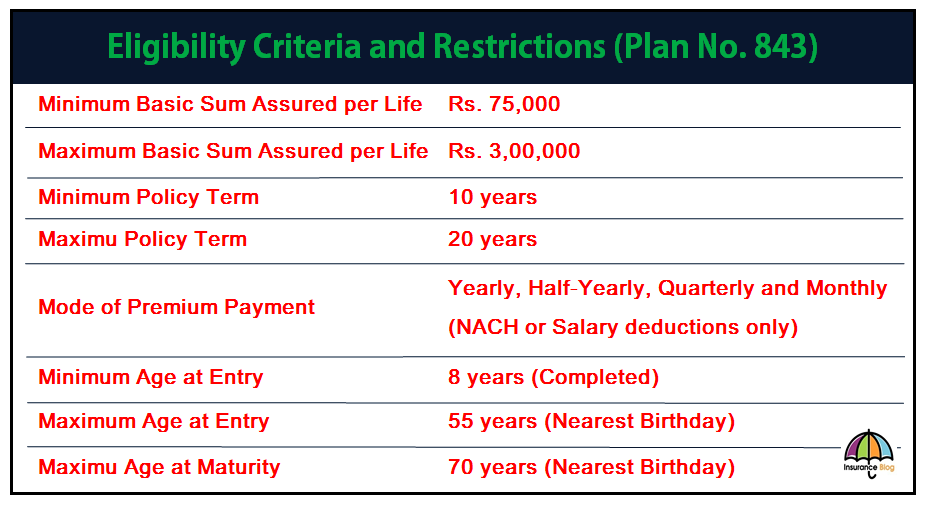

Life Insurance Corporation of India is going to launch its new plan Aadhaar Stambh (Plan No. 843) on 24/04/2017. LIC’s Aadhaar Stambh is non-linked, with-profits, regular premium endowment assurance plan. LIC has designed this plan exclusively for males lives having Aadhaar Card issued by UIDAI (Unique Identification Authority of India). Aadhaar Stambh plan is only available for standard healthy lives without any medical examination. An individual can have a maximum of Rs. 3,00,000 Basic sum Assured in all policies issued under this plan.

LIC’s Aadhaar Stambh (Plan No. 843) will be available for sale from 24/04/2017 and Unique Identification Number (UIN) of this plan is 512N310V01.

Table of Contents

हिन्दी में पढें: एलआईसी की नयी योजना आधार स्तंभ (प्लान न. 843)

Eligibility Conditions and Restrictions in LIC’s Aadhar Stambh

Auto Cover in LIC’s Aadhaar Stambh

“Auto Cover period” in a paid-up policy will be the period from the due date of first unpaid premium (FUP), which includes the grace period. “Auto Cover period” is the period during which full risk cover is available for the life assured even if the regular premium is not paid during this period. The duration of “Auto Cover period” will be available as follows:

- If at least three full years’ but less than five full years’ premium have been paid and any subsequent premium is not duly paid: “Auto Cover period” of six months from the due date of the first unpaid premium will be available

- If at least five full years’ premium have been paid and any subsequent premium is not duly paid: “Auto Cover period” of 2 years from the due date of the first unpaid premium will be available.

Benefits in LIC’s Aadhaar Stambh

Benefits which are payable in inforce LIC’s Aadhaar Stambh Policy are

Death Benefits in LIC’s Aadhaar Stambh

During the first 5 policy years: “Sum Assured on Death” will be paid to the nominee.

After completion of 5 policy years but before the date of maturity: “Sum Assured on Death” and Loyalty addition (if any) will be paid to the nominee of the Life Assured.

The death benefit will not be less than the 105% of all the premium paid in the policy as at the date of death of the life assured. (The premium referred above will not include any taxes, extra amount charged due to underwriting decision and rider premium if any.)

Maturity Benefits in LIC’s Aadhaar Stambh

If the Life Assured survives till the end of the policy term, “Sum Assured on Maturity” along with Loyalty Addition, if any will be payable to the Life Assured.

Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

Optional Benefits in LIC’s Aadhaar Stambh

Proposer can opt for the optional riders by payment of additional premium. Benefits under the optional rider will be available during the policy term only.

LIC’s Accidental Benefit Rider UIN (512B203V02)

If this benefit is opted for, an additional amount equal to “Accidental Benefit sum Assured” is Payable on death due to Accident within 180 days of the accident, provided the rider is inforce at the time of the accident. This rider can be taken at the inception of the policy or before the premium term is over.

Premium rates of this Accidental Benefit Rider is

- Rs. 0.50 per thousand Accidental Benefit sum Assured irrespective of age

- Rs. 1.00 per thousand Accidental Benefit sum Assured if the life assured is engaged in police duty either in military, naval or police organization and opt for this cover while engaged in policy duty.

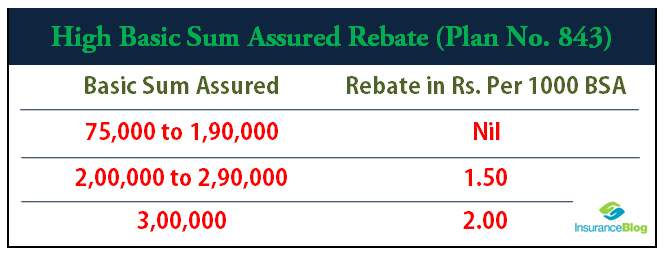

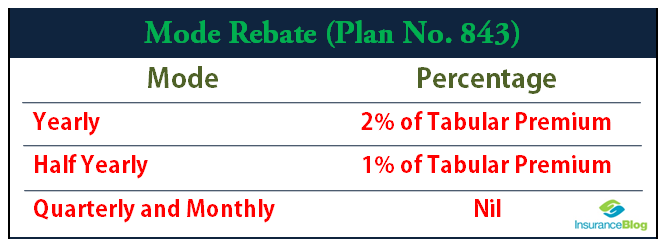

Rebates in LIC’s Aadhaar Stambh

Following rebates to proposer is available on the premium if he opts for the higher mode and takes the high-risk cover policy. Rebates available in LIC’s Aadhaar Stambh are as follows:

Other Important features and condition in LIC’s Aadhaar Stambh

- Loan facility is available in this plan, after the payment of premium for at least full 3 years (up to 90% of surrender value in inforce policy and up to 80% in paid-up policy).

- Policy can be revived within the 2 years of the FUP.

- Grace period in the policy is available; one calendar month, not less than 30 days in yearly, half yearly and quarterly mode and 15 days in monthly mode.

- The policy will acquire paid up value if the premium has been paid for 3 full years.

- Policy can be surrender after the 3 years if at least 3 full year premium is already paid.

- Free look period of 15 days from the date of receipt of the policy bond.

- Backdating is allowed within the same financial year.

- Nomination and Assignment are allowed in the policy as per Sec 39 and Sec 38 of Insurance Act 1938 respectively.

Premium Rates in Jeevan Stambh

Disclaimer: This is a summary of plan Aadhaar Stambh (Plan No. 843), in the case of any ambiguity or to get the benefit illustration of this plan, please contact your LIC agent or LIC office.

Good

sir as per revised condition agency act1972 is it every year mbg and others will change.is it.pl clarify me. 2 da i have given 843 rs75k. max 3lac means stand alone or inclusive other p.p.s.

MBG criteria will be decided by LIC Board every year. SUC in Aadhaar Stambh and Aadhaar Shila is standalone.

Sir let me know the commission percentage allotted for the agents on this plan