With recent changes in the interest rates, Life Insurance Corporation of India has closed its annuity plan Jeevan Shanti with effect from 20/10/2020. It is now relaunched the Deferred annuity plan New Jeevan Shanti. The plan number for New Jeevan Shanti is 858. This newly modified plan is available for sale from 21/10/2020.

LIC’s New Jeevan Shanti (Plan No 858) is a Non-linked, Non-participating, individual, single premium, Deferred Annuity Plan. The annuity rates in New Jeevan Shanti are guaranteed from the inception of the policy. The Unique Identification Number (UIN) for LIC’s New Jeevan Shanti is 512N338V01. This plan is also available for sale through LIC’s Online Portal.

Table of Contents

What is a Deferred Annuity?

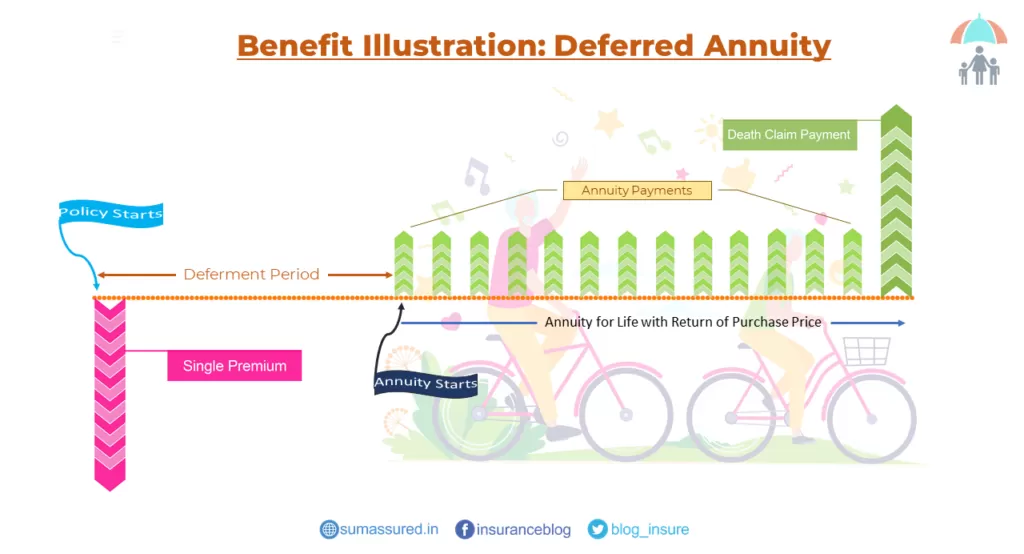

If you are reading about LIC’s Jeevan Shanti, then you may wonder what deferred annuity is? Annuities are classified into two categories, based on when the payment of annuity will start. The first one is an immediate annuity and the second is a deferred annuity. As the name suggests, the payment of annuity immediately starts after the purchase of the plan. On the contrary, annuity payments in deferred annuity start after some period already chosen by the annuitant/proposer at the time of purchase of the annuity plan.

For example, you have purchased the LIC’s New Jeevan Shanti Plan in 2020 and have opted for a deferment period of 5 years. In this case, annuity payment will start in the year 2025. See the diagrammatic illustration below.

Eligibility Criteria of LIC’s New Jeevan Shanti, Plan No 858

Individuals having age between 30 to 79 can take LIC’s New Jeevan Shanti, Plan No 858. Minimum Purchase price is Rs. 150000. However an individual must get an annuity of minimum Rs. 1000 per month, Rs. 3000 per quarter, Rs. 6000 per Half yearly or Rs. 12000 per annum. Although there is no maximum limit for purchase price. Minimum deferment period is 1 year and maximum is 12 years. This plan is also available for joint lives and can be taken between two lineal descendant/ascendant.

Annuity Options and mode Available in LIC’s New Jeevan Shanti

LIC’s New Jeevan Shanti is a deferred annuity plan. Annuity can be taken on the name of single life or on the joint life. Joint life can be Grandparents, parents, children, grandchildren, spouse and siblings.

Allowed mode of payment in Jeevan Shanti is Yearly, Half-yearly, quarterly, and monthly. An annuity in Jeevan Shanti is paid in arrears. Annuitant has the option to change the mode of annuity payment during the deferment period. After vesting, mode change is not allowed.

Benefits of New Jeevan Shanti, Plan No 858

There is no maturity benefit available in this plan. However, survival benefit and death benefit payable in this plan are as follows

Death Benefit

Death benefit payable to the nominee will be higher of

“Purchase Price” plus (+) accrued “Additional Benefit on Death” minus (-) Total annuity amount payable till date of death.

or

105% of Purchase Price.

Option Available for the payment of Death Claim

There are various options available for the payment of death claim in the LIC’s New Jeevan Shanti, Plan No 858. The proposer has the option to choose one of these options at the time of taking the policy. Some options are available to the nominee.

Lumpsum Death benefit

In this option, full death claim amount is paid in single payment. No, future payments of any kind to the nominee.

Annuitization of Death Benefit

As per the need of the nominee, he/she can opt to purchase the annuity from LIC of India with the death claim payable to him/her. The annuity rate will be as per the annuity rates at the time of purchasing the plan and according to the age of the nominee.

Installment death benefit

The death benefit can be taken in installments according to the installment option. The period of installment can be 5, 10, or 15 years. Although, the minimum installment amount should not be less than Rs. 5000 monthly or Rs. 60000 yearly.

Surrender of LIC’s New Jeevan Shanti

LIC’s Jeevan Shanti, Plan No 858 has the option to surrender during the policy term. The surrender value will be different during the deferment period and after the deferment period. The Surrender Value payable will be higher of Guaranteed Surrender Value (GSV) or Special Surrender Value (SSV). Here Guaranteed Surrender Value is defined as (Guaranteed Surrender Value Factor X Purchase Price) – (minus) Total annuity amount payable up to the date of the surrender.

Special Surrender Value is different during the deferment period and after the deferment period.

Loan in Plan No 858

Loan in LIC’s New Jeevan Shanti, Plan No 858 is allowed after the 3 months of the issuance of the policy. Under Joint life policy, the Primary annuitant can take the loan and after the death of the primary annuitant, the secondary annuitant can take the loan in the policy. The maximum loan allowed in policy will be such that loan interest must not be greater than 50% of the annual annuity payable. The rate of interest on the loan will be declared by LIC from time to time.

LIC’s New Jeevan Shanti-other features

- This policy is available for sale from LIC’s Online portal also.

- Backdating is not allowed.

- The policy can be assigned as per section 38 of the Insurance Act 1938.

- A nomination is required in this policy as per Section 39 of the Insurance Act 1938.

- Freelook period of 15 days, from date of receipt of the policy. If the policy is taken online then 30 days.

- GST will be imposed as per the rates declared by the government from time to time.

If you have any other questions related to LIC servicing then just mail us at [email protected]. You can also comment below. Share if you liked this information useful because Sharing is caring!