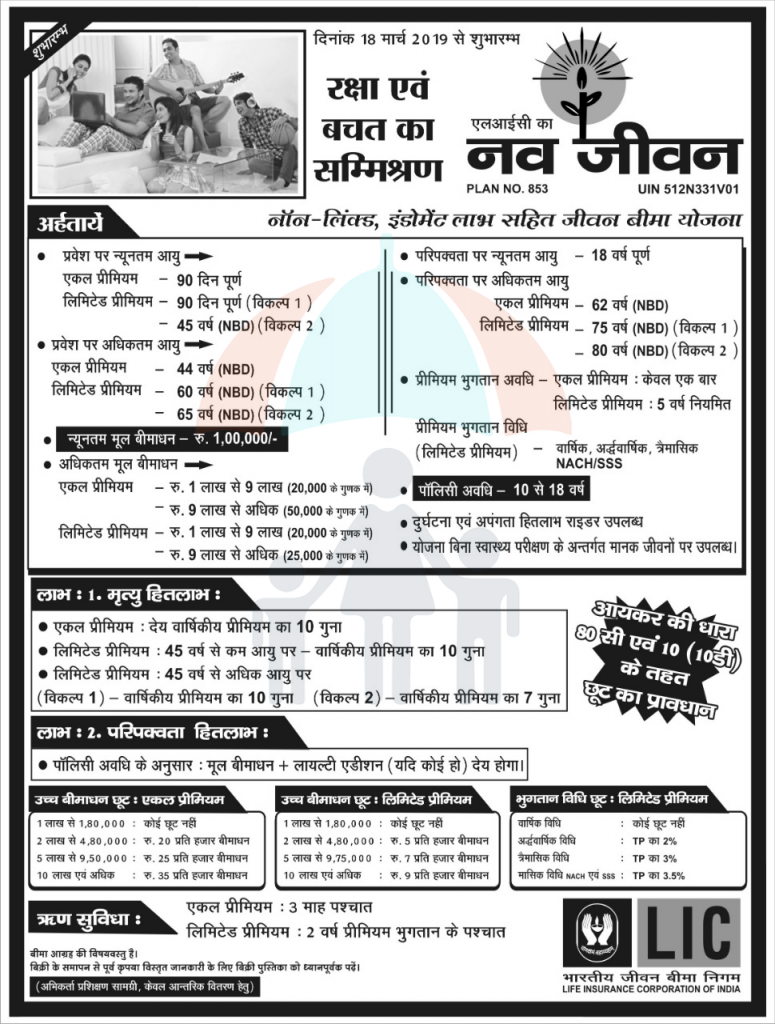

LIC of India is going to launch its new life insurance plan LIC’s Nav Jeevan, Plan No. 853 on 18/03/2019. LIC’s Nav Jeevan is a non linked, with profit, Endowment Life Assurance plan. Under this plan policyholder will have the option to choose between two premium payment options ie single premium or limited premium payment term of 5 years. Unique Identification Number (UIN) of LIC’s Nav Jeevan is 512N331V01.

Table of Contents

हिन्दी में पढ़ें:एलआईसी नवजीवन (प्लान न. 853)

