After the gazette notification issued by Insurance Regulatory and Development Authority of India (IRDAI) on 14/10/2015 for annuity plans offered by Life Insurers, LIC of India may soon withdraw or relaunch (with modifications) its Immediate Annuity Plan Jeevan Akshay VI.

The Authority may issue separate instructions for withdrawing the products which are not in compliance with these Regulations but are currently offered by the Life Insurers and which are approved by the Authority prior to the date of notification of these Regulations.-F. No.IRDAI/Reg/14/104/2015

In the gazette notification IRDAI restrict an insurer to pay or undertake to pay an amount of benefit excluding any profit or bonus on any policy of insurance issued, less than:

- Annuity of 1,000 per month

- Gross sum of 5,000 (Except under Micro Insurance and Health Insurance Business)

- Gross sum of 1,000 for Micro Insurance and Health Insurance Business:

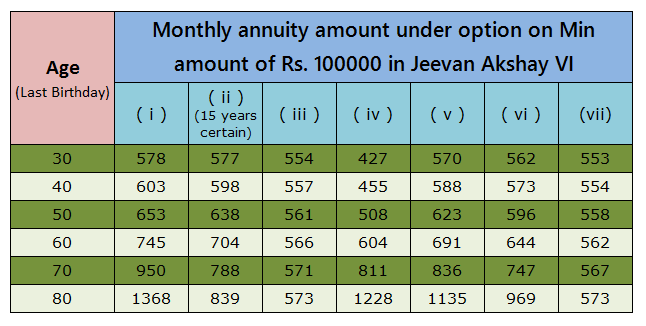

Jeevan Akshay VI is a immediate annuity plan of LIC of India, where annuity/pension is payable for life as per the option and immediately after a month or whatever the mode chosen by Annuitant. Jeevan Akshay VI policy is available for the age group between 30 to 85 years, with minimum premium of 100000 for policy taken offline and 150000 for policy taken online (Excluding Service tax). Monthly Pension in Jeevan Akshay VI policy on minimum amount ie 100000 is mentioned below

Options mentioned above are

- Annuity payable for life at a uniform rate.

- Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive.

- Annuity for life with return of purchase price on death of the annuitant.

- Annuity payable for life increasing at a simple rate of 3% p.a.

- Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

- Annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

- Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor.

To know more about the Jeevan Akshay VI plan and its benefits contact you LIC agent or visit your nearest branch. You can know more about Jeevan Akshay VI policy and buy it online Click Here

To read and download the gazette notification of IRDAI please Click Here

realy as agent upset on this news.pl reconsider.