As announced by the Government of India regarding the pension plan for senior citizen of India (Aged above 60 years) in last financial year, the Government of India has announced the Pradhan Mantri Vaya Vandana Yojana (PMVVY) Plan No. 842 for citizens aged 60 year and above.

Pradhan Mantri Vaya Vandana Yojana (Plan No. 842) is a pension plan with subsidized pension rates which will provide an assured return of 8% per annum payable monthly (equivalent to 8.30% per annum) on the pensioner surviving during the policy term of 10 years.

This plan is available for sale from 04/05/2017 through LIC of India. This plan will be available for sale up to 03/05/2018 (one year). Unique Identification Number (UIN) for Pradhan Mantri Vaya Vandana Yojana is 512G311V01.

Table of Contents

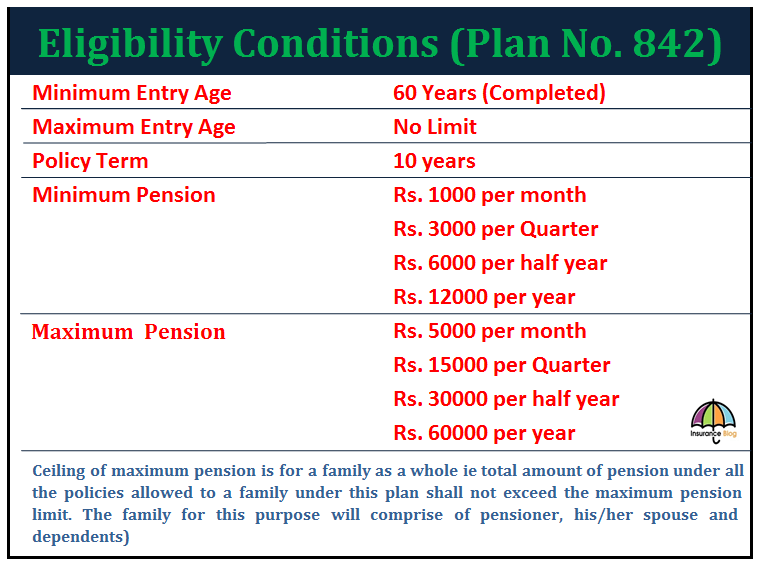

Eligibility Conditions and Restrictions:

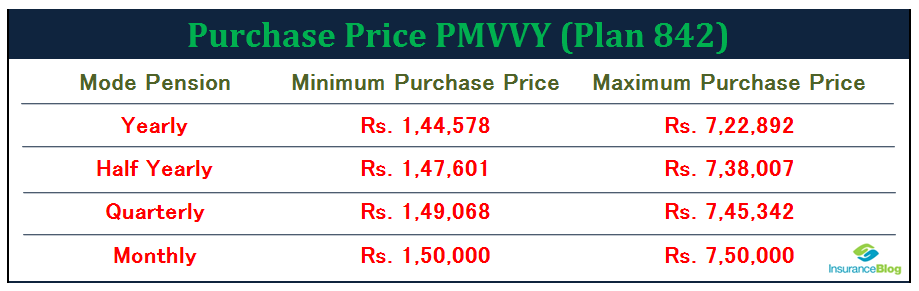

Purchase Price in Pradhan Mantri Vaya Vandana Yojana (PMVVY)

This plan can be purchased by payment of a lump sum Purchase Price. The pensioner has an option to choose either the amount of pension or the Purchase Price.

This plan is also available for online sale from LIC of India website, you can visit the page directly by following this link.

The minimum and maximum Purchase Price under different mode of pension is given below

Benefits of Pradhan Mantri Vaya Vandana Yojana (PMVVY)

Benefits payable under PMVVY are

1. Pension Payment

Pensioner will get the pension during the policy term, pension in arrears (at the end of each period as per mode is chosen by the pensioner) will be payable.

2. Death Benefit

On the death of the pensioner during the policy term, the Purchase Price will be refunded to the nominee (or legal heirs in absence of nominee)

3. Maturity Benefits

On survival of pensioner to the end of the policy term, Purchase Price and final installment of the pension will be paid to the pensioner.

Mode of pension payments and Pension rates in PMVVY

The pensioner can choose the pension mode as per his requirements, pension modes which are available are Yearly, Half-yearly, Quarterly or Monthly.

Pension rates for different modes of pension payments for Rs. 1000/- Purchase price are

Yearly: Rs. 83.00 p.a.

Half Yearly: Rs. 81.30 p.a.

Quarterly: Rs. 80.50 p.a.

Monthly: Rs. 80.00 p.a.

Other features and Benefits of Pradhan Mantri Vaya Vandana Yojana

- Policy can be surrendered during the policy term under exceptional circumstances like pensioner requires money for treatment of any critical/terminal illness of self or spouse. Surrender value payable will be 98% of purchase price.

- Loan Facility available after completion of 3 policy years, maximum loan payable will be 75% of purchase price. Interest on the loan will be recovered from the pension amount.

- There will no exclusion on the count of suicide and full purchase price will be payable to the nominee.

