Have you lost your LIC policy bond? Want to get a duplicate policy bond from LIC of India? Your policy bond is a very important document. It is the main proof of the agreement between you and the Life insurance corporation of India. Whenever you or your nominee approach to LIC for a claim, you have to produce the original policy bond.

Maturity and death claims cannot be settled without submitting the policy bond or indemnity bond. In other words, if in any case, a claim arises in the policy, and you do not have the policy bond, then, in that case, you can submit the indemnity bond in format 3815. But, what if, there is no claim shortly and your policy bond is lost?

Well, there is nothing to worry about this. You can get a duplicate policy bond from the LIC of India. So, let’s see, what is the procedure to get a duplicate policy bond from LIC of India.

Table of Contents

Step 1: Apply for duplicate policy bond and get relevant forms

Your policy bond is a legal document. Therefore, whenever you are applying to get a duplicate policy bond from LIC, you have to submit the indemnity. When you apply to get a duplicate policy bond from LIC, the office will ask you to submit the indemnity bond. You will also be asked to submit a prescribed questionnaire which provides details about how policy bond lost.

Step 2: Complete Indemnity bond and questionnaire and submit to LIC

You will get a format 3756 from LIC and a questionnaire, you have to complete these forms and submit to LIC of India along with valid address proof and identity proof.

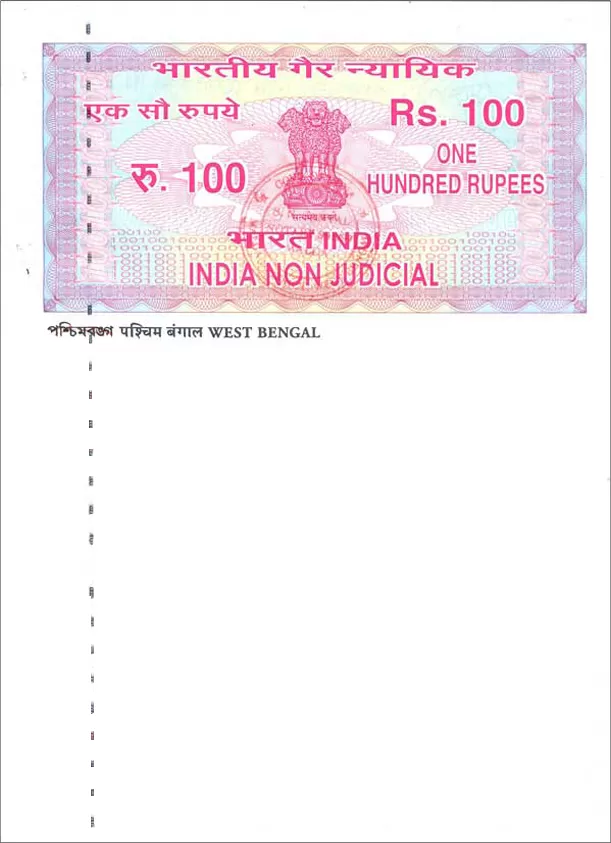

You have to buy a non-judiciary stamp paper to complete the 3756. In other words, the indemnity bond must be notarized on non-judiciary stamp paper of appropriate value. The value of stamp paper varies from state to state. Please confirm the exact value of the stamp paper required from the LIC office.

Print the form 3756 on stamp paper and fill the required details. You have to fill policyholder’s names and policy numbers in form 3756. You need two witnesses to sign the form 3756. Download Form 3756 from Here.

Fill the loss of policy bond questionnaire provided by the LIC of India. It is a simple questionnaire and does not require any witness. It does not require any stamp paper. In other words, it asks about how you lost your policy bond? Have you made any attempt to find the bond? And some more like there questions. Download loss of policy bond questionnaire from here.

You must submit a valid address proof and identity proof along with your indemnity bond and questionnaire. That means LIC will not process your application if you do not provide valid address and identity proof along with your application.

Step 3: Submit the fee for duplicate policy bond

To get the duplicate policy bond from LIC, you have to submit a fee. This fee is called duplicate policy charges. You have to submit a duplicate fee of Rs. 75 along with policy stamp charges at the rate of Rs. 0.20 per thousand Sum Assured. Additionally, you have to pay 18% GST on duplicate policy charges. You have to deposit the fee on the LIC branch cash counter only along with policy stamp charges.

Step 4: Preparation of duplicate policy bond.

If LIC finds your paper in order then they will process your application. A new policy bond marked as DUPLICATE will be prepared for you. Preparation of policy bond may take 2 to 7 working days. Of course, the time taken to prepare a duplicate policy bond will be different from a different office. Meanwhile, you can always call the office and know the status of the policy bond.

Step 5: Collect duplicate policy bond

If you want, you can collect a policy bond directly from the LIC office. Of course, you have to give consent to receive the duplicate LIC policy bond by hand or through the LIC agent.

Else, LIC will send the duplicate policy bond to your registered address. If your address is changed, you can change it online through LIC customer portal in simple steps. Know-How to change address in LIC policy online?

Other points to keep in mind before applying

There are some other things that you should keep in mind before applying for a duplicate policy bond from LIC of India.

- If your old policy bond is torn apart due to some reason. And Policy number visible in torn pieces, then you do not have to submit an indemnity bond. Though, you have to submit the duplicate policy charges along with GST and policy stamp charges.

- Confirm the value of non-judiciary stamp paper with the LIC branch before preparing an indemnity bond. In other words, if you prepare without consulting the value, you may have to again take the pain to buy additional stamp paper. On the contrary, you might end up taking higher value stamp paper than required.

- Earlier you have to give an advertisement in a newspaper regarding the loss of policy bond to get a duplicate policy bond from LIC of India. Now, this has been discontinued by the LIC of India.

- Submit the proper and valid address and identity proof with your indemnity bond. If you are unable to submit the proper KYC documents, you may have to give an advertisement in a newspaper.

- You need a different form for duplicate policy bond if you are surrendering the policy. The same is applied for the Maturity claim and death claim. You have to use another format i.e. 3815 for this purpose.

If you have any other questions related to LIC servicing then just mail us at [email protected]. You can also comment below. Share if you liked this information useful because Sharing is caring!.