LIC’s Dhan Varsha (Plan No. 866) is the name of the new life insurance plan of Life Insurance Corporation of India. Dhan Varsha is available for sale with effect from 17/10/2022. It is a close-ended plan and will be available for sale up to 31/10/2023.

LIC’s Dhan Varsha is a Non-Linked, Non-Participating, Individual, Savings, Single Premium Life

Insurance plan which offers a combination of protection and savings. This plan provides financial support for the family in case of unfortunate death of the life assured during the policy term. It also provides a guaranteed lump sum amount on the date of maturity. The proposer will have two options to choose “Sum Assured on Death”. UIN for LIC’s Dhan Varsha Plan is 512N349V01.

Table of Contents

Eligibility Conditions of LIC’s Dhan Varsha

Date of Commencement of Risk: In case the Life Assured is minor below the age of 8

years, the risk under this plan will commence either 2 years from the date of commencement of policy or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately from the date of issuance of the policy.

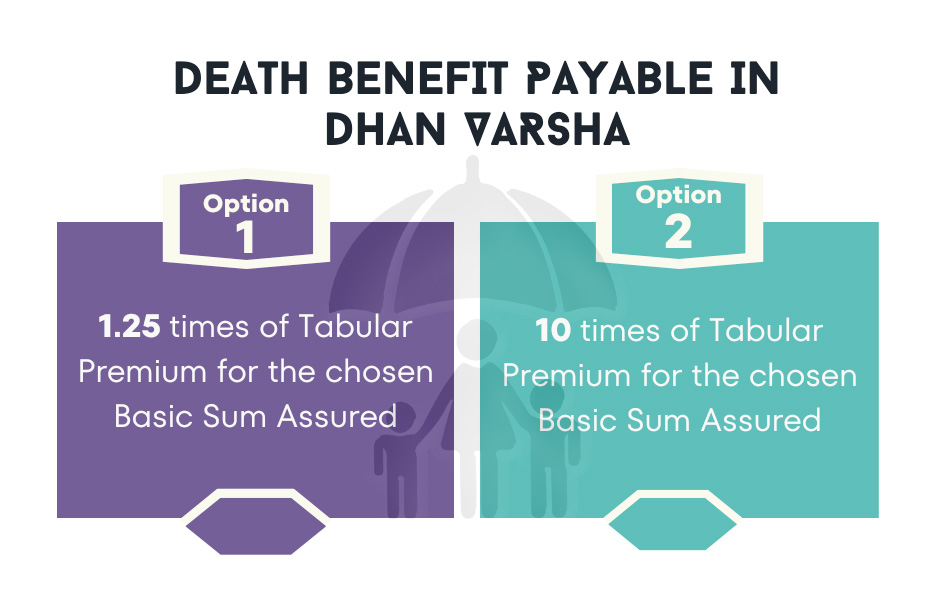

Options in LIC’s Dhan Varsha

The proposer will have two options to choose “Sum Assured on Death” in LIC’s Dhan Varsha. In Option 1, the proposer will have “Sum Assured on Death” equal to 1.25 times of tabular premium. Under Option 2, “Sum Assured on Death” will be equal to 10 times of the tabular premium.

Option 1: 1.25 times of Tabular Premium for the chosen Basic Sum Assured

Option 2: 10 times of Tabular Premium for the chosen Basic Sum Assured

The proposer has to choose one of the above-mentioned options at the proposal stage itself

subject to eligibility conditions. The premium and benefits will change according to the Option chosen and they cannot be changed later.

Death Benefit in LIC’s Dhan Varsha

If the Life Assured dies before the maturity date (and after the date of commencement of risk) in the policy Death benefit is payable. The death benefit in the policy will be equal to the “Sum Assured on Death” along with accrued Guaranteed Additions.

If in any life assured dies before the start of the risk in the policy (in case of a minor), only the premium is refunded excluding any extra premium, rider premium, and taxes.

Maturity Benefit in LIC’s Dhan Varsha

If the Life Assured survives till the Date of Maturity, “Basic Sum Assured” along with

accrued Guaranteed Additions will be payable.

Guaranteed Addition in LIC’s Dhan Varsha

LIC’s Dhan Varsha is a guaranteed Addition plan. It means there will be a guaranteed addition every year in the policy throughout the policy term. Guaranteed Addition rates in Dhan Varsha are different for a different plan, sum assured, and the death sum assured option chosen in the policy. Guaranteed Addition rates in Plan 866 are as follows

Optional Riders

Unlike other LIC plans, Dhan Varsha offers riders along with the base plan on paying an additional premium. These two riders are LIC’s Accidental Death and Disability Benefit Rider UIN (512B209V02) and LIC’s New Term Assurance Rider (UIN 512B210V01). Eligibility conditions for these riders are different than the base plan. Please consult your insurance advisor if you are eligible for these riders or not.

Other conditions in LIC’s Dhan Varsha

- Surrender: Surrender is allowed at any time during the policy term. The Guaranteed Surrender value will of 75% of Single Premium (excluding rider premium, extra premium if any, and taxes) in the first three policy years and 90% of Single Premium thereafter. The surrender value payable is higher of the Guaranteed Surrender Value (GSV) or Special Surrender Value (SSV).

- Loan: Loan is payable after completion of 3 months from the date of policy bond issuance or expiry of the free look period. The maximum loan payable is as follows

- Freelook period: Policyholder will get 30 days free look period.

- Back Dating: Date backing is allowed but not before the date of launch of the product.

- Assignment and Nomination: Assignment and Nomination are allowed as per sections 38 and 39 of the Insurance Act 1938.

- Suicide Clause: If the Life Assured (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk, the nominee or beneficiary of the Life Assured shall be entitled to 80% of the Single Premium paid excluding any taxes, extra premium and rider premiums other than Term Assurance Rider, if any. The nominee or beneficiary of Life Assured shall not be entitled to any other claim under this policy

If you have any other questions related to LIC servicing then just mail us at [email protected]. You can also comment below. Share if you liked this information useful because Sharing is caring!.