This year LIC of India has declared Bonus rate for all its with profit policies before the usual time as LIC is celebrating its Diamond Jubilee year. Every year Actuarial Department of LIC do the valuation and declares the bonus rates. These bonus rates are applicable for policy year entered upon during the inter-valuation period i.e. 01/04/2015 to 31/03/2016 and in force for full sum assured as on 31/03/2016. It will be applicable to policies resulting from claims by death or maturity (including those discounted within one year of maturity) or surrendered on or after 01/01/2016.

Life Insurance Corporation of India has also declared the One time Diamond Jubilee Bonus.

Latest News: LIC Launched New Plan Bima Shree (Plan 848). Click the image or link to Know more

एलआईसी की नयी योजना बीमा श्री (प्लान न. 848)

एलआईसी की नयी योजना बीमा श्री (प्लान न. 848)

Latest: LIC of India’s Bonus rate declared for 2017-18

Final additional bonus (FAB) and Loyalty addition (LA) are also declared with reversionary bonus rate. FAB and LA are not applicable to each policy. They are paid as per the policy conditions and depend on the Sum assured and policy term.

How to calculate Bonus in your policy

Example: If you have a New Jeevan Anand Policy (Table No. 815), Sum Assured: Rs. 500000, Term: 21 years. Bonus calculations Formula: (Sum Assured/1000)*Bonus rates

Bonus in above mentioned plan: (500000/1000)*49 = Rs. 24500.

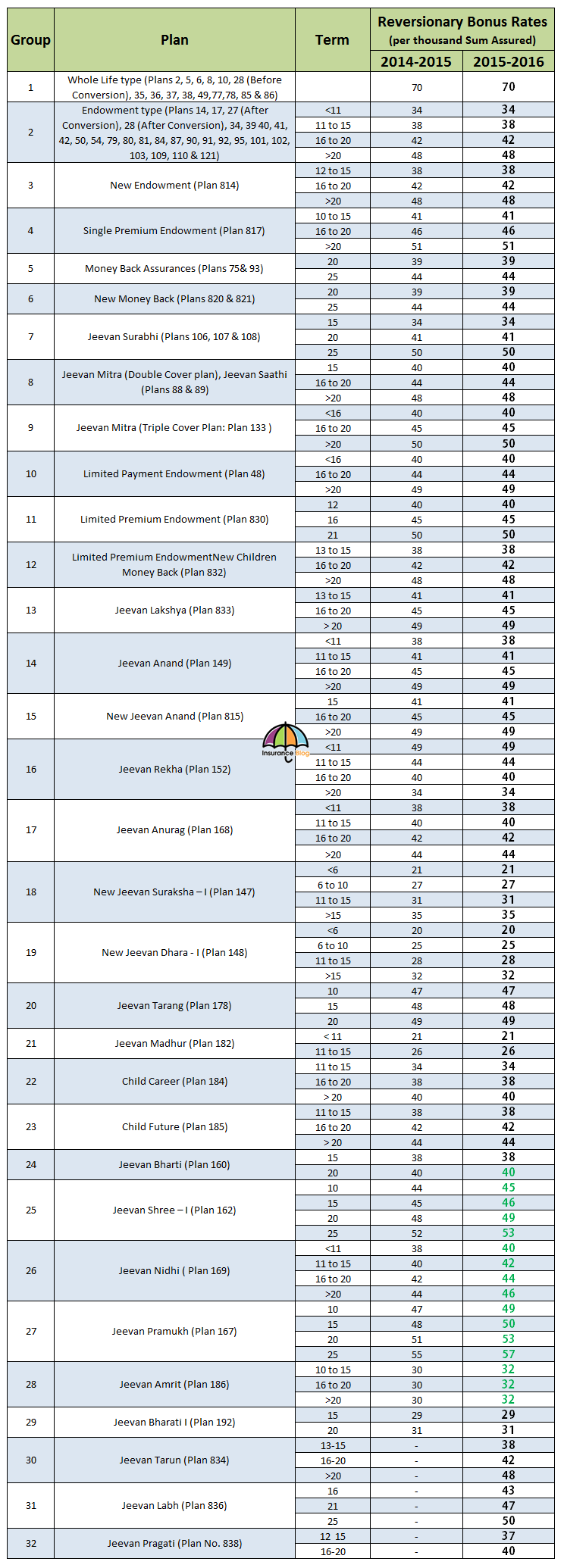

Bonus Rates declared by LIC of India

The rates of Simple Reversionary Bonus declared in respect of participating policies issued by Life Insurance Corporation of India are as given in the table below

The above reversionary bonus rates are applicable for policy year entered during the inter-valuation period i.e. 01/04/2015 to 31/03/2016 and in force for full sum assured as on 31/03/2016. Bonus rates will be applicable to the policies resulting from claims by death or maturity (including those discounted within one year of maturity) or surrendered on or after 01/01/2017.