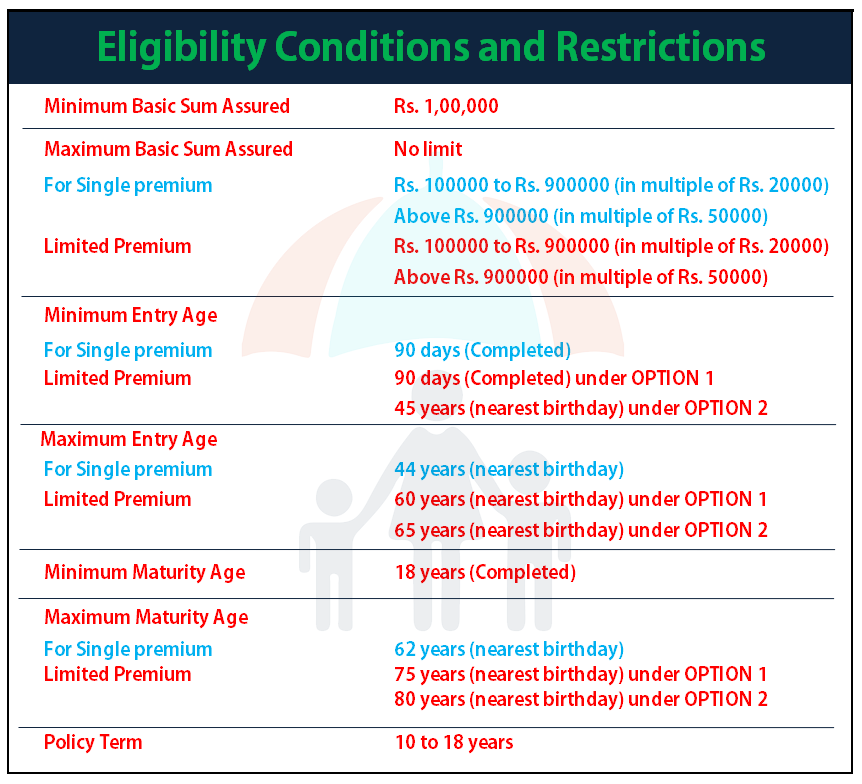

1. LIC’s Nav Jeevan -Eligibility conditions and Restrictions

2. Benefits payable under LIC’s Nav Jeevan Policy:

a) Maturity Benefit:

When the policyholder survives till the end of the policy term and all the due premiums have already been paid “SUM ASSURED ON MATURITY” along with LOYALTY ADDITION if any will be payable where “SUM ASSURED ON MATURITY” is equal to BASIC SUM ASSURED.

b) Death Benefit:

In case life assured dies before the date of maturity and policy is in force condition then the benefits payable to nominee/assignee is as under

On death during the first five years:

Before the date of commencement of risk: Refund of premium without any interest.

After the date of commencement of Risk: “SUM ASSURED ON DEATH” is payable

On death after completion of five policy years but before the date of maturity:

“SUM ASSURED ON DEATH” along with LOYALTY ADDITION is any payable

3. What is “SUM ASSURED ON DEATH” in LIC’s Nav Jeevan

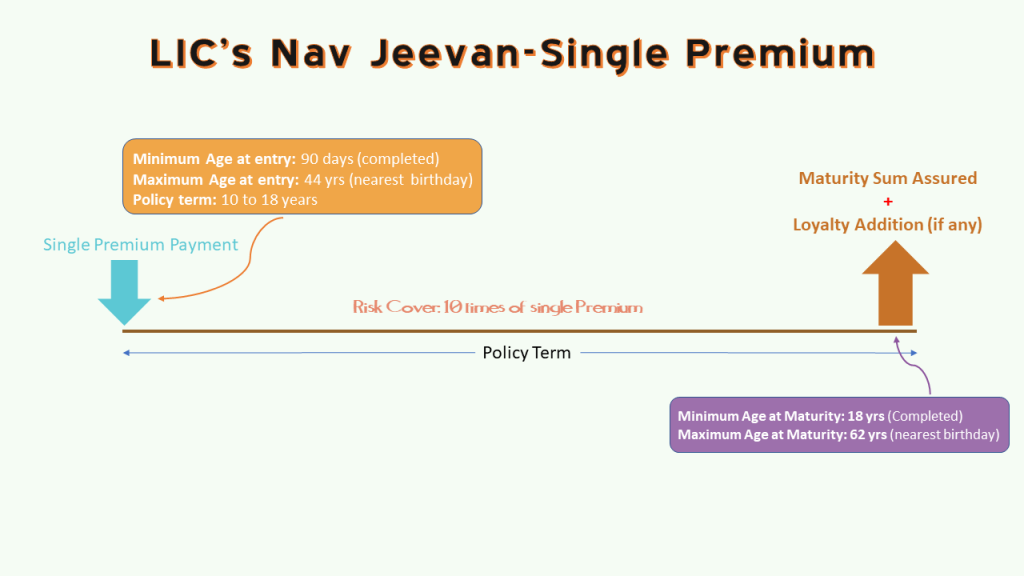

For Single Premium Policy: “SUM ASSURED ON DEATH” is defined as the higher of Guaranteed sum assured on maturity that is basic sum assured or absolute amount assured to be paid on death that is 10 times of tabular single Premium for the chosen basic sum assured.

