Indian Life Insurance Giant Life Insurance Corporation of India is going to launch its new health insurance related policy LIC Cancer Cover, Plan No. 905 on 14/11/2017. The Unique Identification Number of the LIC Cancer Cover Plan is 512N314V01. This policy will also be available for online sale on LIC of India’s Portal

It is a non-linked, regular premium payment health insurance plan which provides fixed benefit in case the Life Assured is diagnosed with any of the specified Early and/or Major Stage Cancer during the policy term.

Table of Contents

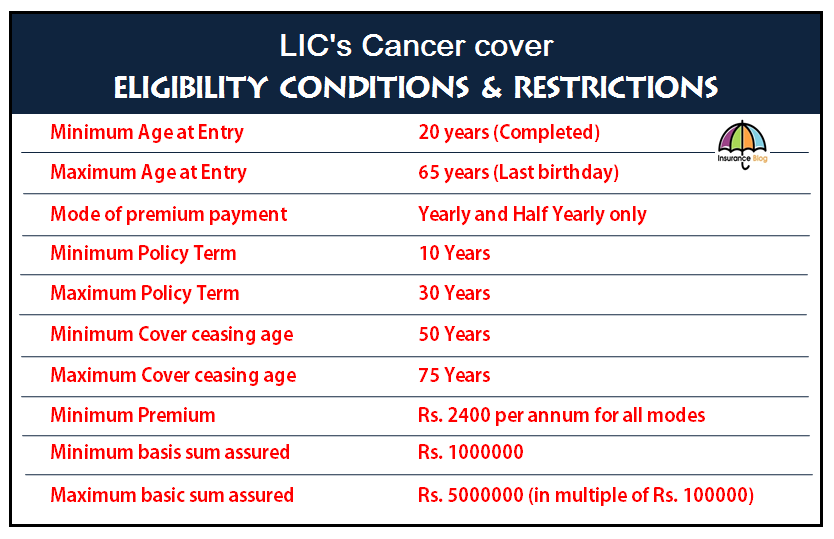

1. Eligibility Criteria for LIC Cancer Cover

2. Types of Sum Assured Offered in LIC Cancer Cover Policy

The plan has two benefit options which have to be chosen by the proposer at the proposal stage. Premium rates will depend upon the option chosen by the proposer.

Option I-Level Sum Insured:

The Basic Sum Insured shall remain unchanged throughout the policy term.

Option II Increasing Sum Insured:

The Sum Insured increases by 10% of Basic Sum Insured each year for the first five years starting from the first policy anniversary or until the diagnosis of the first event of Cancer, whichever is earlier. On diagnosis of any specified cancer, all the claims payable shall be based on the Increased Sum Insured at the policy anniversary coinciding or prior to the diagnosis of the first claim and further increases to this Sum Insured will not be applicable

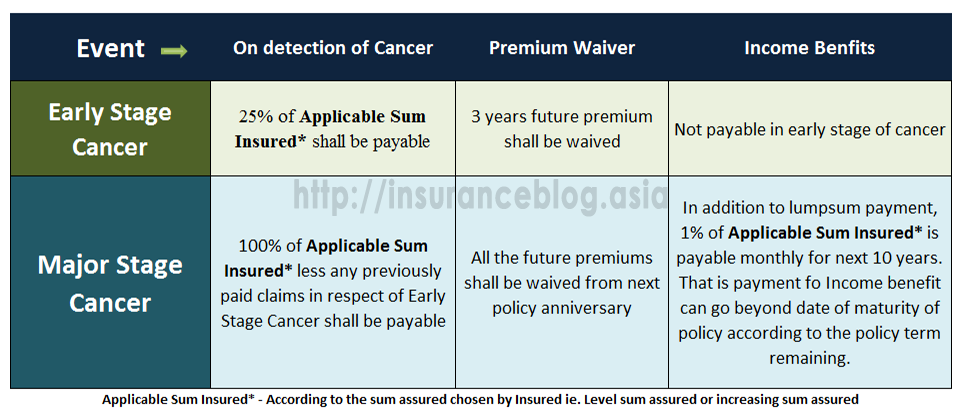

3. Benefits of LIC Cancer Cover policy

Benefits fo LIC Cancer cover policy will depend upon the stage of cancer detected during the policy term and when the policy is in full force at that time.

Maturity Benefit: No maturity benefit is payable under this plan.

Death Benefit: No death benefit is payable under this plan.

4. REVIEW OF PREMIUMS:

Premium calculated will remain unchanged up to 5 years. After 5 years premium may change according to the claim experience of LIC and if changed, it will then remain unchanged for the next 5 years. (Any revision in premium will be calculated according to entry age of proposer at the date of commencement of the policy)

5. The list and definitions of the Cancer covered under this plan:

All the stages which are covered under the LIC Cancer Cover plan are defined below. Any claim payments will depend upon these definitions and finding of this cancer stage on diagnosis

Early Stage Cancer:

The diagnosis of any of the listed below conditions must be established by histological evidence and be confirmed by a specialist in the relevant field.

