LIC has announced to launch of a new pension product with the name of LIC’s Jeevan Dhara 2. LIC’s Jeevan Dhara 2 is a Non-Linked, Non-Participating, Individual. Savings, Deferred Annuity plan. In LIC’s Jeevan Dhara 2 proposer has the option to choose the mode of premium payment, Deferment Period, Annuity Option, and mode of Annuity payment.

In Jeevan Dhara 2, annuity rates are guaranteed since the inception of the policy and annuities are payable after the Deferment Period in the arrears throughout the lifetime of the Annuitant (s) according to the annuity option chosen by the proposer.

Table of Contents

Salient Features of LIC’s Jeevan Dhara 2

- Guaranteed annuity from inception

- Higher annuity rates at higher ages

- Life cover during the deferment period

- Option for regular and single premium payment

- Enhanced benefits for existing LIC Policyholders

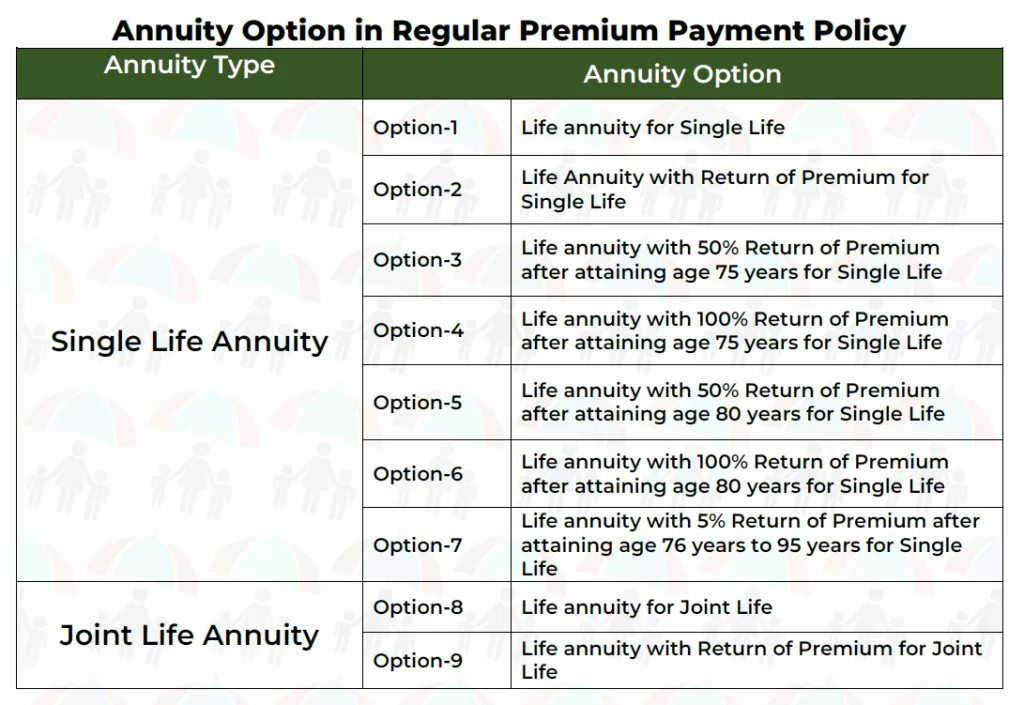

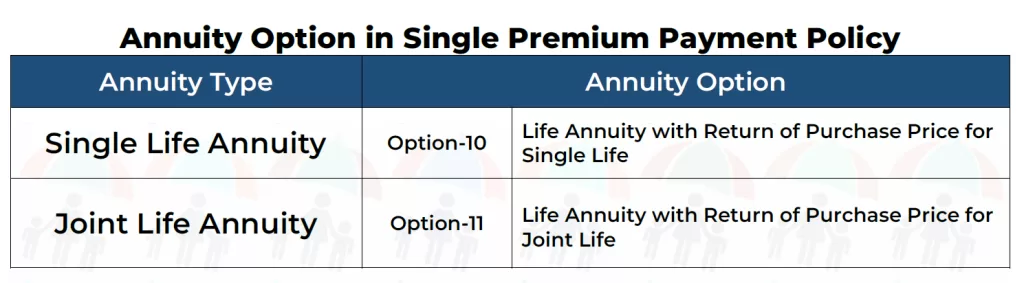

Annuity Options available in Jeevan Dhara 2

There are multiple annuity options available to choose from in LIC’s Jeevan Dhara 2. These options are

