This year from 01/09/2016 Life Insurance Corporation of India (LIC) is celebrated it’s Diamond Jubilee year. On this occasion, LIC had launched plan “Bima Diamond” Table No. 841. This policy is available for sale up to 31 August 2017. LIC’s Bima Diamond is a Non-linked, with profits, limited premium payment money back plan. It provided money back at an interval of every 4th year. LIC’s Bima Diamond provided extended life cover up to the half of the policy term after the completion of the policy term. Unique Identification of LIC’s Bima Diamond Plan is 512N307V01.

Table of Contents

हिन्दी में पढें: एलआईसी की नयी योजना बीमा डायमंंड (प्लान न. 841)

Auto Cover in LIC’s Bima Diamond

“Auto Cover period” in a paid-up policy will be the period from the due date of first unpaid premium (FUP), which includes the grace period. “Auto Cover period” is the period during which full risk cover is available for the life assured even if the regular premium is not paid during this period. The duration of “Auto Cover period” will be available as follows:

- If at least three full years’ but less than five full years’ premium have been paid and any subsequent premium is not duly paid: “Auto Cover period” of six months from the due date of the first unpaid premium will be available

- If at least five full years’ premium have been paid and any subsequent premium is not duly paid: “Auto Cover period” of 2 years from the due date of the first unpaid premium will be available

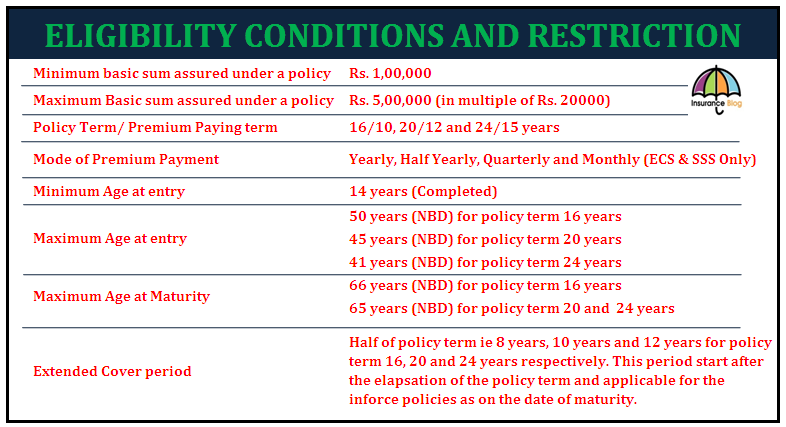

Eligibility Conditions and Restrictions in LIC’s Bima Diamond

Benefits in LIC’s Bima Diamond

Benefits which are payable in inforce LIC’s Bima Diamond Policy are

Death Benefits in LIC’s Bima Diamond

In case of the death of Life Assured before the date of Maturity

During the first 5 policy years “Sum Assured on Death” will be paid to the nominee.

After completion of 5 policy years but before the date of maturity: “Sum Assured on Death” and Loyalty addition (if any) will be paid to the nominee of the Life Assured.

The death benefit will not be less than the 105% of all the premium paid in the policy as at the date of death of the life assured. (The premium referred above will not include any taxes, extra amount charged due to underwriting decision and rider premium, if any.)

In case of the death of Life Assured during the extended cover period

An amount equal to 50% of Basic sum assured will be paid to the nominee.

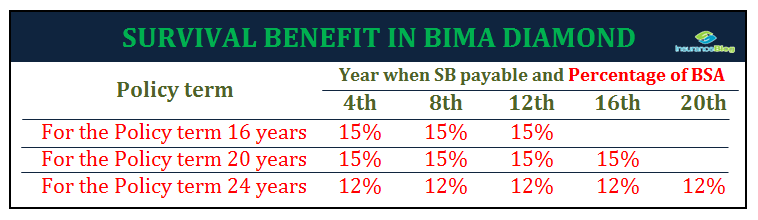

Survival Benefits in LIC’s Bima Diamond

If life assured survives to the specified duration during the policy term, then a fixed percentage of Basic Sum Assured is will be payable to the life assured. The fixed percentage in various terms are mentioned below:

Maturity Benefits in LIC’s Bima Diamond

If the Life Assured survives till the end of the policy term, “Sum Assured on Maturity” along with Loyalty Addition, if any will be payable to the Life Assured.

Where “Sum Assured on Maturity” in LIC Bima Diamond is

55% of Basic Sum Assured in policy term 16 years

40% of Basic Sum Assured in Policy terms 20 and 24 years.

Optional Benefits in LIC’s Bima Diamond

Proposer can opt for the optional riders by payment of additional premium. Benefits under the optional rider will be available during the policy term only.

LIC’s Accidental Death and Disability Benefit Rider UIN (512B209V01)

If this benefit is opted for, an additional amount equal to “Accidental Benefit sum Assured” is Payable on death due to Accident, provided the rider is inforce at the time of the accident. In the case of the accidental permanent disability (within 180 days from the date of accident) an additional amount equal to “Accidental Benefit sum Assured” is Payable in equal monthly installments spread over 10 years. The future premium will be waived for the accidental benefit rider and premiums for the portion of Basic sum assured will be waived. This rider can be taken at the inception of the policy or before the premium term is over.