Carcinoma-in-situ (CIS)

Prostate Cancer – early stage

Thyroid Cancer – early stage

Bladder Cancer – early stage:

Chronic Lymphocytic Leukaemia – early stage:

Cervical Intraepithelial Neoplasia:

Major Stage Cancer:

A malignant tumor characterized by the uncontrolled growth and spread of malignant cells with invasion and destruction of normal tissues. This diagnosis must be supported by histological evidence of malignancy. The term cancer includes leukemia, lymphoma, and sarcoma.

6. Exclusions in cancer stages mentioned above

The following are excluded from major stage cancer benefits (Exclusions):

Exclusions in Early Stage Cancer:

The following are specifically excluded from all early-stage cancer benefits (Exclusions):

- All tumors which are histologically described as benign, borderline malignant, or low malignant potential

- Dysplasia, intraepithelial neoplasia, or squamous intraepithelial lesions

- Carcinoma-in-situ of skin and Melanoma in-situ

- All tumors in the presence of HIV infection are excluded

Exclusions in Major Stage Cancer:

The following are excluded from major stage cancer benefits (Exclusions):

- All tumors which are histologically described as carcinoma in situ, benign, premalignant, borderline malignant, low malignant potential, neoplasm of unknown behavior, or non-invasive, including but not limited to Carcinoma in situ of breasts, Cervical dysplasia CIN-1, CIN -2 and CIN-3.

- Any non-melanoma skin carcinoma unless there is evidence of metastases to lymph 4 nodes or beyond;

- Malignant melanoma that has not caused invasion beyond the epidermis;

- All tumors of the prostate unless histologically classified as having a Gleason score greater than 6 or having progressed to at least clinical TNM classification T2N0M0

- All Thyroid cancers histologically classified as T1N0M0 (TNM Classification) or below;

- Chronic lymphocytic leukemia less than Rai stage 3

- Non-invasive papillary cancer of the bladder histologically described as TaN0M0 or of a lesser classification,

- All Gastro-Intestinal Stromal Tumors histologically classified as T1N0M0 (TNM Classification) or below and with mitotic count of less than or equal to 5/50 HPFs;

- All tumors in the presence of HIV infection.

7. Waiting period in LIC Cancer Cover:

A waiting period of 180 days will apply from the date of issuance of policy or date of revival of risk cover whichever is later, to the first diagnosis of “any stage” cancer. “Any stage” here means all stages of Cancer that occur during the waiting period. This would mean that nothing shall be paid under this policy and the policy shall terminate if any stage of Cancer occurs:

- At any time on or after the date of issuance of the Policy but before the expiry of 180 days reckoned from that date; or

- Before the expiry of 180 days from the Date of Revival.

8. Survival Period in LIC Cancer Cover:

No benefit shall be payable if the Life Assured dies within a period of 7 days from the date of diagnosis of any of the specified Early Stage Cancer or Major Stage Cancer. The 7 days survival period includes the date of diagnosis. The benefit under this plan shall be payable subject to fulfilling all of the below criteria:

- 7 days survival period from the date of diagnosis

- Signs and symptoms relevant to cancer should have been present and documented before death

- All investigations to confirm the diagnosis of cancer should have been done before the death of the insured.

- The satisfaction of the cancer definition as per the policy condition

9. Other features and Benefits of LIC Cancer Cover (Plan No. 905)

- Tax rebate under Income Tax Section 80D for a premium paid in LIC Cancer Cover

- Freelook period of 15 days if the policyholder is not satisfied with “Term and Conditions” of the policy

- A grace period of 1 month but not less than 30 days are allowed

- LIC Cancer Cover will not acquire any paid-up value or surrender value, therefore, no loan is available in this policy.

- The policy will lapse if the premium not paid within the grace period, though it can be revived but within 2 years of the first unpaid premium (FUP)

- This policy can be purchased through the online portal of LIC.

- GST as per rules will be applicable on premium.

- Claim payment decisions will be taken by the claim department by LIC (TPA not involved)

- Backdating is not allowed

- The policy can be assigned under as per Sec 38 of Insurance Act 19838

- Nomination required as per Sec 39 of Insurance Act 1938

Disclaimer: Utmost care has been taken to share the right information with readers. But in case of any ambiguity or confusion please contact your nearest LIC of India branch for clarification.

Thanks for the list. I have gone through each blog sites and they are very helpful. Again many Thanks and Keep posting!!!

My mother was diagnosed with breast cancer 4 years ago and had it surgically removed. She was later diagnosed with Ovarian cancer last year and had another surgery. Can you please clarify if she is eligible to apply for this policy for any new cancer that she may get in the future?

Mr Karthikeyan Kumar

your mother already effected with cancer so she is not eligible for this plan for info you can contact # 9818094635, [email protected]