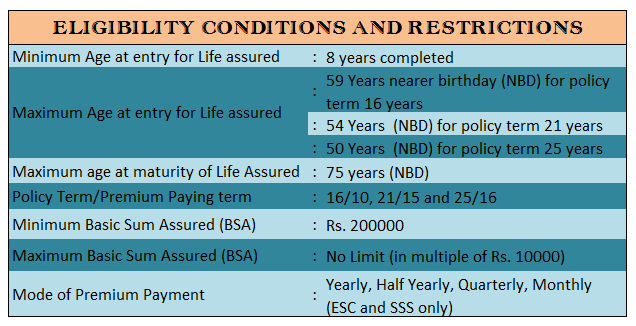

LIC of India’s Jeevan Labh (Plan No. 836) is a limited premium paying, non-linked, with-profit endowment assurance Plan. Unique identification number (UIN) of Jeevan Labh plan is 512N304V01. This policy is available from a child of 8 years old to a person of age 59. The main feature of this plan is a very limited premium payment option, for the 16-year policy term customer have to pay the premium for 10 years and for 21 and 25 years of policy term policyholder have to pay the premium for 15 and 16 years respectively.

Table of Contents

Benefits of Jeevan Labh Plan

Benefits payable under an inforce policy are:

Death Benefit

On the death of the life assured during the term of the policy, the Death Benefit defined as the sum of “Sum Assured on Death” and vested simple reversionary bonuses and Final Additional Bonus, if any, shall be payable.

Where “Sum Assured on Death” is defined as the higher of 10 times of annualized premium or absolute amount assured to be paid on death i.e. Basic Sum Assured.

This death benefit shall not be less than 105% of the total premiums paid as on date of death.

Premium mentioned above will not include any taxes, extra amount chargeable under the policy due to underwriting decision and rider premium if any

हिन्दी में पढें: एल आई सी की नयी योजना जीवन लाभ (तालिका क्र. 836)

Maturity Benefit in Jeevan Labh

On survival to the end of the policy term, “Sum Assured on Maturity” along with vested simple reversionary bonuses and Final Additional bonus, if any, shall be payable. Where Sum Assured on Maturity is equal to Basic Sum Assured (BSA)

Optional Benefits

- LIC’s Accidental Death and Disability Rider UIN (512B209V01): If this benefit is opted for an additional amount equal to the Accidental Benefit Sum Assured is payable on death due to an accident, provided the rider is in full force at the time of the accident.

- LIC’s New Term Assurance Rider UIN (512B210V01): If policyholder opts for this rider then, an amount equal to Term Assurance Rider sum assured will be payable to on the death of the Life Assured during the policy term, provided the rider cover is in full force at the time of death.

Other conditions and policy feature of Jeevan Labh

- Policy will acquire paid up value if at least 3 full years’ premiums have been paid

- Jeevan Labh policy can be surrendered at any time during the policy term provided at least three full years’ premium have been paid

- Loan facility is available under this plan, after payment of premiums for at least 3 full years subject to conditions: Maximum loan for inforce policy-90% of surrender value and for paid up policies 80% of surrender value.

- Policy can be taken from backdate up to current financial year

- Nomination and assignment in this policy are available

- policy can be revived within the 2 years of First Unpaid Premium (FUP) by paying all the due premiums

New Jeevan Labh policy. Is my wife aged 59 years eligible?(dob 8 3 56).Policy term.4. states that policy can be taken from back date to current fin year. If so, can it be taken from Jan 2014 by paying two year premium when her age at entry would be 57. Pl inform. If 10L policy is taken what is the annual premium?

Hi, my age is 32. I want to pay lic premium 50000 annually. I want death cover, accidental cover & disability cover. What is the best LIC plan for me. Also pls advise about LIC’s child plan. my child age is 3 years.

good plan

good

Please provide LIC’s New Plan Jeevan Labh (Plan no. 836)

calculation

I am a highly qualified and authorised Insurance agent of most trusted LIFE INSURANCE COMPANY (LIC) in India to serve all income group peoples in Mumbai-Thane area for several years.

If you are unsure and want to know the best suitable and profitable LIC plan then please contact me on +91-9665310172 / +91-8087703317 or you can drop me an email with your requirements at [email protected].

I want to buy a lic policy. my monthly income is Rs. 15000/-. Tell me the name of a policy to give maximum benefit.

Sir..My son is 1.5 years old my age is 43 and my income is 50k monthly kindly suggests me weather I go for jeevan tarun or jeevan shikhar

I am a highly qualified and authorised Insurance agent of most trusted LIFE INSURANCE COMPANY (LIC) in India to serve all income group peoples in Pune area for several years.

If you are unsure and want to know the best suitable and profitable LIC plan then please contact me on +91-9503201043 / +91-7741077969 or you can drop me an email with your requirements at [email protected]

Please inform in detail new beneficial lic scheme/policy launched including Jiban Labh

I am not able to under stand jeevan labh policy. Please explain in simple words. My age is 25 year what should i pay annually.