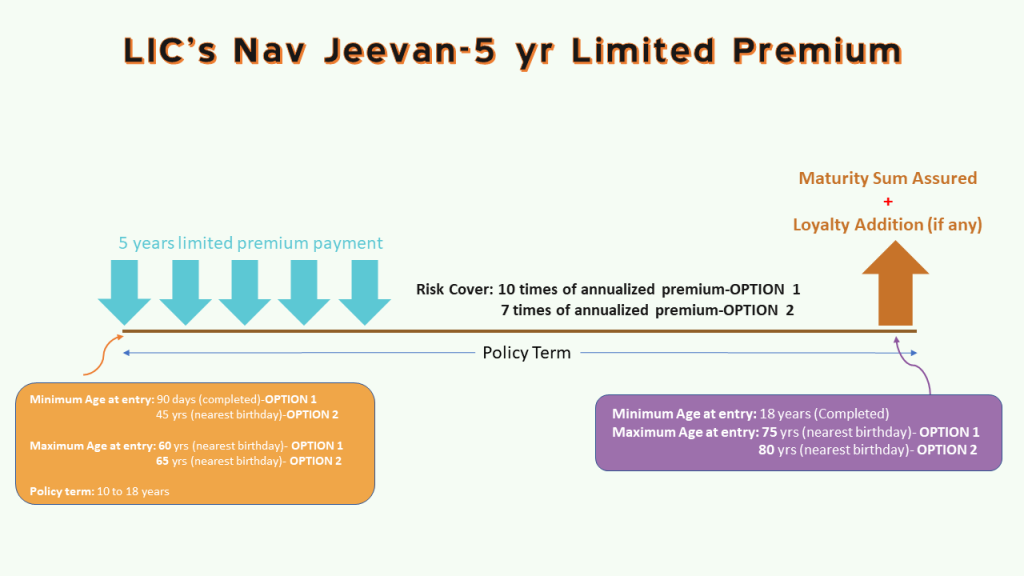

For Limited Premium Policy: sum assured on death is defined as higher of guaranteed sum assured on maturity or absolute amount assured to be paid on death that is 10 times of annualized premium if OPTION 1 is opted for or 7 times of annualized premium if OPTION 2 is opted for

The death benefit under Limited premium payment shall not be less than 105% of total premium paid excluding extra amount is charged under the policy due to underwriting decisions.

4. Mode of Premium Payment

Premiums can be paid either in lumpsum (Single Premium) or for a limited period of 5 years in case of limited premium payment premium can be paid with modes of premium payment yearly, halfyearly, quarterly or monthly (through NACN) or through salary deductions (SSS)

5. Other Important features and condition in LIC’s Nav Jeevan

- Loan facility is available in this plan, after 3 months from the date of issuance of policy bond in single premium policy and after completion of 2 years in case of limited premium payment policy. Maximum loan can be granted up to 80% of the surrender value in inforce policy.

- Policy can be revived within the 2 years of the FUP.

- Grace period in the policy is available; one calendar month, not less than 30 days in yearly, half-yearly and quarterly mode and 15 days in monthly mode.

- The policy will acquire paid up value if the premium has been paid for 2 full years in case of limited premium payment policy.

- Policy can be surrender at any time during the policy term in single premium policy and after 2 years in limited premium payment policy if at least 2 full year premium is already paid.

- Free look period of 15 days from the date of receipt of the policy bond.

- Backdating is allowed within the same financial year.

- Nomination and Assignment are allowed in the policy.