LIC’s New Term Assurance Rider UIN (512B210V01)

If this benefit is opted for, an additional amount equal to “Term Assurance Rider sum Assured” is Payable on death to nominee, provided the rider is inforce at the time of the death of the Life Assured. This rider can be taken at the inception of the policy.

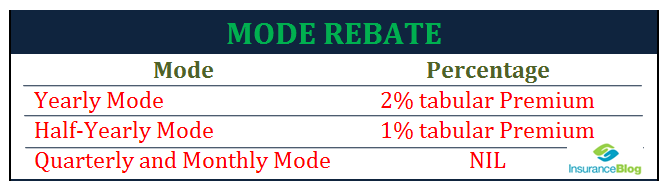

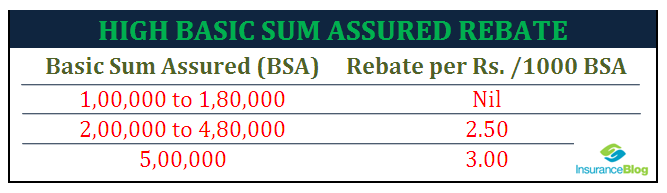

Rebates in LIC’s Bima Diamond

Following rebates to proposer is available on the premium if he/she opts for the higher mode and take the high-risk cover policy. Rebales available in LIC’s Bima Diamond are as follows:

Other Important features and condition in LIC’s Bima Diamond

- Loan facility is available in this plan, after the payment of premium for at least full 3 years.

- Policy can be revived within the 2 years of the FUP.

- Grace period in the policy is available; one calendar month, not less than 30 days in yearly, half yearly and quarterly mode and 15 days in monthly mode.

- The policy will acquire paid up value if the premium has been paid for 3 full years.

- Policy can be surrender after the 3 years if at least 3 full year premium is already paid.

- Free look period of 15 days from the date of receipt of the policy bond.

- Backdating is allowed within the same financial year.

- Nomination and Assignment are allowed in the policy.

Premium Rates in the LIC’s Bima-Diamond Policy

Great.

I am 69 years old. Am I eligible for this plan ?

BEST OPTION FOR THIS AGE GROUP IS SINGLE PREMIUM JEEVAN AKSHAY PENSION PLAN

Respected Sir,you are not eligible for this plan.Maximum age limit for this plan is Age 50. Hence you can take other plan which is suitable for your age. You can contant me at cell no.9840876199/my email: [email protected].

WHY THE PREMIUM TERM OPTION NOT MENTIONED IN HIGHLIGHT. HIGHLIGHT THREE ITEMS ONLY

very good plan

till now premium chart not published

PLS PRINT PREM.CHART OF BIMA DIAMOND.

PLS PRINT PREM.CHART OF BIMA DIAMOND.

NEW LIC BIMA DIAMOND 841 VERY GOOD POLICY

sir thank u.auperb plan.like old174/179.

As per lic act sum assured and bonus are guaranteed. What about loyalty addition. kindly reply.

if one person take 1 lakh policy”841-16(10)” how much RS. he will got in 16th year

very very good plan

nice plan

Lics New plan Bima diamond (841) no doubt it is a good money back plan. Premium chart chart is not given so far, what is the use of it?. No premium chart how the agents sell this Bima diamond plan. All the big brass of LIC don’t know this simple thing?. Added to that it is closing ended plan. At least better late than before like that our LIC will shortly announce the premium chart?.

very very good plan

very good plan

I am 55 years old. Am I eligible for this plan ?

iam55yearsage best plan foryou

I am 55 years old. Best plan for me ?

VERY VERY LUCRATIVE AND PROFITABLE PLAN INTRODUCED BY LIC . THIS IS AS PER THE NEED OF PUBLIC DESIRE PLAN AND MAY BE SUCCESSFUL IN THE MARKET SINCE THE PUBLIC DO NOT WANT TO KEEP THE HOLDING OF MONEY FOR LONG DURATION. AJAY CHAKRABORTY LIC AGENT 11593 41J, KOLKATA.

Indha (This) Policy Super policy, Indha Policy Best Policy, Indha Policy Top Policy, Indha policy Value for Money Policy !

I am a house wife aged 58. Am I eligible in this plan?

Short term LIC latest money back plan.

Very good plan for midle class families

Can any one take two or three policies of bima diamond of sum assured five lacs

Can anyone buy more than one policy of 5lacs of bima diamond

very good plan for year money plan

Hi

I have a question:

I wish to buy a Term Plan for myself. As per the current news, GST is supposed to be rolled out from April, 2017.

I have already completed Section-80C investments for Income Tax Purpose for this year, so want to go for new Term Plan in next year April so that I can claim its rebate under 80C.

My question is what will be the implication on Total Premium outgo in terms of Service Tax/ GST if I purchase now or in April, 2017. If I purchase now, will GST still affect my Premium outgo next year onwards if it gets rolled out in April, 2017.

