On March 02, 2020, the Life insurance corporation of India launched its new ULIP plan Nivesh Plus, Plan No. 849. LIC’s Nivesh Plus is a single premium, non-participating, Unit linked, Individual Life insurance plan. This an insurance cum investment plan. In other words, you enjoy both life insurance cover and returns together throughout the policy term. LIC’s Nivesh Plus is available for sale online as well as offline.

In LIC’s Nivesh Plus, you have the option to choose risk cover as per your need. Option 1 will give you 1.25 times risk cover of single premium, on the other hand, option 2 will give 10 times the risk cover of a single premium. However, once you opt for the option, you cannot change it later. Besides this, LIC’s Nivesh Plus offers Guaranteed Addition a certain percentage of single premium after a fixed interval of time.

Unique Identification number (UIN) of LIC’s Nivesh plus is 512L317V01

Table of Contents

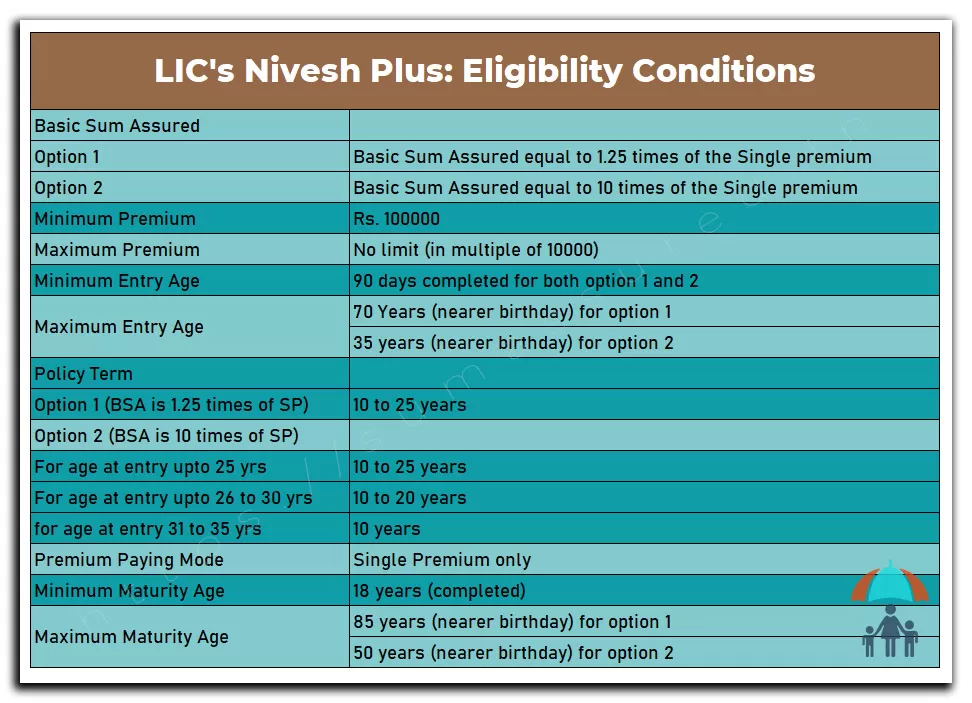

Eligibility Conditions and Features

Date of Commencement of Risk: In case the Life assured is less than 8 years old at the time of taking the policy. The risk cover will start after 2 years of policy DOC or when Life assured completes 8 years of age, whichever is earlier. In case the life assured is 8 years or old at the time of taking the policy, then risk cover will start immediately.

Date of Vesting: If the life assured is minor at the time of taking the policy. Then, on completing the age of 18, the policy will automatically vest in the name of the life assured.

Benefits in Nivesh Plus

Benefits payable in LIC’s Nivesh Plus includes Death claim and Maturity Claim. If the life assured dies before the date of maturity, then the benefit is payable to the nominee. If the life assured survives till the date of maturity then maturity claim is payable to the life assured himself. Let’s see what are the conditions for these benefits in LIC’s Nivesh Plus.

The benefit payable on the death of the life assured.

If the life assured dies before the stipulated date of maturity, then death claim is payable to the nominee. Death claims may come before the start of risk or after the risk commencement. In other words death benefit payable is different in both the scenarios i.e. death before commencement of risk and death after commencement of risk.

Death benefit on death before the date of commencement of Risk:

If the life assured is minor and he dies before the commencement of the Risk in the policy. Then an amount equal to Unit fund value is payable to the proposer.

Death benefit on death after the date of commencement of Risk:

If the life assured minor or major dies after the date of commencement of the risk. Then, an amount equal to the Basic sum assured reduced by any partial withdrawals during the last 2 years (before the date of death) or fund value, whichever is higher. Basic sum assured is as per the option chosen by the life assured/proposer.