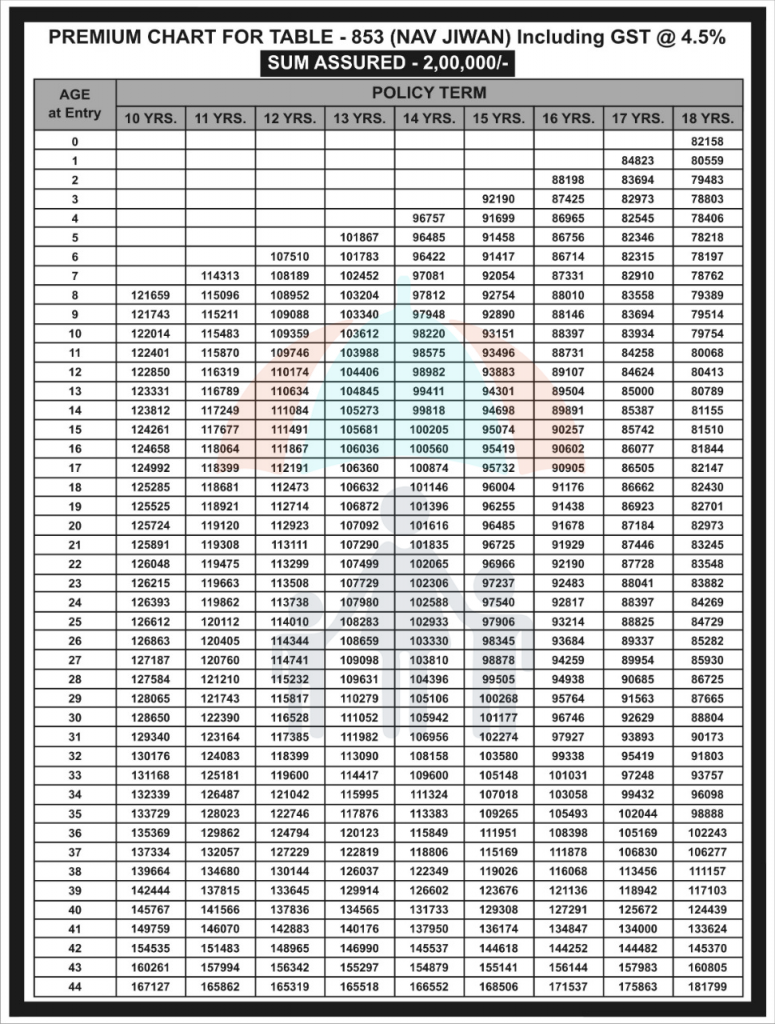

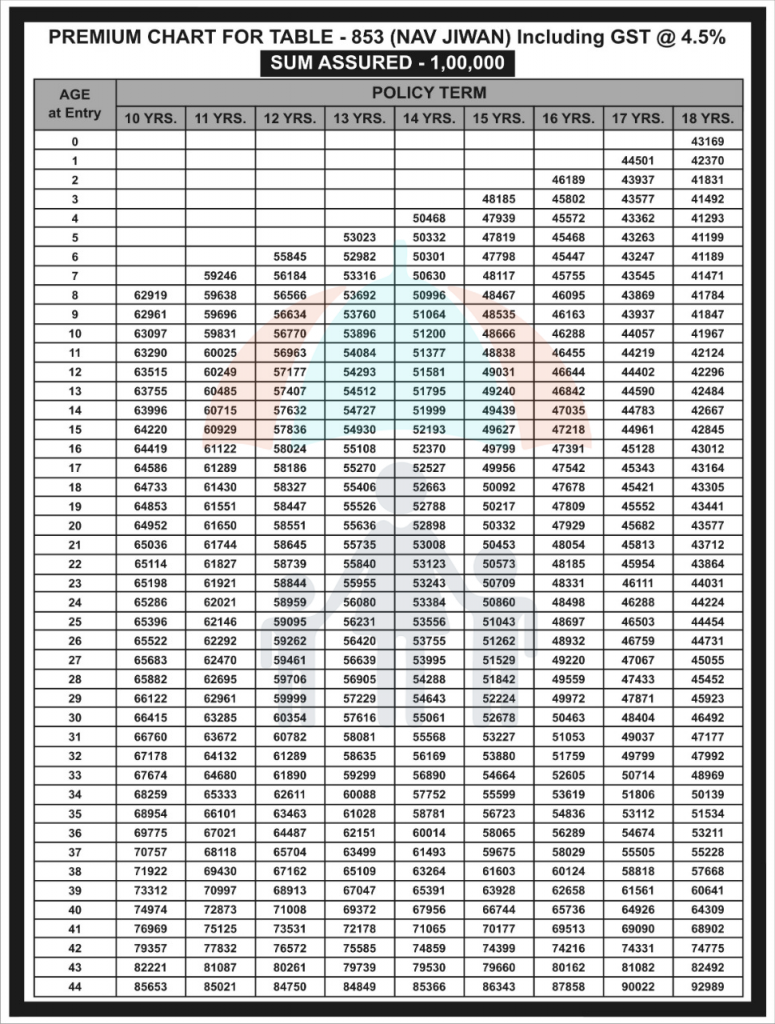

AGE-27YRS TERM-11(5), SUM ASSURED-60 LACS

PREMIUM, WITHOUT AB -= 8.38 LACS

WHETHER PREMIUM ELIGIBLE FOR 80C & RETURNS AT MATURITY AFTER 11 YEARS ARE EXEMPTED IN 10 10(D)

Premium eligible for 80(C) but only extent upto 1.5 lakh only.