Life Insurance Corporation of India is going to launch its new plan Jeevan Umang (Plan No. 845) on 16/05/2017. LIC’s Jeevan Umang is non-linked, with-profits, whole life assurance plan. This plan provides for annual survival benefits from the end of the premium paying term till maturity and lump sum payment at the time of maturity or on the death of the policyholder during the policy term.

The Unique Identification Number (UIN)of LIC’s Jeevan Umang is 512N312V01.

This plan has features similar to LIC’s earlier closed plan Jeevan Tarang (Plan 178), which used to provide the survival benefit after the premium payment term is over until the maturity or death of the policyholder.

Table of Contents

हिन्दी में पढें: एलआईसी की नयी योजना जीवन उमंग (प्लान न. 845)

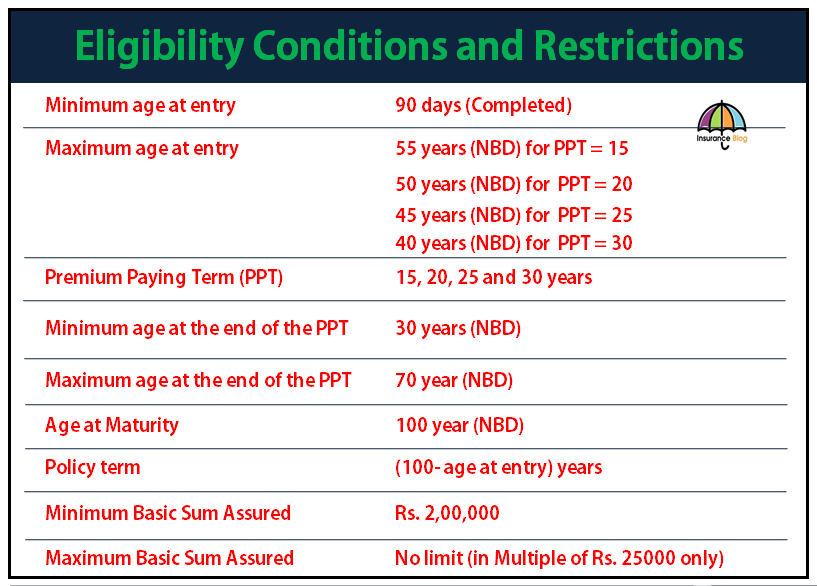

Eligibility Conditions and Restrictions in LIC’s Jeevan Umang

Date of Commencement of Risk

If age of Life Assured is less than 8 years on date of taking policy, the risk under this plan will start either one day before the completion of 2 years from the date of commencement of the policy or one day before the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier. For Life assured aged 8 or more, risk will commence immediately.

Benefits of LIC’s Jeevan Umang

The benefits payable under an inforce Jeevan Umang policy are

Death Benefits in LIC’s Jeevan Umang

On death before the commencement of Risk:

An amount equal to the total amount of premium/s paid without interest shall be payable

On death after the commencement of Risk:

Death Benefit, defined as sum of “Sum Assured on Death” and vested simple reversionary bonuses and Final Additional Bonus, if any shall be payable

Where “Sum Assured on Death” is defined as the highest of

-10 times of annualised premium or

– Sum assured on Maturity or

-Absolute amount assured to be paid on death ie Basic Sum Assured

The death benefit will not be less than 105% of all the premiums paid as on date of Death. Premium referred here will not include any taxes, extra premium charged due to underwriting decision and rider premiums.

Survival Benefit in Jeevan Umang

On the life assured surviving to the end of the premium paying term and all the premiums in policy have been paid, a survival benefit equals to 8% of Basic sum assured (BSA) shall be payable each year. First survival benefit shall be paid at the end of the premium paying term and thereafter on completion of each subsequent year till life assured survives or policy anniversary prior to the date of maturity, whichever is earlier.

Maturity Benefit in Jeevan Umang Policy

On the life assured surviving to the end of the policy term, and all the due premiums have been paid, “Sum Assured on Maturity” along with Vested Simple Reversionary Bonuses and Final Additional Bonus (FAB) if any shall be payable to the policyholder.

Where “Sum Assured on Maturity” is equal to Basic Sum Assured (BSA)

Riders Available with Jeevan Umang (Plan No. 845)

- LIC’s Accident Death and Disability Benefit Rider (UIN-512B209V01)

- LIC’s Accident Benefit Rider (UIN-512B203V02)

- LIC’s New Term Assurance Rider (UIN-512B210V01)

- LIC’s New Critical Illness Benefit Rider (UIN-512A212V01)

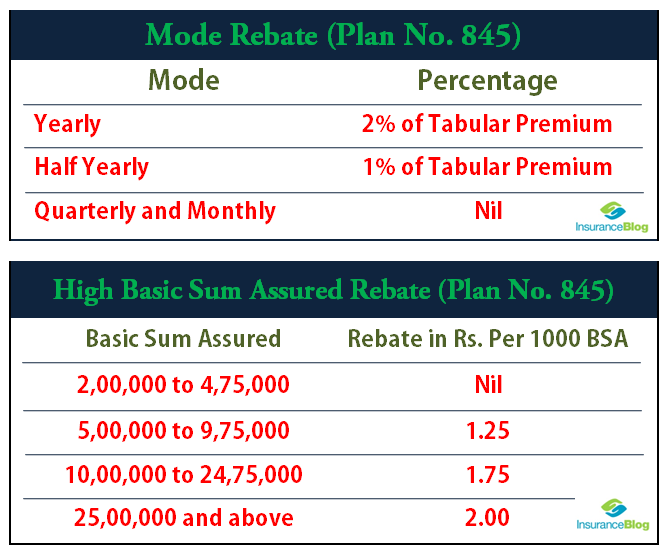

Mode rebate and Sum Assured Rebates in Jeevan Umang

Other features and Benefits of Jeevan Umang (Plan 845)

- If at least three full-year premiums have been paid and subsequent premiums be not duly paid, then policy will acquire paid value

- Premium paying modes: Yearly, Half yearly, Quarterly and Monthly (Monthly mode is only available with SSS and NACH mode)

- Policy can be surrendered during the policy term provided at least three full-year premiums have been paid.

- Loan Facility available after completion of 3 policy years during premium paying term, if at least three full year premiums have been paid. Maximum loan payable is

- Up to 90% of surrender value in inforce policies

- Up to 80% of surrender value in paid up policies.

- Free look period, 15 days available from the date of receipt of policy bond if the policyholder is not satisfied with the “Terms and Conditions” of the policy.

- Assignment as per Sec 38 of Insurance Act 1938 allowed. Nomination required as per Sec 39 of Insurance Act 1938.

- Lapse Policy can be revived within 2 years from First unpaid premium (FUP).

- Policy can be taken from a back date but within the same financial year. Back-dating interest as applicable on the date of completion will be charged for the period in excess of one month.

- Grace period in the policy is available; one calendar month, not less than 30 days in yearly, half yearly and quarterly mode and 15 days in monthly mode.

Premium Rates in Jeevan Umang (Plan No. 845)

Disclaimer: This is a summary of plan Jeevan Umang (Plan No. 845), in the case of any ambiguity or to get the benefit illustration of this plan, please contact your LIC agent or LIC office.

Hi Everyone,

For more details about this plan you can contact me on [email protected]