Settlement Option! have you wondered what is this? Lump sum amount in LIC of India is payable when policy exit by way of maturity claim or death claim (or as per the policy conditions). But, if claimant (Policy holder/nominee) want this amount to be payable in installment over a period of time, then this amount is payable to claimant in installment for a period of minimum 2 year to 10 years as opted by the claimant.

What is settlement option?

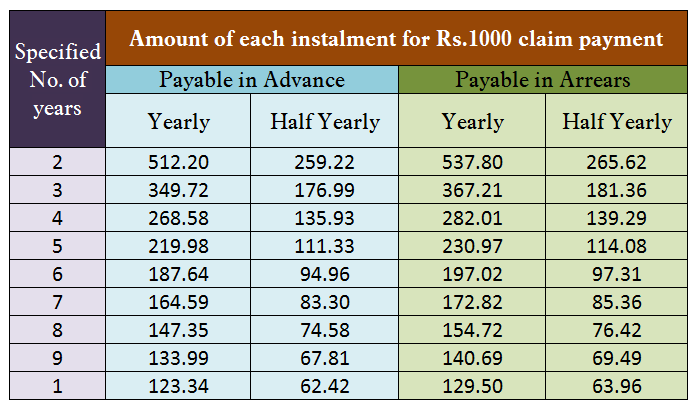

Claim settlement option is nothing but the payment of lump sum claim amount payable in a policy in installment. There are two types of settlement option, one is advance ie first installment is paid on the due date of the claim, and second is arrears ie first installment is paid after 6 month or 1 years (as opted by policy holder). Following are the other important points:

- Claimant has to exercise the option 6 months before the claim become due for payment or later but claim should not have been paid.

- In settlement option claim is paid in yearly or half yearly installments only, and not paid in quarterly or monthly installments.

- Option can be exercised for minimum period of 2 years to maximum period of 10 years only.

- If option is taken minimum amount per installment should not be less than Rs. 2000.

- Claimant who decides to take maturity claim/death claim in installment can take the payment in arrears or advance.

- If the advance installment option is selected then first installment is paid on date of maturity of the claim or date of payment of death claim. Next installment will be paid after 6 months or 1 years (as per the option chosen by the claimant)

- If the arrears option is exercised then first installment is paid after 6 months or 1 years (as per the option chosen by the claimant)

This is good option in hand of policy holder who want a regular payment on maturity instead of lump sum payment. To know more about settlement option, visit this link to read the related circular issued by LIC of India.

very good