Government vide Notification No. 22/2015-Service Tax dated 6 November 2015, has imposed a Swachh Bharat Cess (SBS)at the rate of 0.5% on all services, which are presently liable to service tax with effect from 15 Novemeber,2015. Hence the revised rate (effective from 15/11/2015) shall be 14% Service tax plus 0.50% SBS i.e. 14.50%.

Table of Contents

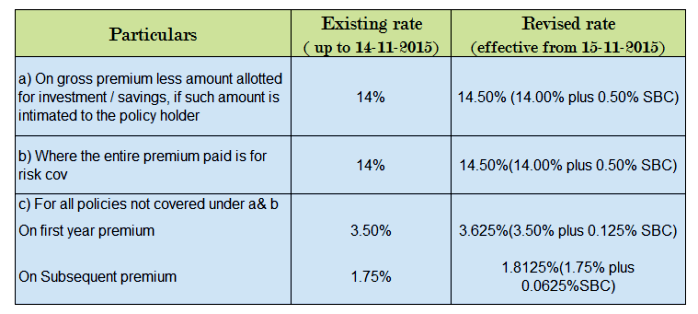

Impact of Swachh bharat cess (SBC) on Insurance premium

Insurance service falls under category of services on which service tax is levied, there for all the insurance premium which are falling due on or after 15/11/2015 will levied by the the rate of 0.5% of the insurance premium. New rates of tax on insurance premium is as follows:

What is Swachh Bharat Cess (SBC)?

It is a Cess which shall be levied and collected in accordance with the provisions of Chapter VI of the Finance Act, 2015,called Swachh Bharat Cess, as service tax on all the taxable services at the rate of 0.5% of the value of taxable service.

What is the date of implementation of SBC?

The Central Government has appointed 15th day of November, 2015 as the date from which provisions of SBC will come into effect (notification No.21/2015-Service Tax, dated 6th November, 2015 refers).

Whether SBC would be leviable on exempted services and services in the negative list?

Swachh Bharat Cess is not leviable on services which are fully exempt from service tax or those covered under the negative list of services.

Why has SBC been imposed?

SBC has been imposed for the purposes of financing and promoting Swachh Bharat initiatives or for any other purpose relating thereto.

How will the SBC be calculated?

SBC would be calculated in the same way as Service tax is calculated. Therefore, SBC would be levied on the same taxable value as service tax.

For More FAQs Related to Swachh Bharat Cess (SBC) Please Click Here

Mr. Pawan,

I have Jeevan Saral policy with quaterly premium 1235/- and policy term of 21 years. I took it at the age of 23 years. The policy purchased year of 2010. What would be the maturity value at the time of maturity?