Life Insurance corporation of India is going to launch its new immediate annuity plan Jeevan Akshay VII (Plan No. 857). Jeevan Akshay VII is a Single Premium, Non-linked, Non-participating, Individual immediate annuity plan. This plan is available for sale from 25/08/2020.

This plan will be having 10 immediate annuity payment options to choose from (Option A to J). These options are similar to old Jeevan Akshay VI. With the launch of this plan, LIC is also withdrawing the immediate annuity options from Jeevan Shanti (Plan N0. 850). In other words, Jeevan Shanti will now be a deferred annuity plan only.

The unique Identification Number (UIN) of Jeevan Akshay VII is 512N337V01

Table of Contents

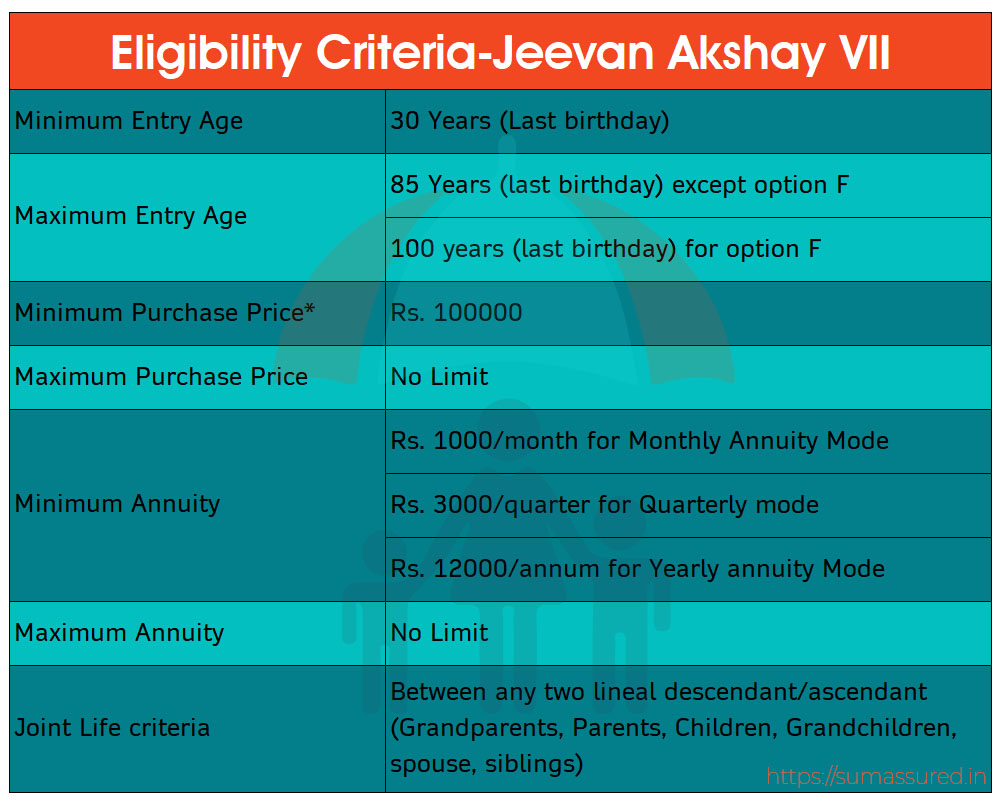

Eligibility Criteria of Jeevan Akshay VII

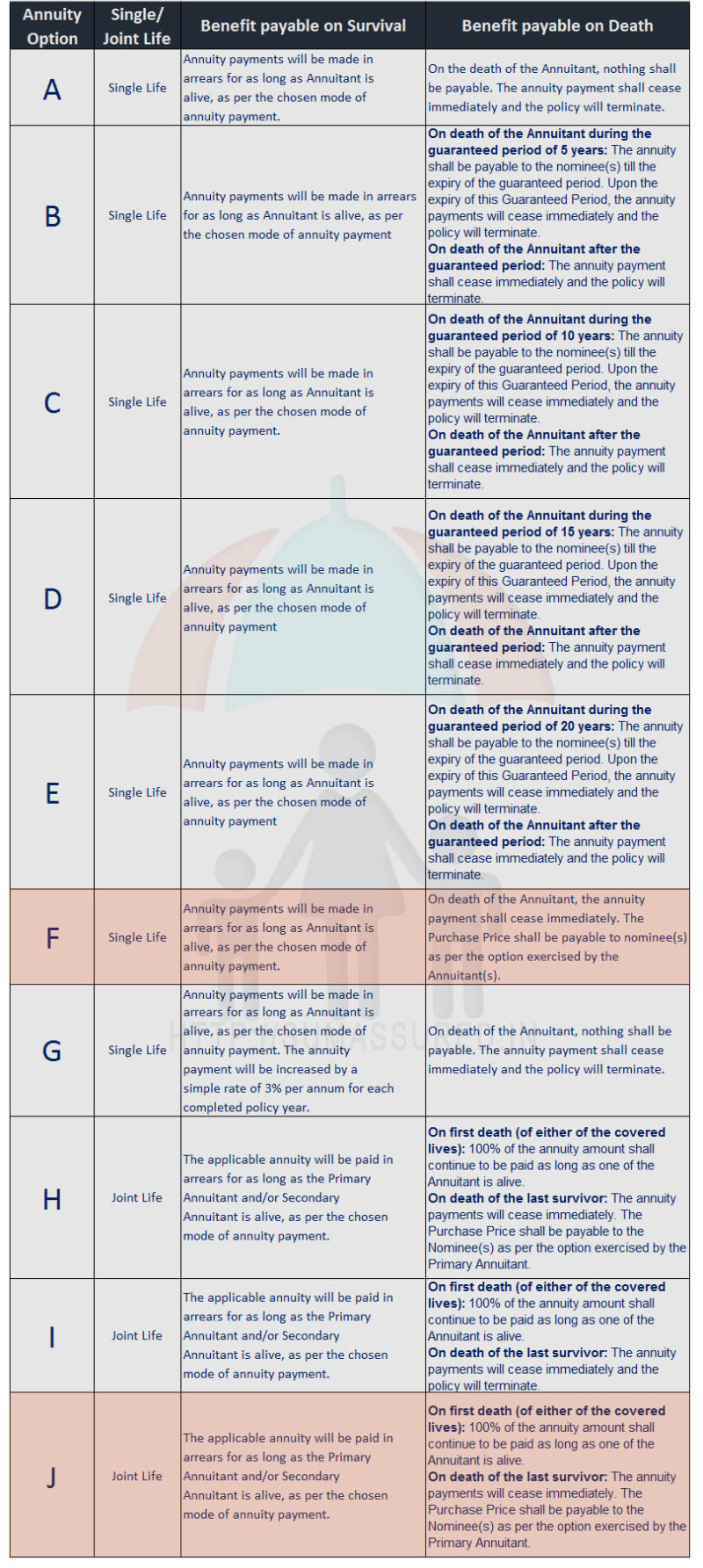

Annuity Options in Jeevan Akshay (Plan 857)

There are 10 option annuity options available in the LIC’s Jeevan Akshay VII plan. Proposer has to choose one of these option at the proposal stage. Once you have selected annuity option, you cannot change. Therefore choose the option wisely. Most popular options are Option F and Option J. These option provide the return of purchase price after death of annuitant.

Benefits of Jeevan Akshay VII

After the purchase of an annuity in Jeevan Akshay VII, the first installment of the annuity will be paid after one year, six months, three months, or one month. This depends upon the mode of annuity payment option yearly, half-yearly, quarterly, or monthly respectively. The proposer has to choose the option at the proposal stage only. The annuity amount is assured throughout the period of which it’s payable. The annuity will be paid during the lifetime of the annuitant with the following provisions on the death of the annuitant according to the option of the annuity chosen. Please see below the various benefits in LIC’s Jeevan Akshay VII

