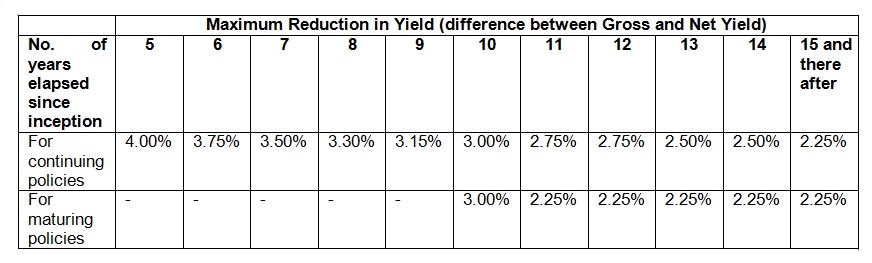

As per the guidelines issued by Insurance Regulatory and Development Authority of India (IRDAI), barring the traditional insurance-cum-investment products, insurance policies now have a cost on caps in the form of reduction in yield. This is applicable on unit-linked insurance plans (ULIPs) and variable insurance plans (VIPs). At various durations starting from 5th policy anniversary till the end of the policy term, Reduction in Yield (RIY) will be calculated as the difference between Gross Yield and Net Yield. Where Gross Yield shall be computed based on the actual accrual of all income elements i.e. premiums, income from investments as an when received and all actual debits.

What is the net reduction in yield?

Reduction in Yield (RIY) is defined in the South African Actuarial Journal as the percentage-point reduction in annual return over the period of saving that is equivalent in overall effect to the erosion of value due to all charges. For example, a RIY of 3.5% p.a. means that you will pay an average annual fee of 3.5% over the term of the investment.

What is Non-negative claw-back Additions?

IRDAI has put on cap on the maximum reduction in yield. If the difference between calculated reduction in yield and Maximum return in yield required is positive then an equivalent number of units shall be added to the Policyholders’ Fund in such a way that the calculated redction in yield shall be equal to the maximum reduction in yield. The same shall be called as Non-negative claw-back addition. The units of the Non-negative claw-back shall be based on the NAV declared as on the date of Non-negative claw-back addition.

Lets see an example taking Maximum reduction in Yield of Newly launched New Endowment Plus plan of LIC of India (Shown in the table above). Suppose the calculated reduction in yield in the 10 year of the policy is 3.15%. But as per IRDAI guideline, in the 10th year of a ULIP policy maximum reductin in yield should not be more than 3%. It means there is a positive deviation, so insurer have to add equivalent number of units to policy holders fund value to bring down the calculated reduction in yield to 3% or less in that year. This addition of unit to maintain the reduction in yield up to a definite level is called Non-negative claw-back Additions.

What is in there for Policy Holders?

There are various charges in ULIP policies, which are deducted from the policy holders fund by cancelling the equivalent amount of NAV. Since performance of any ULIP fund change with time and so does the charges or the cost to the policy holder. By putting on the cap on reduction in Yield by IRDAI, it ensures that charges should not fluctuate much during the policy term and remain with in the limit as prescribe by IRDAI.

To know more about IRDA (Non-linked insurance Products) Regulations, 2013 and IRDA (Linked Insurance Products) Regulations, 2013 please Click Here

Good article, nicely explained the non negative claw back addition.