No cash bonus rate has been declared in respect of New Jeevan Akshay – I (Plan 146).

For General Annuity / Pension policies (Plans 147, 148 & 169), the bonus rates are applicable only during the deferment period. The bonus rates in case of Plan 147 & 148 are not applicable for policies exiting by death during the deferment period. However, the cash value of bonuses is payable in case of surrenders during the deferment period.

No bonus has been declared for any other General Annuity or Pension plans.

Disclaimer: I have taken utmost care while entering the bonus rates, but in the case of error or any ambiguity please consult your LIC Branch.

today i got call from +911166252500 Mr. Rahul sHarma stating that i have divined of Rs. 187498.69 it should for agent but agent was not updating details so LIC going give full amount to customer so they asked the 5 policy details(like Policy No. premium year of policy) to get the amount i need generate customer ID so they requested for training i said as i am employee its not possible 2nd option they gave me open policy with exide life insurance for min premium of 32000 after making payment customer id will generate within few days, by the help of customer ID i can claim the 187498.69 and within 1 month the amount will return wihc was paid to exide by deducting 750/- rupees

so please guide me what it is

Is this Jubilee bonus additional to annual bonuses?

lic jeevan sral plan no 165 rate

LIC JEEVAN SARAL PLAN WILL PAY LOYALTY ADDITIONS AFTER MATURITY OF THE POLICY AND THIS IS NOT NORMAL BONUS BUT IT IS LOYALTY ADDITION WHICH WILL DEPEND ON LIC’S INVESTMENT PERFORMANCE FOR THIS PLAN.

What about Jeevan Shree (old) Table 112. I do not see any details for last two years. Can you please help me on this and provide the bonus and other details if any.

While checking my policy status online, I find that the new bonus details are not updated. When are they likely to be updated?

I AM POLICY HOLDER OF JEEVAN TARANG TABLE NO.178 WITH 20 YEARS PREMIMUM TERMS. PLEASE LET US KNOW AFTER COMPLETION OF PERIOD 20 YEAR I AM ELEGIBLE FOR TAKING BENIFIT OF SUM AMOUNT AND BONUS

I am Policy Holder Of Jeevan SARAL (Table No.165) With 20 Years Premimum Terms. Please Let Us Know After Completion of Period 20 Year I Am Eligible for taking Benefit of Sum Amount and Bonus

YES, UNDER JEEVAN SARAL PLAN, AFTER YOUR TERM AND PPT ARE OVER, YOU WILL GET THE SUM ASSURED PLUS LOYALTY ADDITIONS AND THIS WILL DEPEND ON LIC’S INVESTMENT PERFORMANCE.

HARISH KATIRA

I am getting calls from +919136216020 (Name: Ankitha Mishra, Mr, Guptha), informing that LIC is paying loyalty bonus of Rs. 170616 towards the policies taken by me. and asking for bank account number to transfer the amount. Then it was informed that LIC has invested 70% in HDFC, to withdraw the bonus amount I need to take a insurance policy in HDFC.

Please advise.

I can’t understand it. I have LIC money back plan running since 4.5 years, and I just started another LIC plan April this year. Am i entitled for the aforementioned bonus. does any one who has a policy irrespective of its nature eligible for this bonus?? Am I entitled for it as well? Please assist.

Bonus declared by LIC, I believe, is per thousand per year; confirm the same please.

Sir I Kunal Harsh ,have completed NOP=2 ,No.of lives=1 , FPI= Rs.117422 , from 01/01/2017 to 14/01/2017, my Agency month is December , will my Agency Year continue in 2018.

I have New Jeevan Shree(T. No. 151) Running into 16 year with one premium remaining and total maturity period of 25 year. Will I get Bonus and Loyalty Addition, If I surrender the policy now.

IF YOUR PPT PREMIUM PAYING TERM IS 16 YEARS AND YOUR TOTAL POLICY TERM IS 25 YEARS, AND IF YOU SURRENDER YOUR POLICY AFTER PAYING 15 YEARS PREMIUM, YOU WILL GET YOUR SURRENDER VALUE WHICH IS PAYABLE TO YOU TODAY.

YOU WILL NOT BE ENTITLED TO GET ANY FUTURE BONUS, FINAL ADDITIONAL BONUS, LOYALTY ADDITIONS, OR ANY RISK COVER IN FUTURE ONCE YOU SURRENDER YOUR POLICY TODAY.

HARISH KATIRA

why group number: 30, 31, 32 reversionary bonus rates are blank?

Because these products were launched in FY 2015-2016.

i have one policy for SUM Assured Rs.200000/- under table 165-JEEVAN SARAL. POLICY TERM IS 25 YEARS i took this policy in 2013. now i m 30 years old.

what will be the maturity value as per 25 year term and also wanted to know that after 10 years how much amount i wil be get ?