LIC’s New ULIP Plan Index Plus (Plan No. 873)

- Dipti R Barik

- Feb 5, 2024

- 6 min read

Updated: 11 hours ago

LIC of India has launched a new ULIP plan, Index Plus (Plan No. 873). LIC's Index Plus is a Non-Participating, Unit Linked, Regular Premium, Individual Life Insurance plan. LIC's Index Plan offers insurance cum savings during the term of the policy. This plan is available for sale starting 06/02/2024. The UIN of Index Plus is 512L354V01.

LIC's Index Plus (Plan No. 873) offers two Unit Fund options. In Index Plus, the life assured receives a Guaranteed Addition after a specific year during the policy term, as a percentage of the Annual Premium. This plan can be taken online through LIC's website.

Features of LIC's Index Plus

The Following are the main features of LIC's Index Plus.

Insurance with the benefit of Investment in a single plan

Guaranteed Addition on the 6th, 10th, 15th, 20th and 25th policy year.

Two unit funds, namely Flexi Smart Growth Fund and Flexi Growth Fund, are based on the NIFTY 50 and NIFTY 100 indexes.

Refund of Mortality charges on Maturity

Liquidity through the Facility of Partial withdrawal is available after the 6th policy year.

Choose the risk cover of 7 times or 10 times the Annualised premium.

Higher Guaranteed Addition on a higher premium

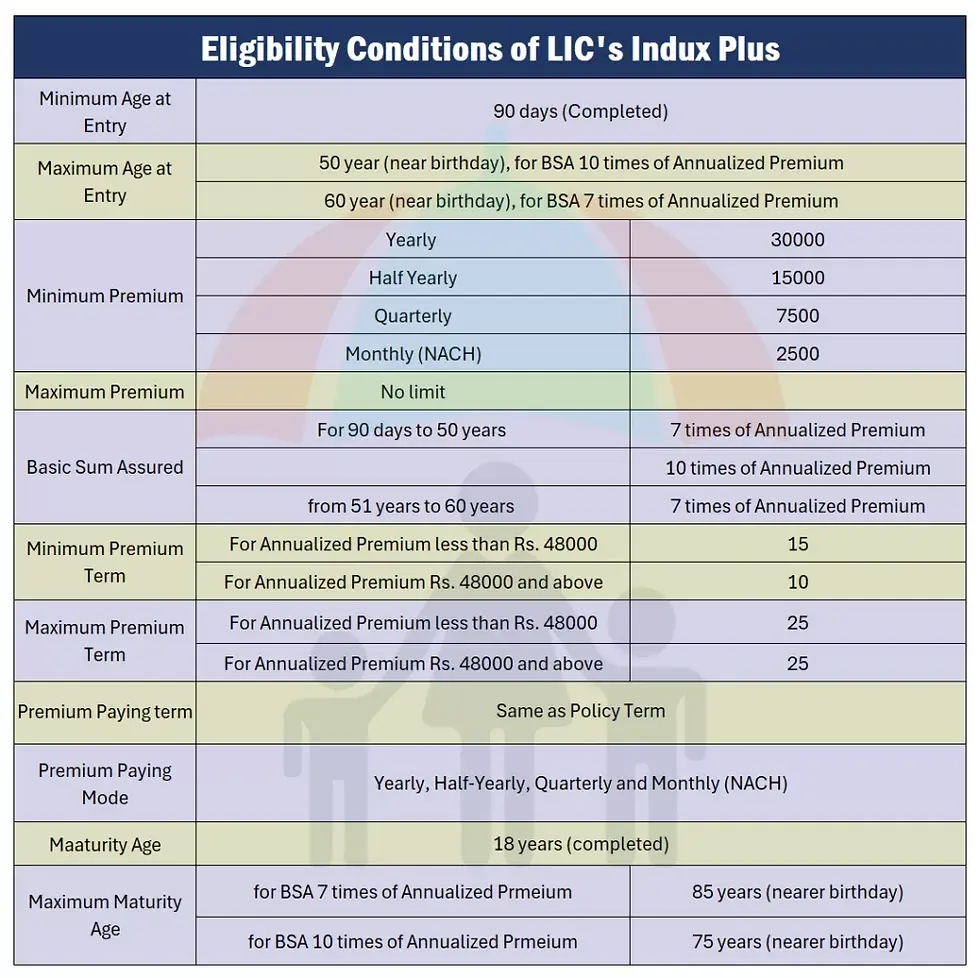

Eligibility Conditions of LIC's Index Plus

In the above table, BSA denotes the Basic Sum Assured.

Date of Commencement of Risk: If the Life Assured is a minor under 8 years old, risk will commence after 2 years from the date the policy is taken or after the child reaches the age of 8, whichever is earlier.

Maturity Benefit in LIC's Index Plus

Life Assured will get an amount equal to the Unit Fund Value on the maturity date. Along with the Unit Fund value, Life Assured will also get the mortality charges deducted during the policy term. Mortality charges will only be refunded when the premium is paid for the policy's full term—no refund of Mortality charges in case of policy surrender.

Guaranteed Addition in LIC's Index Plus

LIC's Index Fund provides Guaranteed Addition after a specified policy term in the inforce policy (where all premiums have been paid). Guaranteed Addition is payable as a percentage of Annulized Premium and will be added to Unit Fund Value. The Guaranteed Addition rates are given below:

Death Benefit in LIC's Index Plus

Death Benefits will be paid if the policy is in force and the Life Assured dies before the Date of Maturity (including the Grace Period).