Options available for payment of death claim

In the options F and J (where return of purchase price is available) the nominee have 3 options to take the death claim. These options are:

- Lump-sum Death Benefit: In this option, the nominee will get the full purchase price in one full installment.

- Annuitisation of death benefit: The nominee have an option to take the annuity from the death claim amount. However, annuity rates will be according the prevailing rates at that time and the age of the nominee.

- Death Benefit in Installment: The nominee can take the death benefit in the policy in installments. Period of installment can be 5, 10 or 15 years.

Other important conditions

- This policy is available for online sale also. Additional rebate is available on the online sale of this policy.

- Statutory tax if any is applicable as per the prevailing rates. Currently, it is 1.8% on annuity plans.

- Freelook period/cooling-off period of 15 days available from the date of receipt of the policy bond. 30 days if policy purchased online.

- Loan facility available in this plan after 3 months of issuance of policy bond. Available only under option F and J. In other words, loan facility available in the options where return of purchase price is available.

- The policy can be surrendered after 3 months of issuance of policy bond. Available only under option F and J.

- Backdating not allowed in this plan.

- The assignment of this policy is allowed as per Section 38 of the Insurance Act, 1938.

- The nomination is allowed as per Section 39 of the Insurance Act, 1938

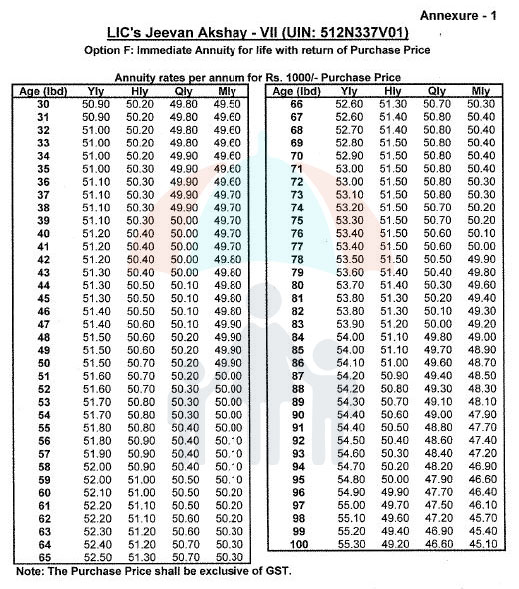

Annuity rates of Jeevan Akshay VII- Option F