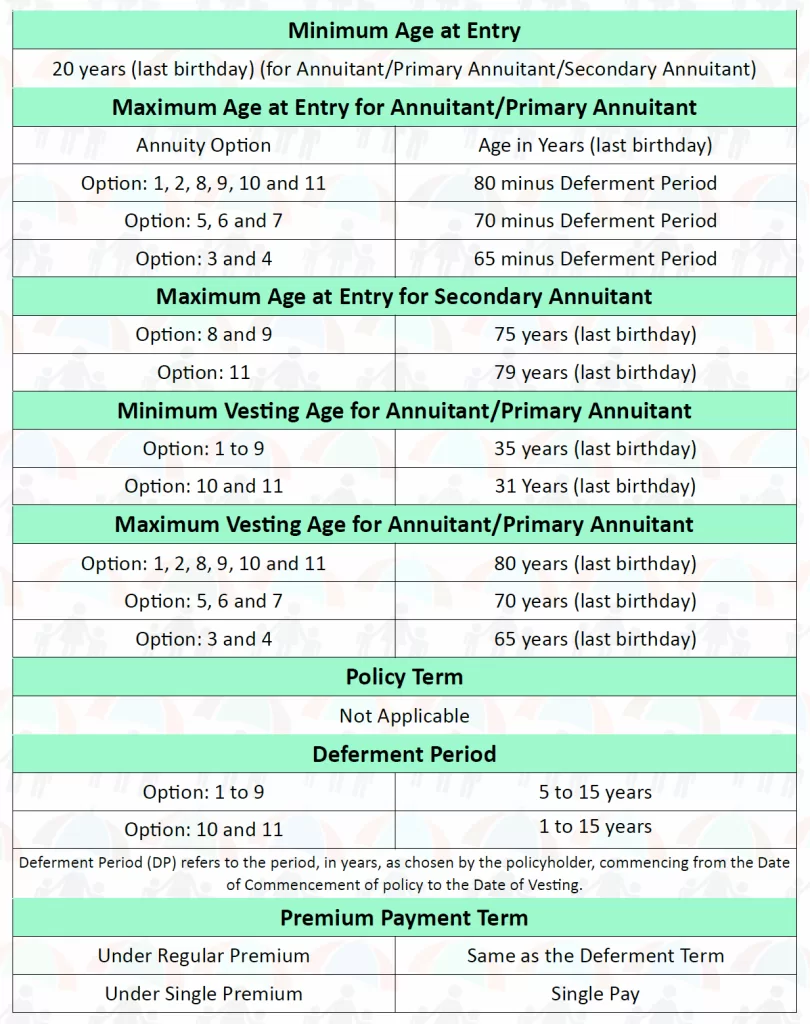

Eligibility Conditions of LIC’s Jeevan Dhara 2

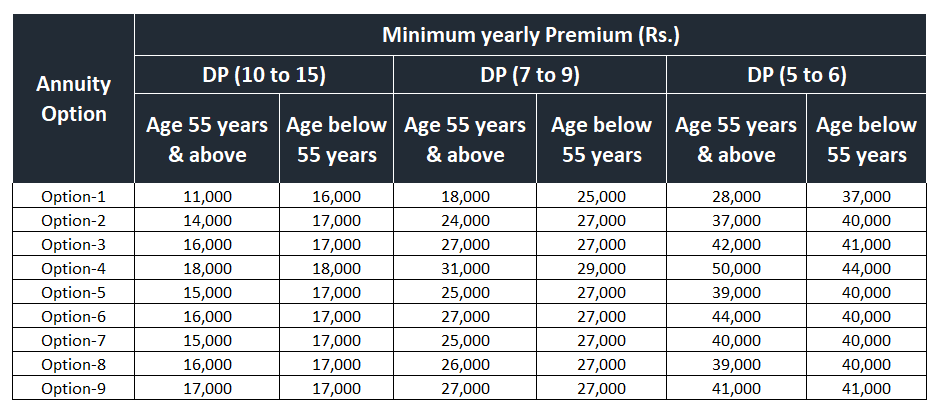

Minimum Premium under Jeevan Dhara 2

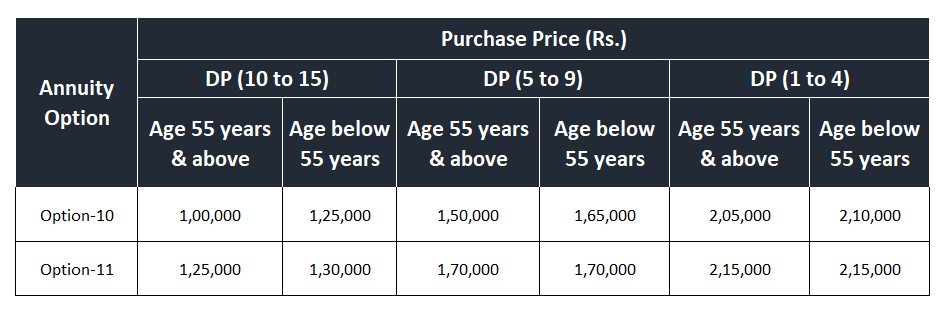

The minimum yearly premium/purchase price for different annuity options and Deferment Period (DP) for age at entry of Annuitant/Primary Annuitant below 55 years (last birthday) and for age at entry of Annuitant/Primary Annuitant greater than or equal to 55 years (last birthday) based on minimum annuity criteria are as under:

Minimum Purchase Price (in case of Single Premium)

There are maximum limit of yearly premium or purchase price in the LIC’s Jeevan Dhara 2 subject to the underwriting decision of the LIC of India.

In regular premium payment option premium can be paid in yearly, half yearly, quarterly and monthly mode (NACH and SSS only)

Mode of Annuity Payment in LIC’s Jeevan Dhara 2

The modes of annuity available are yearly, half-yearly, quarterly, and monthly.

The Annuity will be payable in arrears i.e. the annuity payment will be after 1 year, 6 months, 3 months, and 1 month from the Date of Vesting of the annuity depending on whether the mode of the annuity payment is Yearly, Half yearly, Quarterly and Monthly respectively. The date of Vesting means the date on which the Deferment Period expires and the annuity becomes payable in arrears as per the mode chosen for annuity payment. If the opted mode of the annuity payment is other than yearly, the Annuity instalment as per the chosen mode of annuity payment will be calculated as per the rules.

The mode of an annuity payment can be altered during the Deferment Period and the modified modal annuity amount will be calculated as per rule.

Benefits of LIC’s Jeevan Dhara 2

Maturity Benefit: There is no maturity benefit in the LIC’s Jeevan Dhara 2 policy. There are only survival and death benefits in this plan.