Thanks

Mohit goel

I do not understand how much exactly i will get after the Full Term, As it is (BSA + vested simple reversionary bonuses + Final Additional Bonus). Can you tell me regarding the two bonus’s mentioned here. For Eg: Term 16, PPT 10, BSA 2Lack and Age 35. What could be the approximate Overall Bonus we may get?

My child physically handycapd.her age is 5years ok suggest in best lic childeren policy.

Kindly suggest best return amount plan after 15,20 years

I wish to take take a policy for Jeevan Labh 836 and please let me have the premium and returns (benefit upon maturing) through a mail … Age 15 – 10 years policy…maturity after 16 years….what are all the benefits

HI I AM 31YRS MY ANNUAL INCOME IS 05LACS,I HAVE A TRIPLE ENDOWNMENT POLICY OF RS 600000 A CHILD PLAN JEEVAN ANKUR OF RS 670000. I HAVE TOTAL 03 CHILDREN PLEASE SUGGEST ME A PLAN AND ALSO LET ME KNOW BETWEEN JEEVAN ANAND,JEEVAN LABH,JEEVAN PRAGATI,NEW ENDOWNMENT PLAN 814 THE BEST PLAN FROM TESE IF THE SUM ASSURED IS RS 1200000.

I am a highly qualified and authorised Insurance agent of most trusted LIFE INSURANCE COMPANY (LIC) in India to serve all income group peoples in Delhi area for several year

If you are unsure and want to know the best suitable and profitable LIC plan then please contact me on +91-9871045828 or you can drop me an email with your requirements at [email protected]

this is best policy in lic.this policy more benifit in lic.

sir

my age 28 year sum assurd 3 lakh .term 21 years .plz tell me the premium yearly

sir

my plan jeevan labh

my age 28 year sum assurd 3 lakh .term 21 years .ppt 15.term 21.plz tell me the premium yearly

sir

i trust inlic.i have policy with lic

i want to take lic policy that gives a good return and high risk covour

i can pay premium yrly 50 k(50000 thou)yearly,pl advise me with full details

my age is 47 years,policy required for 20 yrs

i have a policy jeevan saraland i ampaying 3000 thousand per month from 2005/

its is for 2

15 yrs

how much i can getat end of 2020

I AM 23 YRS & EARNING OF RS, 19000/0 SALARY PM KINDLY SUGGEST ME THE SUITABLE LIC POLICY FOR 15 TO 20 YRS

lic suitable policy

pl. suggest me the suiatable LIC policy for me

Very nice plan for policy holder

Lic new jeevan pragati plan A comprehensive plan for Young People by LIC of India, where the risk cover will increase automatically up to 200% without any extra cost

And tax Free amount after maturity

Regard

Pramod Tiwari

Lic of India (units 310)

86 Janpath new Delhi 110001

09310467871

09650941946

GET TAX FREE MATURITY OF 26LAKHS+PENTION OF RS 2 LAKHS FOR LIFE TIME WITH FAMILY FUND OF 35 LAKHS JUST SAVE RS 251/- PER DAY ONLY

further details please free to call me

U koti

9705149928

I AM GANAPATHI RAO NALI, CHIEF LIFE INSURANCE ADVISER FROM LIFE INSURANCE CORPORATION OF INDIA (LIC OF INDIA) WITH 20 YEARS EXPERIENCE. PLEASE SEND YOUR REQUIREMENTS WITH YOUR YOUR DATE OF BIRTH, EMAIL AND PHONE NUMBER. I WILL GUIDE YOU A SUITABLE PLAN OR CONTACT 09490132317 FOR FULL DETAILS

PLEASE FEEL FREE TO CONTACT MR. GANAPATHI RAO NALI PH. 09490132317 OR EMAIL [email protected] for BEST INSURANCE AND FINANCIAL ADVISE

want a benefit of sum of one crore in 10 years !!is there any appropriate lic policy

Lic new jeevanLabh plan A comprehensive plan for Young People by LIC of India, where the risk cover will increase automatically up to 200% without any extra cost

And tax Free amount after maturity

Lic new jeevan Labh plan A Lucrative and profitable plan for Young People by LIC , where the risk cover will increase automatically without any extra cost

and tax Free amount after maturity and yield High return value.

Sir

My mom is 40yrs old .she is non salaried but working women.can she opted jivan lav & e-term plan.

Am a defence personnel who has service of 6 years would like to join in jeevan labh of 3000 range monthly scheme.ryt now my age is 26.can u brief me the benefits of that?

hiiii all my friends

i am insurance advisor in LIC of India

i will help any work about LIC pls contact my cell urgent 9167378026 and whatsapp no 7506055507 i will help u