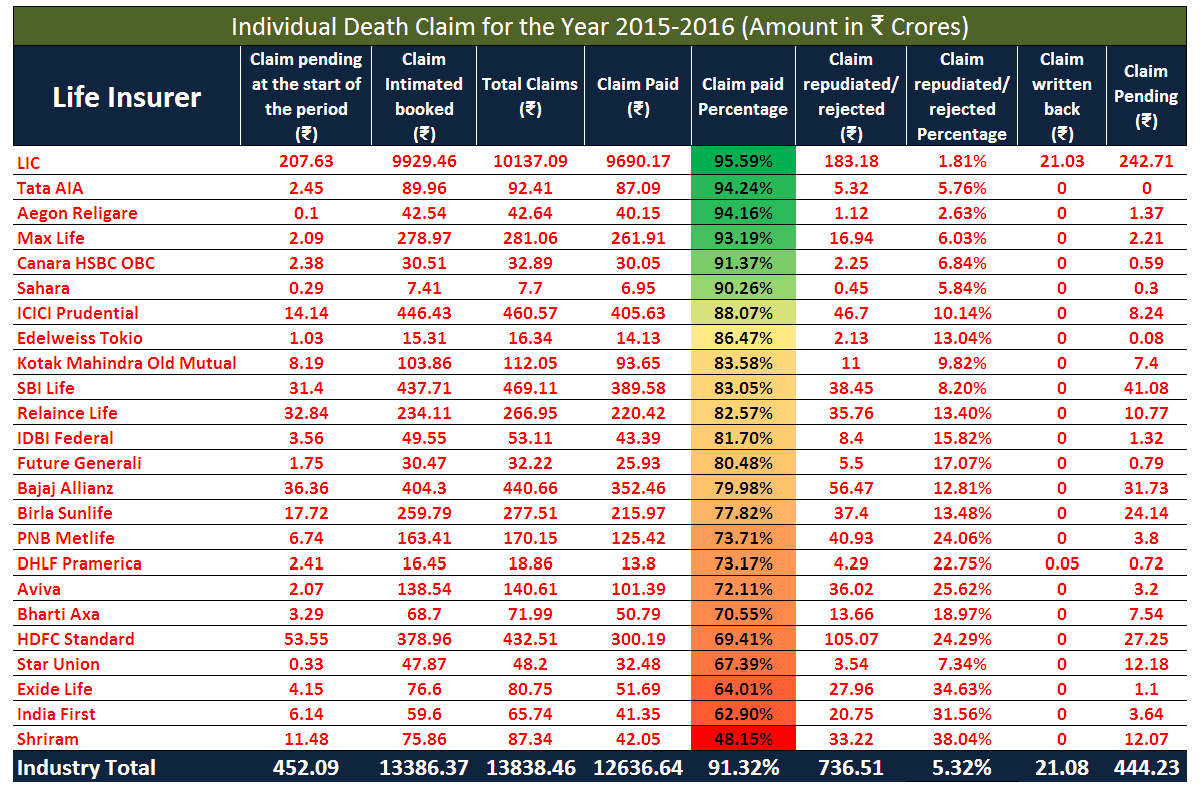

Individual death claims for the year 2015-2016 (Number wise)

Individual death claims for the year 2015-2016 (Number wise)

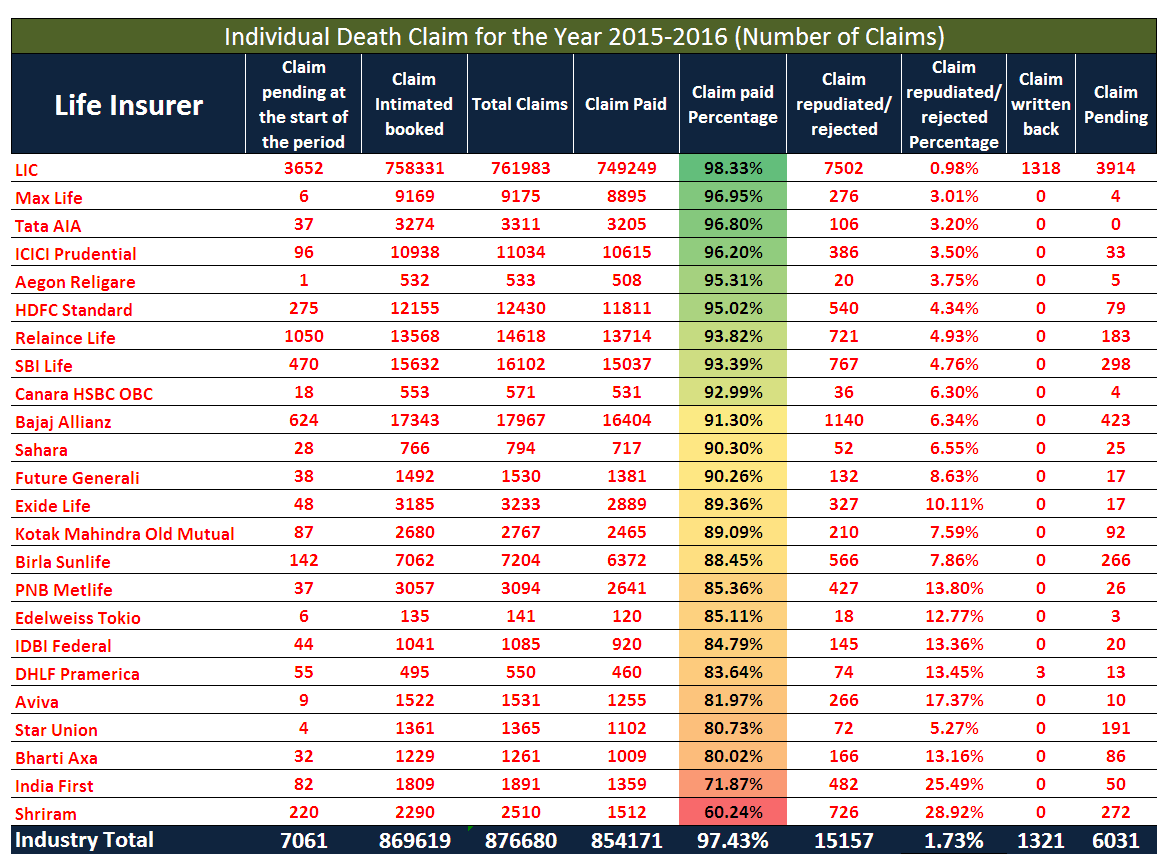

Individual death claims for the year 2015-2016 (Amount wise)

How does death claim ratio help policyholders?

Ultimate motive of buying a life insurance by a customer is to provide a financial security to his/her dependent after the untimely demise of the life assured. Death claim ratio provides a view about a insurer’s ability to pay the claim and its ratio of rejection of the claim.

- Though the majority of claims which are repudiated are due to suppression of material facts by the life assured at the time of taking policy, but higher rejection ratio reduces the credibility of the insurer and put a question mark on its underwriting practices.

- A low rejection and outstanding in number but higher in amount show that an insurer is not able to pay claims of higher sum assured policy on time.

- A Higher percentage is also not enough to compare insurer, life assured must also compare that what is the total amount the insurer is paying in that particular year and the total amount of claim arisen. Higher the amount higher the policies are being serviced by the insurer.

Though this ratio helps the policyholder to choose a good life insurer for taking a life insurance policy but this is not the only thing that a policyholder should rely on, he/she must also consider various factors like, insurers reputation in market, number of branches, servicing aspects, convenience of depositing premium and ultimately the conditions of the policy which they are buying.

To download the full annual report of IRDAI please Click Here