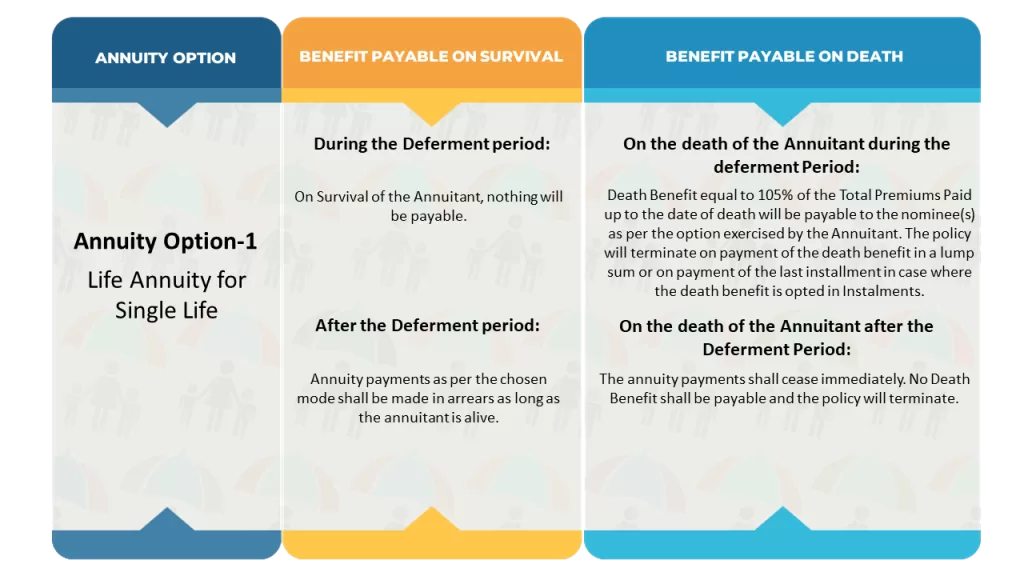

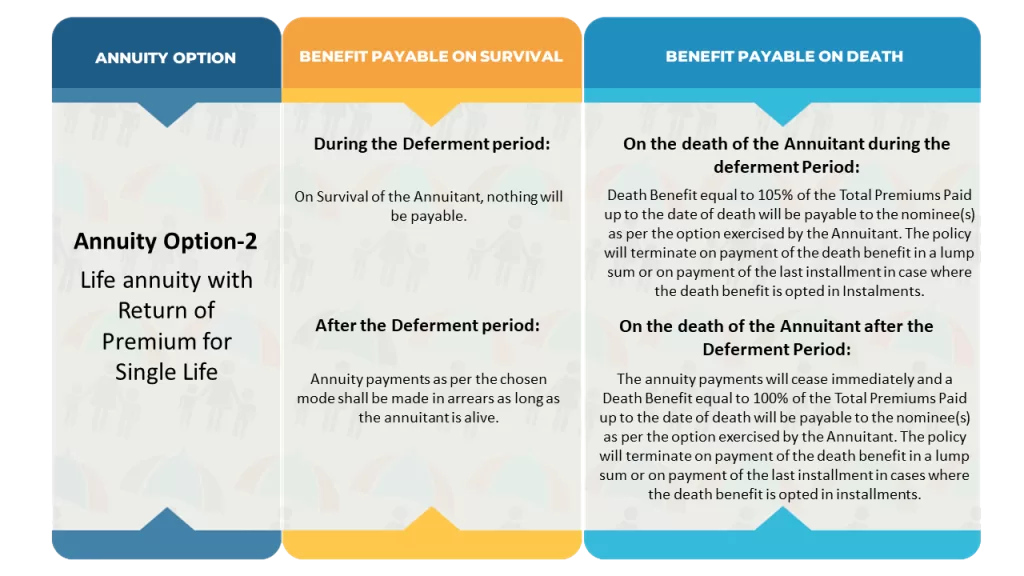

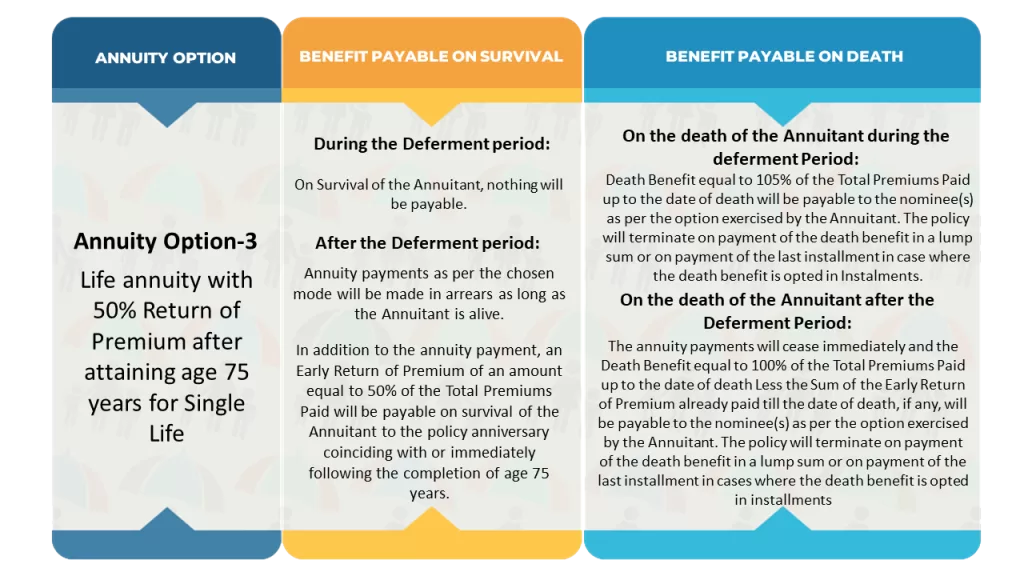

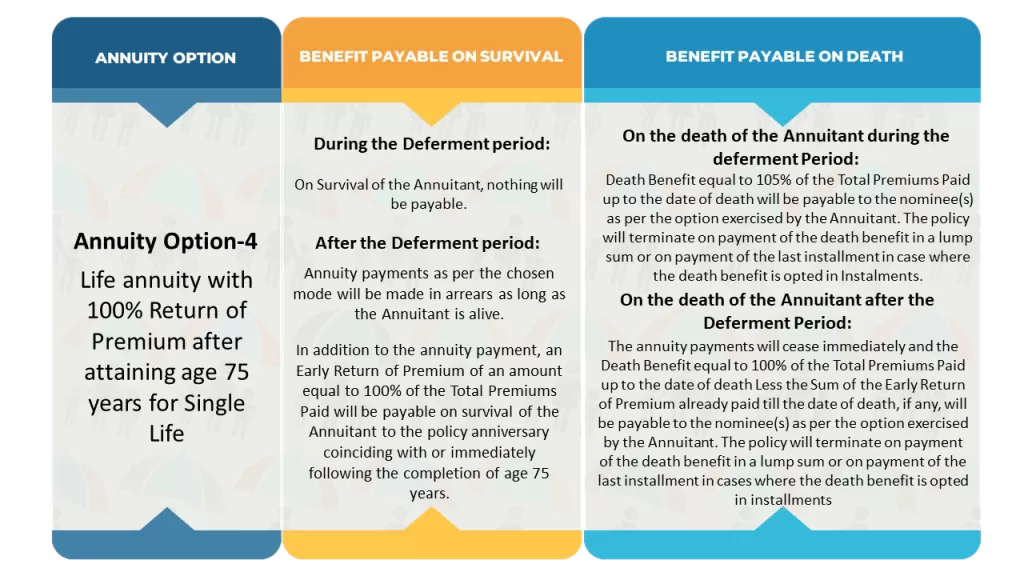

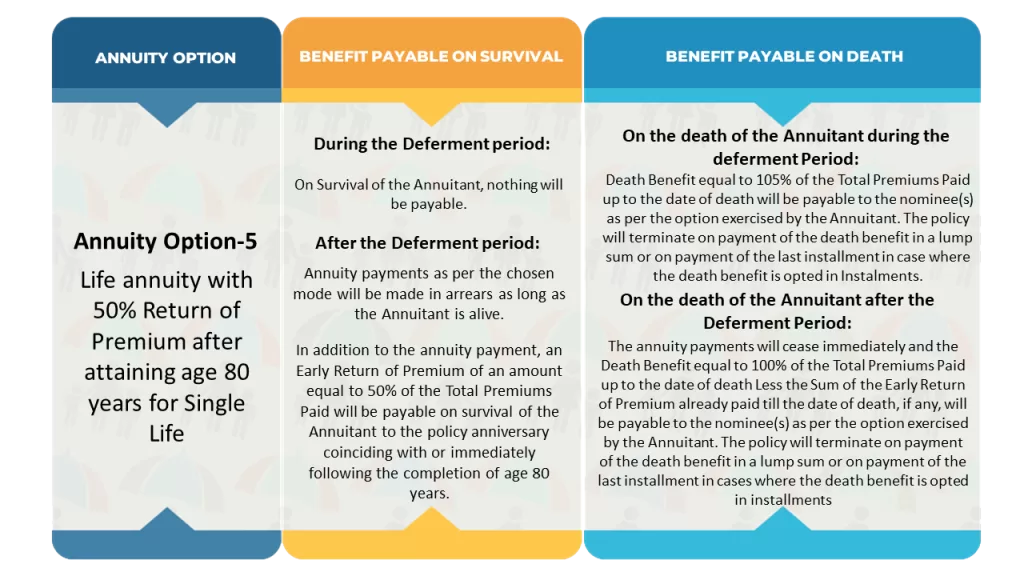

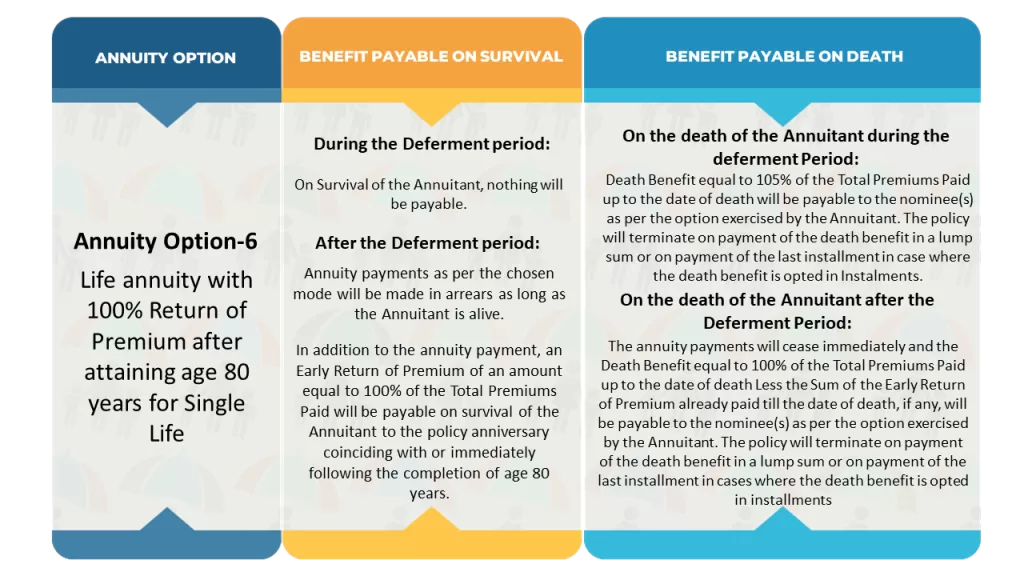

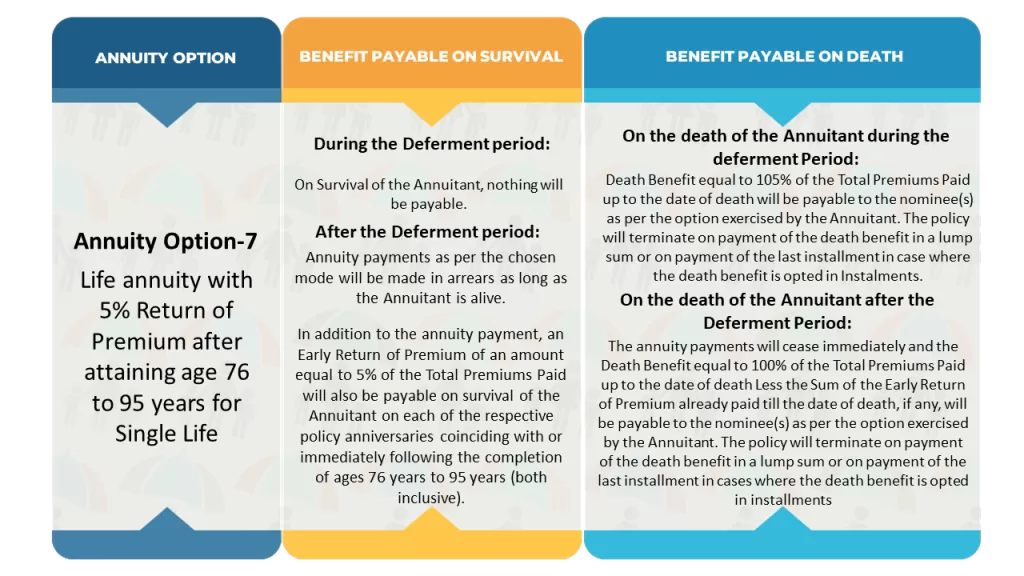

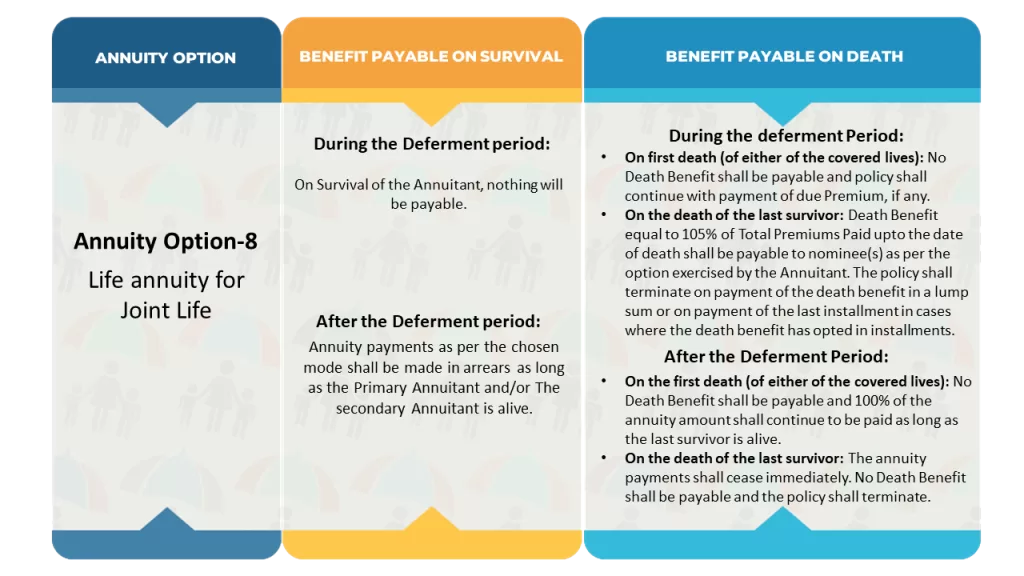