On the death of the Life Assured before the Date of Commencement of Risk

If the Life Assured dies before the Date of Commencement of Risk, the Unit Fund Value on the date of death will be paid to the proposer.

On the death of the Life Assured after the Date of Commencement of Risk

If the Life Assured dies after the Date of Commencement of Risk, the payout will be the highest of the following:

The basic Sum Assured is reduced by any Partial Withdrawals made in the two years preceding death;

Unit Fund Value as of the date of intimation of the death of life assured or

105% of the total premiums received up to the date of death are reduced by partial withdrawals made in the two years preceding death.

The admissible claim will be booked upon receipt of intimation of death and the death certificate. Mortality Charges, Accident Benefit Charges, Policy Administration charges, and Tax Charges recovered after the date of death will be added back to the Unit Fund.

Any Guaranteed Addition added to the policy after the date of death will be recovered from the Unit Fund.d

Partial Withdrawal in LIC's Index Fund

Policyholders can make partial withdrawals of their units after the five-year lock-in period, starting from the policy commencement date. However, the following conditions apply:

For minors, partial withdrawals are permitted only once the Life Assured is 18 years of age or older.

Partial withdrawals can be made in fixed amounts or fixed numbers of units.

The maximum amount that can be withdrawn as a percentage of the fund during each policy year is subject to the following limits:

Investment Fund Types in LIC's Index Plus

While purchasing the policy, the proposer can choose any of the two available funds in Index Plus. These funds are the Flexi Smart Growth Fund and the Flexi Growth Fund. Details of these funds and their broad investment pattern are given below:

Discontinued Policy Fund (SFIN: ULIF001201114LICDPFNLIF512):

This fund is a segregated unit fund consisting of discontinued policy funds from all unit-linked life insurance products. The investment Pattern of the Discontinued policy fund is

Money market instruments: 0% to 40%

Government securities: 60% to 100%

Charges and Frequency of Charges

Premium Allocation Charges

A percentage of the premium is deducted toward the charges from the received premium. The premium allocation charges as a percentage of the instalment premium are given below:

Mortality Charges

A mortality charge is deducted from the Unit Fund each month to provide the policy's risk cover. These charges will be deducted only when the Basic Sum Assured exceeds the Unit Fund value in the policy. Mortality Charges will not be deducted if the Unit Fund value exceeds the Basic Sum Assured.

Accident Benefit Charge

This charge is deducted from the Unit Fund Value if the customer opts for the LIC's Linked Accidental Death Benefit Rider. There will be no deduction if customers do not opt for the rider. The rider's rate is Rs 0.40 per thousand of the sum assured.

Fund Management Charges

Fund management charges in ULIPs cover the cost of allocating your money into the funds of your choice. This charge is levied at the time the NAV is computed, which is done daily. The NAV thus declared will be net of FMC. Fund management Charge in Index Plus is

1.35% per annum of the Unit Fund in both the funds

0.50% per annum in the Discontinued Policy Fund.

Policy Administration Charge:

A charge known as the Policy Administration Charge will be applied at the start of every policy month beginning from the sixth policy year until the end of the policy term. This charge will be capped at Rs 500 per month (equivalent to Rs 6000 per annum). It will be deducted from the Unit Fund Value by cancelling units for the corresponding month (i.e., Rs 6000 p.a.) for the equivalent amount.

Other Important Conditions in the LIC's Index Plus

Lock-in Period:

There is a 5-year lock-in period for LIC's Index Plus, as with all LIC's ULIP plans.

Switching:

Switching is allowed in the Index Plus. The Life Assured can change the Fund type in accordance with their risk appetite at any time during the policy term, provided the policy is in force. Four switches are free per year, and thereafter a fee of Rs. One hundred will be charged per switch of the fund.

Learn more about how to switch funds online in LIC ULIPs.

Surrender:

The policy can be surrendered at any time during the policy term. However, suppose the life assured surrenders the policy during the locking period. In that case, the fund will be transferred to the Discontinued Policy Fund, and the fund value will be paid upon the lock-in period's completion. Discontinue Charges will be recovered from the unit fund.

If the life assured surrenders the policy after the lock-in period, then the fund value will be paid to the life assured without any deduction. There are no discontinuity charges after the lock-in period.

Loan:

There is no loan facility in LIC's Index Plus

Revival:

Policyholders can revive the policy within 3 years from the date of the first unpaid premium by paying all the due premiums. There will be no interest charged. However, all the charges will be recovered from the Unit Fund on revival.

Nomination and Assignment:

Nomination is compulsory as per Section 39 of the Insurance Act of 1938. Policyholders may assign the policy for valuable consideration under Section 38 of the Insurance Act of 1938.

Back Dating:

Backdating is not allowed in any LIC of India ULIP plan.

Suicide Clause:

Suppose the life assured commits suicide within 12 months from the date of commencement of the policy or the date of the revival. In that case, only the Unit Fund value available in the policy will be paid to the nominee.

Free Look Period:

Suppose the policyholder is unhappy with the "Terms and Conditions" of their policy. In that case, they can return the policy to the LIC of India within 30 days of receiving the electronic or physical copy of the policy document, whichever is earlier. They should also state the reasons for their objection.

If you have any other questions about LIC servicing, email us at info@sumassured.in. You can also comment below. Share if you liked this valuable information because Sharing is caring!

Disclaimer: This blog post is written based on the information available. In case of any discrepancy or wrong information, don't hesitate to get in touch with any authorised LIC agent or the nearest LIC office for clarification.

Comments