- Free look period, 15 days available from the date of receipt of policy bond if the policyholder is not satisfied with the “Terms and Conditions” of the policy.

- Assignment as per Sec 38 of Insurance Act 1938 allowed only in favor of LIC of India (in the case of Loan taken on policy). Nomination required as per Sec 39 of Insurance Act 1938

- The pension will be paid through NEFT or Aadhaar Enabled Payment System.

Many thanks for the information.

Was wondering if you could help us with two more points, a) what would be the tax treatment on this, and b) does the interest payment start rolling out from the first year or is there a lock-in period.

Much obliged

a) Pension paid will be added to your total income and tax will be calculated accordingly (if the total income comes under the tax bracket).

b) No locking period, the pension will be released as per the mode chosen by you, ie if monthly mode then after one month of policy date, if quarterly then after 3 months.

Like other LIC schemes, will premium paid be eligible to be included in 80c?

No, premium paid in PMVVY will not be eligible for 80(C).

Good initiative by our Govt for sr citizen

Very nice scheme. Thanks to our Prime Minister. If 80 c tax benefit is given it would be still nice.

Nice one

What will be position if needed to receive payment on maturity and not as pension.

there is no such option as this is the pension plan, so you get the pension either monthly, quarterly, half yearly or yearly basis.

Nice policy. Iz service tax there on purchase price.

Why not this be treated on the lines of J A scheme extension with immediate pension and no tax deduction on investment and pension receipts ? Because , on one hand you will give 8% percent interest in the form of pension and on the other hand deduct tax on it ? So this is not Pradhan Mantri’s vandan to senior citizens . Instead this is a GOVT’s FD scheme with tax deduction In the garb of PMVVscheme !

when bank reduces rate of interest this scheme will shine.

When banks are cutting interest for sr citizen.hat off to pm for 10 long year of social security.

Many Many Thanks To LIC For New Plan no 842

Really Good steps taken by government for senior citizen

Thanks lots to PM and his team

I could see many Senior citizens are very happy with this plan. But I don’t think it is that very attractive for the following reasons:-

1. The maximum you could invest is Rs 750000 and the maximum you can earn in a year is interest or pension is rs 60000. Is this adequate for a senior citizen?

2. No income tax benefit on the interest and on the amount invested.

3. It could at best augment other investments to the rich pensioners.

4. For poor pensioners do they have this kind of money to invest is the question one has to ponder.

5. A senior citizen will be spending at an average of Rs 2000 per month per head on medication and Rs 3000 per head. What about the other expenditures. where will he / she meet from? I would have appreciated if the Govt had announced a plan where the minimum tax free pension of Rs 10000 pm per head. Thereafter it could have been taxed. Such plan would have benefited the poor who had invested their life time saving to get a pension. In the current form it is only beneficial to people who are already getting pension from their employment.

In my previous post, I meant Rs 3000 per head per month for food.

Adequacy of 8% interest to meet expenses of Senior Citizens, who may have to depend on medical help for survival, will be difficult considering the cost of medical care these days. It will be an alternative option, to some extent as there is a maximum ceiling, to those who mainly depend on interest income from Banks. In my opinion, cheap and good medical insurance policies with adequate coverage (which will include cost of medicines) and prompt service would be of more help to senior citizens.

It would be better if tax benefit is given on the pension amount

If company dividends are tax free, why not pension amount can’t be made tax free for the benefit of senior citizens may be up to certain limit?

Can we put subscription in instalments during this one year window period, of course subject to ceiling amount?

ok

PLEASE MAKE ARRANGEMENTS FOR ONLINE PURCHASE.ALSO THE FORMS SHOULD BE AVAILABLE ONLINE

This policy will be available for online sale.

You can now buy this plan online from LIC website, follow the link given below

https://eterm.licindia.in/onlinePlansIndex/login.do;jsessionid=406F5161809D2184718BCE99E1081C25

The pension received atleast should be tax exempt, to benefit all.

This policy will be available for online sale.

No information on LIC Portal.Pls share a link for online purchase & Oblige.

Haresh Soni

LIC may provide the online link later on their website.

You can now buy this plan online from LIC website, follow the link given below

https://eterm.licindia.in/onlinePlansIndex/login.do;jsessionid=406F5161809D2184718BCE99E1081C25

What about those employees retiring before 60years as retirement age in some pvt. companies is 55 or 58. Are they eligible to invest in this scheme.

Whether the interest is tax free or not?

After maturity or death the amount given to whom ever is considered as non taxable or taxable ?

1. A nice scheme.

2. Like many others , I would have preferred the investment u/s 80c.

3.Pension is subject to tax deduction. This should be tax free in the hands of Senior citizen

4. Pl inform the on-line application information so that the pension can be purchased on line.

I presume this plan is independent of the previous LIC VPBYs and the ceiling of return from this plan is in addition to the total ceiling of investment and interest income under VPBYs.

Yes, it is independent of previous VPBY.

Whether the income received under this scheme will be come under TDS Scheme ?

There will not be TDS deductions from the pension.

The income received under this scheme will be counted for Tax calculation. Pl. clarify Whether the LIC will deduct the Tax directly under TDS, while making payment of pension, if pension, during the year, is more than 10,000.00 per year ?

