LIC of India has launched its new Single Premium, Closed-ended plan Jeevan Utkarsh, Plan No. 846. This plan will be available for sale from 06/09/2017 up to 31/03/2018. LIC’s Jeevan Utkarsh is a Non-linked, with profits, saving cum protection plan in which risk cover is 10 times the single premium. Unique Identification of LIC’s Bima Diamond Plan is 512N313V01.

Update: Jeevan Utkarsh (Plan 846) Policy is now available for sale up to 02/06/2018.

Table of Contents

हिन्दी में पढिये: एलआईसी की नयी योजना जीवन उत्कर्ष (प्लान न. 846)

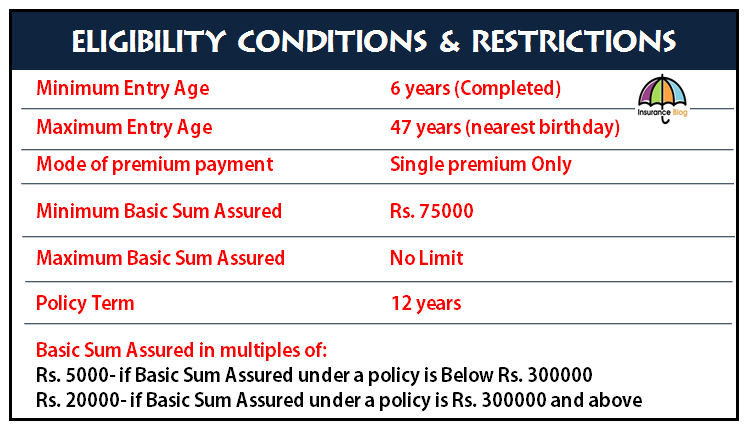

Eligibility Conditions and Restrictions in LIC’s Jeevan Utkarsh

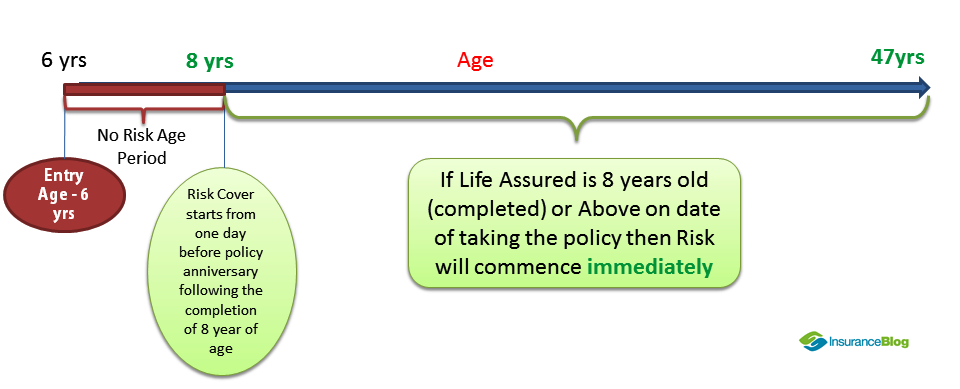

Date of Commencement of Risk

In case the age at entry of the Life Assured is less than 8 years, the risk under Jeevan Utkarsh will start from one day before the policy anniversary coinciding with or immediately following the completion of 8 years of age.

Example:

Date of Birth of Life Assured: 04/09/2010 (7 years completed)

Date of Taking policy: 06/09/2017 (DOC)

Date when LA will complete 8 years of age: 04/09/2018

Date of Start of Risk Cover: 05/09/2018 (One day before the policy anniversary ie 06/09/2018)

Death Benefit in LIC’s Jeevan Utkarsh

On death during first five policy years:

Before the date of Commencement of Risk: Refund of Single premium without interest. (Single premium mentioned here will not include any taxes, extra premium charge due to underwriting decisions and rider premium if any)

After the date of Commencement of Risk: “Sum Assured on Death“ is payable.

On death after completion of five policy years but before the date of maturity:

“Sum Assured on Death” along with Loyalty Addition if any is payable.

Where “Sum Assured on Death” is defined as the highest of

- 125% of the Single Premium; or

- Guaranteed Sum Assured on Maturity ie Basic Sum Assured; or

- “Absolute amount assured to be paid on death” ie 10 times of Tabular Single Premium

Maturity Benefit in LIC’s Jeevan Utkarsh

On the Life Assured surviving to the end of the policy term, “Sum Assured on Maturity” along with Loyalty Addition, if any, is payable. Where “Sum Assured on Maturity” is actual to Basic Sum Assured.

Loyalty Addition will depend upon the LIC’s experience the policies will be eligible for Loyalty Addition at the time of exit after completion of five policy in the form of Death during the policy term or Maturity, at the rates declared by LIC time to time.

Optional Benefit in LIC’s Jeevan Utkarsh

First-time LIC has included Accidental death and disability Benefit rider (512B209V01) with its single premium plan. This rider can only be taken at the time of inception of the policy and cannot be taken during the policy term. Only major lives (Aged above 18 years) can opt for this rider.

Settlement Option in LIC’s Jeevan Utkarsh

This option enables the Claimant or the Life assured to take the amount received through Death claim or Maturity claim in installments. Claimant/Life Assured can take the amount in installment for a chosen period of 5 or 10 or 15 years. Installment can be monthly, quarterly, Half Yearly or Yearly Mode. Installment amount should not be less than the amount mentioned in the table given below:

| Mode of Installment Payment | Minimum Installment Amount |

| Monthly | Rs. 5000 |

| Quarterly | Rs. 15000 |

| Half Yearly | Rs. 25000 |

| Yearly | Rs. 50000 |

Interest rates for arriving the installment will be declared by LIC time to time and may change over the period according to the prevailing market rates or LIC’s experience. At any time during the installment period, claimant/life assured can commute the outstanding installment amount on written request to LIC.

Rebate on High Basic Sum Assured

| Basic Sum Assured (BSA) | Reduction in Tabular Premium (per Rs. 1000 BSA) |

| Rs. 75000 to Rs. 145000 | Nil |

| Rs. 150000 to Rs. 295000 | Rs. 15.00 |

| Rs. 300000 to Rs. 480000 | Rs. 20.00 |

| Rs. 500000 and above | Rs. 25.00 |

Other Important features and condition in LIC’s Jeevan Utkarsh

- Loan facility is available in this plan after three months of completion of the policy (3 months from the date of issuance of the policy).

- Policy can be surrender any time during the policy term (subject to realization of premium cheque by LIC) guaranteed surrender value in 1st year is 70% of single premium (without taxes and extra premium and rider premium) and 90% from second year onwards

- Backdating is allowed within the same financial year.

- Free look period of 15 days from the date of receipt of the policy bond.

- Nomination and Assignment are allowed in the policy.

- Premium paid under this plan (excluding taxes) can be claimed for rebate in income tax under 80(C)

- Maturity amount payable to Life assured is also tax-free under sec. 10(10)D

Minimum how much I can invest in single premium. What is basic sum assured. Unable to understand