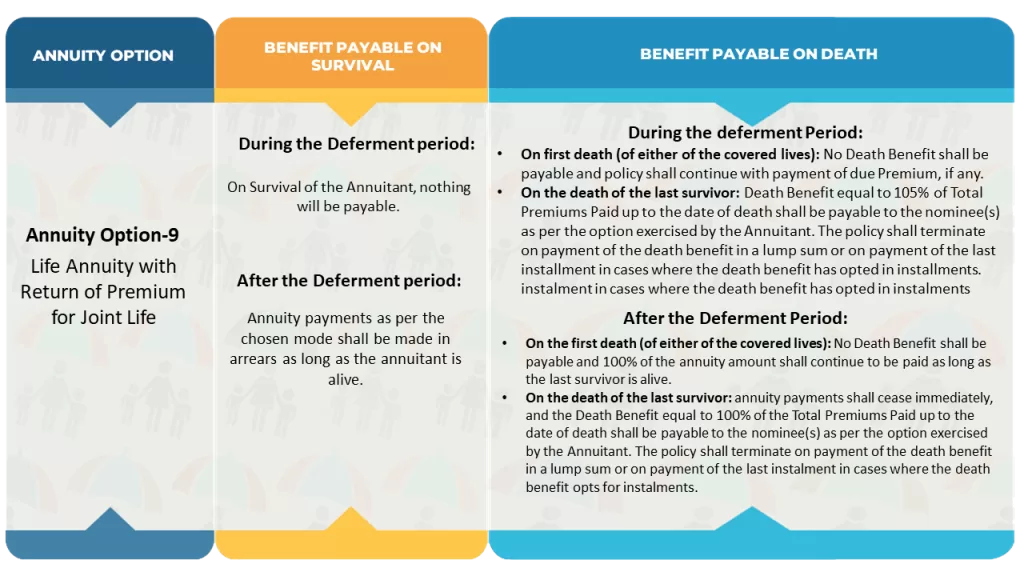

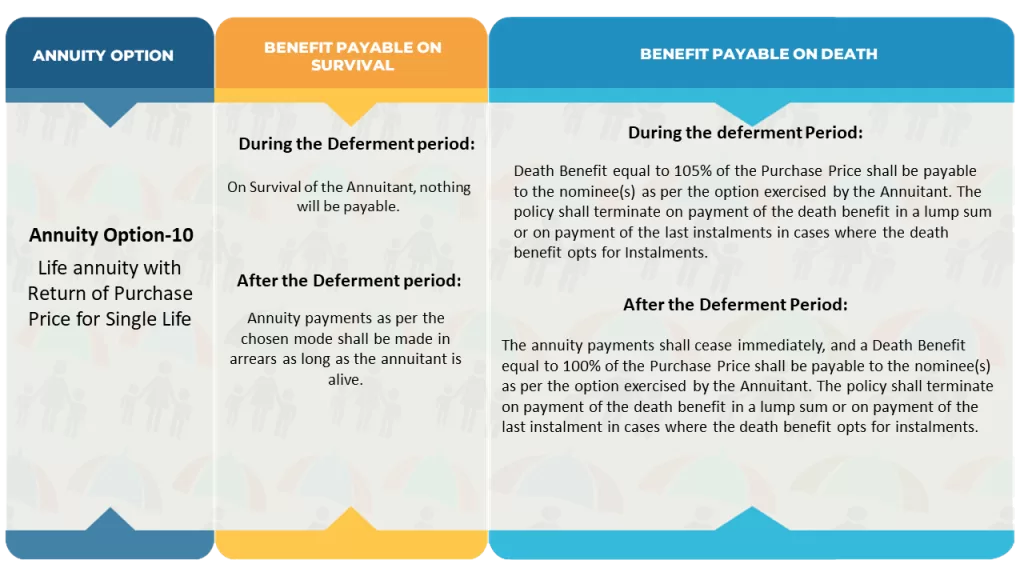

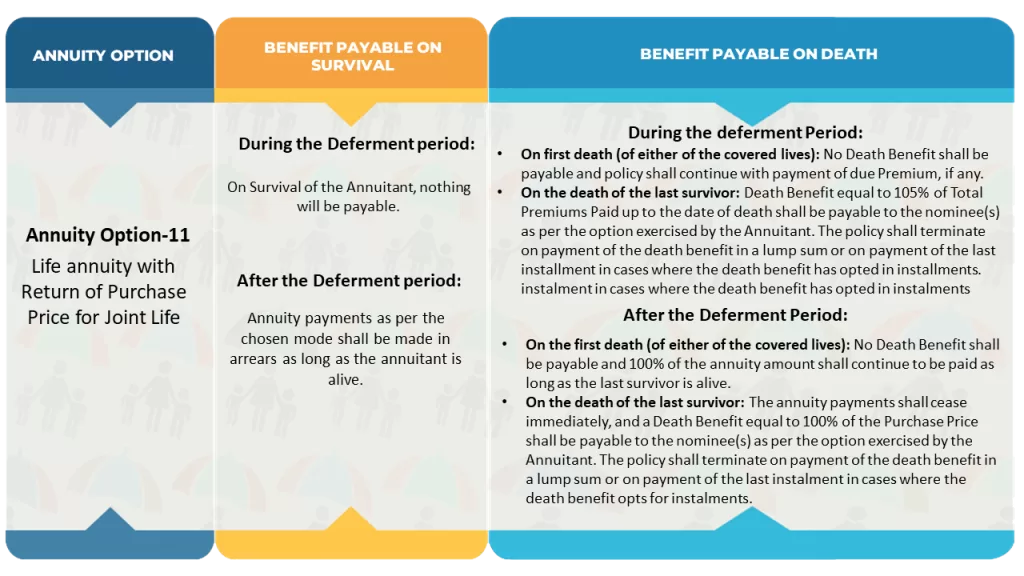

Survival and death bene in Jeevan Dhara 2 differ according to the Annuity Option chosen by the proposer when taking the policy. Survival benefit and death benefits of varying annuity options are given below:

