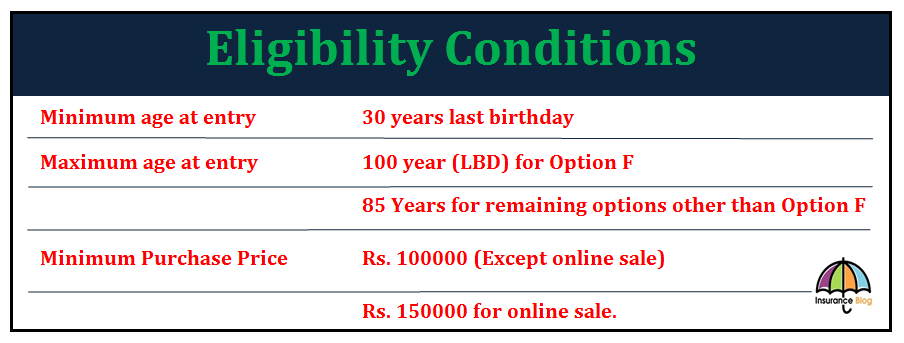

Life Insurance Corporation of India (LIC) has reintroduced its immediate annuity plan Jeevan Akshay VI with certain modification. Though LIC have not changed the name and plan number of this modified version and will be available with same name and plan number i.e. Jeevan Akshay VI, Plan number 189. IRDA UIN for this modified version is 512N234V05. This modified version of Jeevan Akshay VI is available for sale from 24/10/2016.

Table of Contents

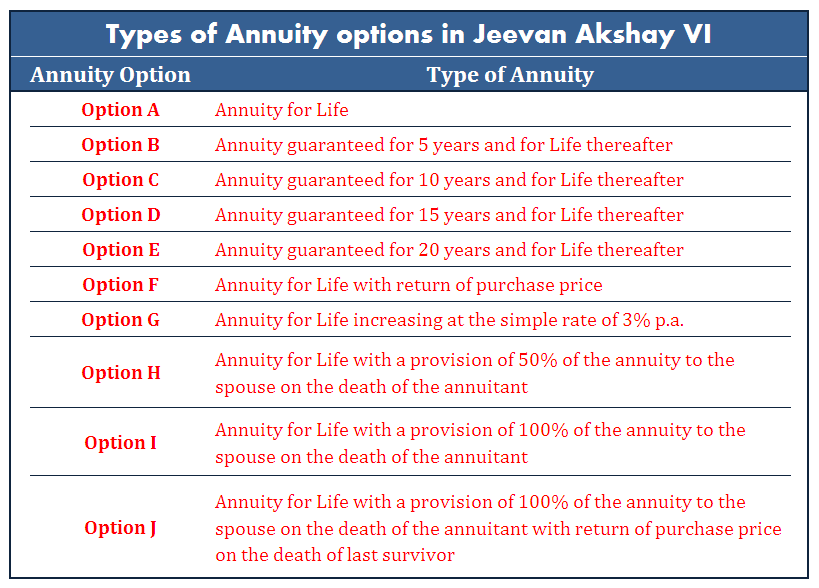

Types of Annuity and mode of payment available in Jeevan Akshay VI

Jeevan Akshay is an immediate annuity plan, proposer gets annuity immediately after the deposit of lump sum amount in this plan according to opted mode of annuity payment. Monthly, Quarterly, Half-yearly, and yearly mode are available for annuity payment.

Benefits of Jeevan Akshay VI

After the purchase of annuity in Jeevan Akshay VI, the first installment of the annuity will be paid after one year, six months, three months or one month depending upon the mode of annuity payment option yearly, half-yearly, quarterly or monthly respectively chosen by the annuitant at the time of the proposal. Annuity amount is assured throughout the period of which it’s payable. The annuity will be paid during the lifetime of the annuitant with following provisions on the death of the annuitant according to the option of the annuity chosen.

- Option A: Payment of annuity stops

- Options B, C, D, and E:

- On the death during the guaranteed period: Annuity is paid to the nominee till the end of the guaranteed period and thereafter annuity stops

- On the death after the guaranteed period: Payment of annuity stops

- Option F: Payment of annuity stops and the purchase price (excluding taxes) is paid to the nominee.

- Option G: Payment of annuity stops

- Option H: Payment of annuity stops and 50% of annuity paid to the surviving named spouse during his/her lifetime. If the named spouse has already died before the annuitant then on the death of annuitant annuity stops and nothing payable.

- Option I: Payment of annuity stops and 100% of annuity paid to the surviving named spouse during his/her lifetime. If the named spouse has already died before the annuitant then on the death of annuitant annuity stops and nothing payable.

- Option J: Payment of annuity stops and 100% of annuity paid to the surviving named spouse during his/her lifetime. After the death of the 2nd survivor payment of annuity stops and the purchase price (excluding taxes) is paid to the nominee. If the named spouse is already died before the annuitant then on the death of annuitant payment of annuity stops and the purchase price (excluding taxes) is paid to the nominee.