Govt. should reconsider on Max. Limit and tax benefit on this scheme if really wants to help senior citizen.

842 plan , whether spouse can pay the amount in the name of wife/husband. In who’s income pension will be clubbed ,for income tax purposes.

Pension will be added to income of the pensioner not the proposer (If different)

Good scheme. Since tax benefit is not given, atleast premature withdrawal/exit facility without charges should have been given.

Is it true? If yes. Many many thanks to Lici.

When the amount remains with the LIC for ten years, the pensioner should also get the bonus on maturity of the scheme, as the LIC will be investing the pensioner’s money in the stock exchange and getting high return. It is totally unfair on the the part of the Government / LIC not to extend bonus to the pensioners at the end of the scheme.So, the scheme needs to be revised.

Good scheme for sr citizens.

Minimum ₹20000/- monthly cash required per sr.citizen couple.

Scheme shall felicitate citizens with no otherincome to invest ₹30 lacs without max ceiling of ₹7.5 lacs.( disposing immovable property)

The 8% int. after deduction of a moderate 20% IT the effective int. goes down to 6.4%.

Still in comparative to other FD this is better investment. Is there any TDS.

No TDS

This scheme of 8% interest for senior citizens for 10 long years is very low in view of rising inflation.The govt. Employee retiree’s pension is revised at regular intervals. So this scheme shld have minimum 10% which shld benefit the private company retirees

The govt. Shld revise this scheme.

Appreciate Dipti R Barik for all the info.

(a) Both of my parents are senior citizens. Can I buy this as a joint scheme i.e. on both names ? (b) If yes, in the case of eventuality of one of them, will the pension continue to run on the other name ?

Please clarify.

You can not take this scheme in joint names.

is it different from vbpy2017 announced in budget ?

It’s the same scheme announced but with a different name.

Very big relief to senior citizens.A big thanks. kindly clarify 1.Can be fregmented within 7.5 lac. 2..Can be purchased in joint names.

You can take this scheme in fragments but not available to join life.

I do not require monthly pension. But which has more benefit:If i get monthly pension and invest this pension in recurring deposit in Banks or i get yearly pension and put this pension in fixes deposit in Banks. Please advise me.

Yearly FD will give more yield than the monthly RD. You can check the returns using various financial calculators two are given below

For FD

For RD

There is a substantial percentage of employees who have retired from pvt.service who are not eligible for any pension.The govt.shld bring out a separate scheme so that they may get higher returns to take care of their daily expenses

will the amount received(7.5lac) after 10 years closure will be having tax liability

Can you provide more clarity on the statement mentioned in this policy:

Ceiling of maximum pension is for a family as a whole, total amount of pension under all the policies allowed to a family

under this plan shall not exceed the maximum pension limit. the clarifications required are:

1. If the senior citizen is holding any other LIC policy, would he/she be eligible to take the PMVVY policy ?

2. if yes, what is the maximum amount that can be invested ?

3. If family members / dependents below the age of 60, apply for other policies of LIC, will that affect the PMVVY policy held by the senior citizen ?

4. If there are more than 1 senior citizen in the same family, are they eligible to apply to PMVVY individually ?

1.It is applicable for PMVVY only, you are free to have any other LIC policy.

2. Maximum amount that can be invested is Rs. 750000

3. Any one in family can have other LIC policy there is no restriction to take other policies and will not affect PMVVY.

4. Family here refers to Husband, wife and dependents. If other senior citizen in family and not dependent like father, mother or brothers can take this policy up to permitted limit.

What is the service tax % on the purchase premium?

No service tax on PMVVY.

Is there any discount in premium in case policy is purchased online?

Good policy

It is a good policy for senior citizens who do not have pension option or want to get a regular amount for daily expenses.

The pension shall be Tax free.Retirees have already paid tax during service.The investments is from the Amount rec’d.as retirement benefit

if i want 30000/- pension per year , how much i have to invest in this policy plan 842

Rs. 361446

My wife was working as a primary school teacher in New Delhi Municipal Council at the time of marriage. She continued to work as a teacher in NDMC till she retired at age of 60. I have purchased LIC Policy for annual Rs 60,000/-.

Shrimati contends that she also be permitted to purchase this LIC Policy for Rs 60,000/- annual. Grounds are she has all along throughout been working and financially independent. This condition of Rs 60,000/- annual for family be removed as clubbing of incoming for those independently earning in their careers appears unjustified.

Govt to have a relook. .

Hi, What are the mode of payment to LIC for purchasing PMVVY ?

Only one mode to buy PMVVY ie single premium only.

In PMVVY income is taxable, deposited money cannot be withdrawn for necessacity other than severe disease, after 10 years money received back would value abot 50% of the present value, interest is slightly high which comes down below 7% after paying income tax for 20% slab IT payers. Govt should make it lucrative by allowing IT rebate, easy withdrawal facility and period be reduced to 5 years.

will it be considered as number of live for club membership purpose ? is there any lic circular ?

prabhakar 9246622536

[email protected]