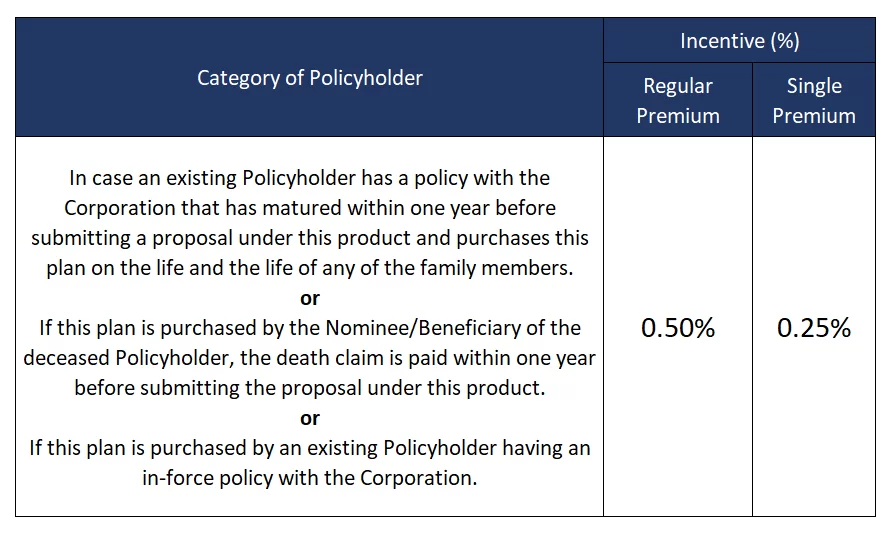

Incentive for existing Policyholders/ Nominee/Beneficiary of LIC of India

Existing policyholders, including the nominee or beneficiary of deceased policyholders, will get an additional benefit through an increased annuity rate per thousand Annual Equivalent Premium (in regular premium) or Purchase Price (in single premium). However, existing policyholders must buy this plan from any Agent/Corporate Agent/ Broker/ Insurance Marketing Firm. Benefit available to existing policyholde is given below:

Other Conditions in LIC’s Jeevan Dhara 2

Grace Period:

Single Premium: Not applicable;

Regular Premium: A grace period of 30 days for payment of yearly, half-yearly or quarterly premiums and 15 days for monthly premiums will be allowed from the date of the first unpaid premium. If the premium is not paid before the expiry of the days of grace, the policy lapses.