Surrender Condition in modified Jeevan Akshay VI

Changes in surrender condition are one of the major modifications of Jeevan Akshay VI. In the earlier version of this plan, surrender was not allowed. Now surrender of modified Jeevan Akshay VI is allowed after completion of at least on policy year. Surrender is only allowed only if Option F is chosen by the annuitant. In other options, surrender is not allowed. Surrender is only allowed under the following circumstances.

- If the annuitant is diagnosed and suffering from any of the critic illness.

- Cancer of specified severity

- Myocardial infarction

- Open chest Coronary artery bypass grafting (CABG)

- Open heart replacement or repair of heart valves

- Kidney failure requiring regular dialysis

- Stroke resulting in permanent symptoms

- Major organ/bone marrow transplant

- Permanent paralysis of limbs

- Motor neuron disease with permanent symptoms

- Multiple sclerosis with persisting symptoms

- Angioplasty

- Benign brain tumor

- Blindness

- Deafness

- End stage lung failure

- End stage liver failure

- Loss of speech

- Loss of limbs

- Major head trauma

- Primary (idiopathic) pulmonary hypertension

- Third-degree burns

- If annuitant is shifting to another country permanently (evidence of visa or citizenship documents required)

Above mentioned surrender options are also allowed for annuitant under LIC’s Jeevan Akshay VI (UIN: 512N234V04) in respect of policy issued on or after 16/05/2012.

Other important condition of Jeevan Akshay VI

- This policy is available for online sale also (to buy Jeevan Akshay VI online Click Here)

- Statutory tax if any, are applicable as per the prevailing rates

- Free look period/cooling off period of 15 days available from the date of receipt of the policy bond.

- No loan available under this plan

- Backdating not allowed

- Assignment of this policy is not allowed

- Nomination is allowed as per the Section 39 of the Insurance Act, 1938

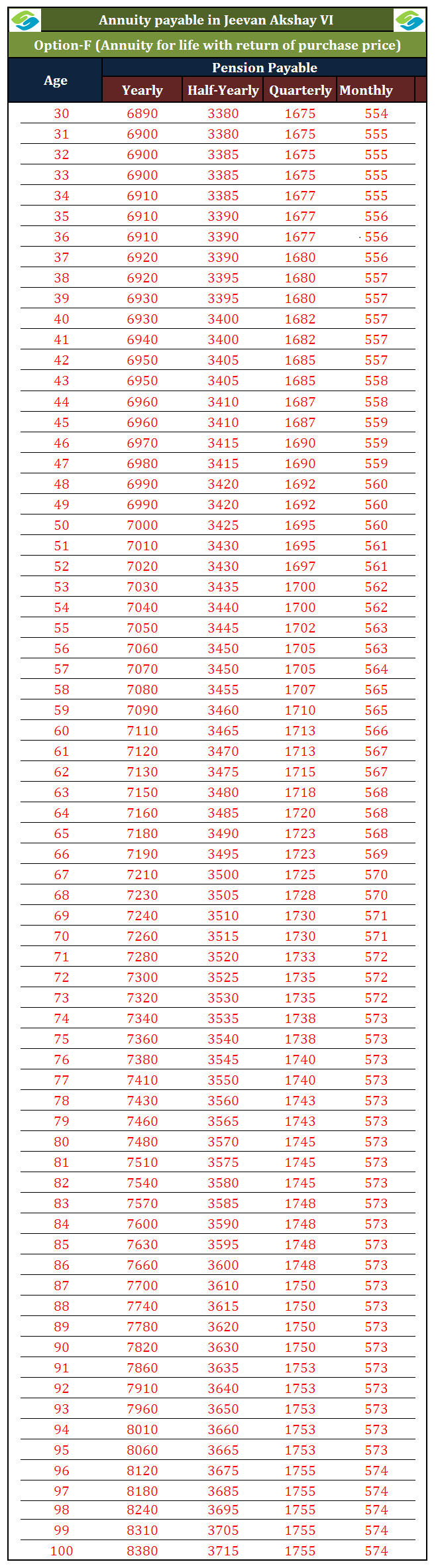

Annuity Payable in Jeevan Akshay VI Under Option(F)

Below is the chart showing the annuity payable for the purchase price of Rs. 100000 in Option-F ie. annuity for life with return of purchase price

Below is the chart showing the annuity payable for the purchase price of Rs. 100000 in option F ie. annuity for life with return of purchase price

What is Special claim concession ? Pls elaborate

what if i am already NRI and i buy jeevan akshay 6 and after one year i want to surrender ?

Thanks for the information, it’s really helpful. I learnt many things from this blog. I would like to add few words what I think about life Insurance is Life Insurance is the most beautiful thing you will ever buy for the ones who truly depend on you. It’s your way of letting them know that no matter what happens in life they can always count on you. I got this information from Tata AIA. Thanks for your blog. And I am waiting to read more such blog from your site.

Lic is good for life but when we get its facility

thanks a lot for giving information it would help me & my contactors in to secure life.

Can I change spouse if I divorce after taking jeevan akshay policy with pension option J (with first wife as spouse)