Please suggest what will be the better time to purchase new plan.

PREMIUM CHART NOT AVIABLE

I am getting premium chart.

Dear Pawan Sir,

I had taken a policy in year 2003, Plan term was 75/20. The policy will mature in 2023. Will the Dimond Jubilee Reversionary bonus declared by LIC recently added to my Vested Bonus…….? Please guide me in this regard.

PLAN IS TOTALLY WORTHLESS BECAUSE PERSON IS PAYING (9057 RS. PREMIUM * 10 YEARS)=90000 APPROX. LIC GIVES RETURN ONLY 114000 RS. IF YOU INVEST SAME AMOUNT IN MUTUAL FUNDS THAN YOU CAN GET HANDSOME RETURN. THEREFORE DON’T GO WITH THIS LIC.

if mutual fund returns are so lucrative why 26 crore indian investor tag their saving in LIC ???

respected sir,

iam tk manikanta working as engineer i want lic policy my age 24 which is the best policy please can u suggest me

Hi Manikanta. If you are still looking for a good financial solution then do contact me on [email protected]

My age is 37 yrs which plan suitable for savings , investment & protetion , suggest me

Hi Sunil, If you are still looking for a good financial solution then kindly contact me on [email protected]

LIC have many plans Jeevan Ananad, Jeevan Labh and Bima Diamond Plan thease plans are very much suitable for savings, Investment, and Protection. This is depend on you which policy you like to take.

Please contact to get LIC policies in MUMBAI Ghatkopar region.

Dharmendra Bharti

LIC of India and Income tax return

Mobile:9004627603/9702320582

sir bimadiamond superb plan. i have sold nearly 5.on launching day 1st in sat office.just for information.cliant have lote of awaireness.by j.arulmozhi

Nic plan

very useful matter of LIC plans.but it is amazing that you hav such a wonderful presentation of only LIC and not another 25 Life ins companies

hiiii all my friends

i am insurance advisor in LIC of India

i will help any work about LIC pls contact my cell urgent 9167378026 and whatsapp no 7506055507 i will help u

Great

Life insurance corporation (LIC) is the largest insurance company in India fully ownverd by the government this financial year 2016-2017 teck lic new policy and save tax under both and maturity clam tax free returns

Regards

pramod tiwari

Lic of India (unit 310)

86 janpath new Delhi 110001

09310467871

09650941946

Dear

sir any problems and any query regarding lic policy so please call me or visit nearby lic branch office please don t’ by shear any details any one proson an phon call

f you want to know more about the policies offered by LIC, simply dial 1251 from your landline (BSNL/MTNL) number.

Mobile phone users should prefix the STD number of their city. If you have a query or complaint related to your policy, then you may call the all India

To know Policy details through IVRS, simply dial 1251 available 24×7 in the following cities

LIC Customer Care Toll Free Number : LIC Helpline Number

LIC toll free numbers 1800-33-4433 or 1800-22-4077. Alternatively you can call the regional customer service number for LIC office in your city

I have provided regional customer care numbers for some of the main cities in India

LIC of India Contact Number

LIC Customer Care Toll Free Number: 1800-33-4433, 1800-22-4077

LIC Policies Enquiry Number: 1251 (detailed info. 24X7)

LIC customer care number Delhi:

011-28844132 | 011-28822223 | 011-28855115

LIC Helpline Number Mumbai:

022-22028225 / 022-66599066 |

022-24010375 / 022-30492020 |

022-67819220 | 022-66599233

Open : Mon to Fri 8.00 am to 8.00 pm

Sat 10.00 am to 6.00 pm

Regional LIC Customer Care Numbers

Delhi :- 011-23762681

Kolkata :- 033-23346688

Hyderabad :- 040-23437997

Bengaluru :- 080-26659230

Mumbai :- 022-26137545

Pune :- 020-25514248

Chennai :- 044-25300030

LIC Central Zone Office Number

BHOPAL : – 0755-2676254

BILASPUR : – 07752-2203732

GWALIOR : – 0751-2448606

INDORE : – 0731-2523513

JABALPUR : – 0761-2671079

RAIPUR : – 0771-2583062

SATNA : – 07672-228100

SHAHDOL : – 07652-248469

LIC Central Office Contact Details

Address: Life Insurance Corporation of India , 2nd Floor, Jeevan Bima Marg

Mumbai – 400021, India

Contact Number: 022- 22028227

Email: [email protected]

Official Website LIC of India: – http://www.licindia.com

Should you have any comments or queries please do not hesitates to contact.

Thanks and regards

PramodTiwari

Senior Insurance Advisor (Lic of india)

Branch Office: 310, Oriental Annexe 1st and 2nd floor, 86, Janpath, New Delhi – 110001

Satellite Office: 310 (SO), Plot No. 32, DDA Community Centre, Rani Bagh (Behind M2K Pitam Pura), Delhi – 110034

Mobile-09310467871

09650941046

Email [email protected]

dear sir is there any plan to withdraw jeevan rakshak 827.