The benefit payable on maturity

On the date of maturity life assured will get the Unit fund value of the policy as maturity benefit.

Optional Benefit (Riders)

LIC’s Linked Accidental Death Benefit Rider (UIN: 512A211V02): It is an optional rider that the proposer can opt at the time of taking the policy. Although, you can take this rider during the policy term at any policy anniversary. Though you can take this rider at any time during the policy term if cancel cannot re-opt it again. The maximum entry age for this rider is 65 years.

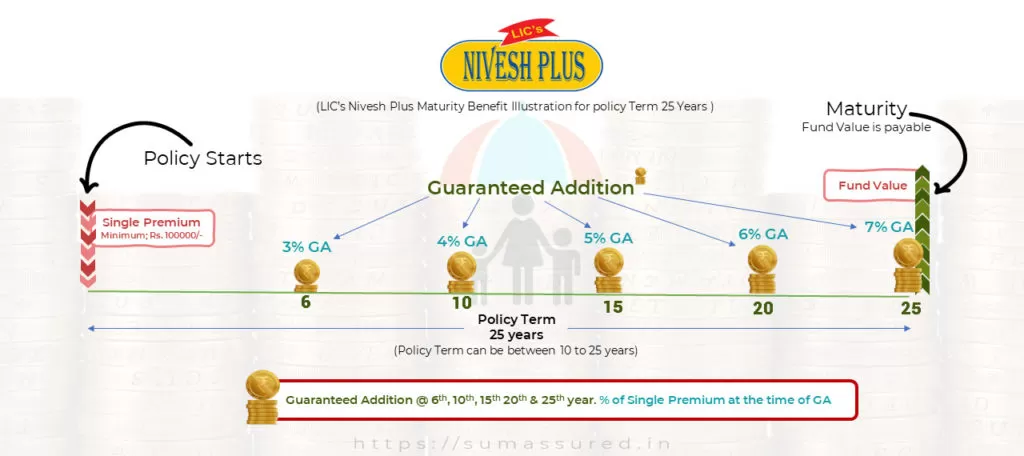

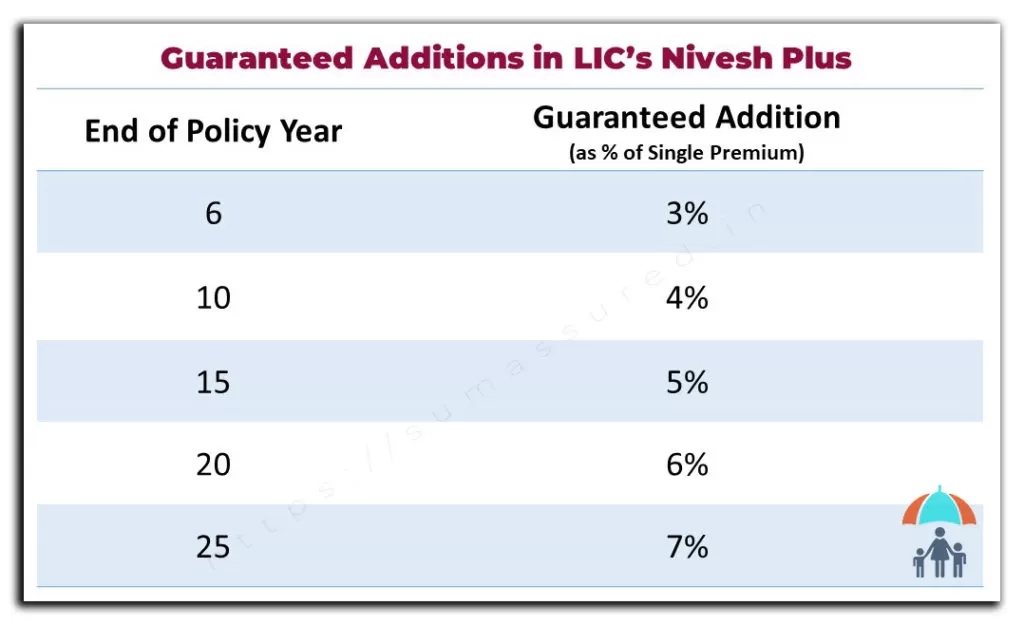

Guaranteed Addition in LIC’s Nivesh Plus

LIC’s Nivesh Plus has a provision of Guaranteed Addition. After completion of a specific duration in the policy, a certain percentage of the single premium will be added in the unit fund of the policy. See the table below to know the Guaranteed Addition percentage of duration after which it is added.

This loyalty addition is then converted to unit funds based on the NAV of the fund in the policy as on date of this guaranteed addition. Any such addition after date of death of policy holder we will reduced from claim amount (due late intimation of death claim)

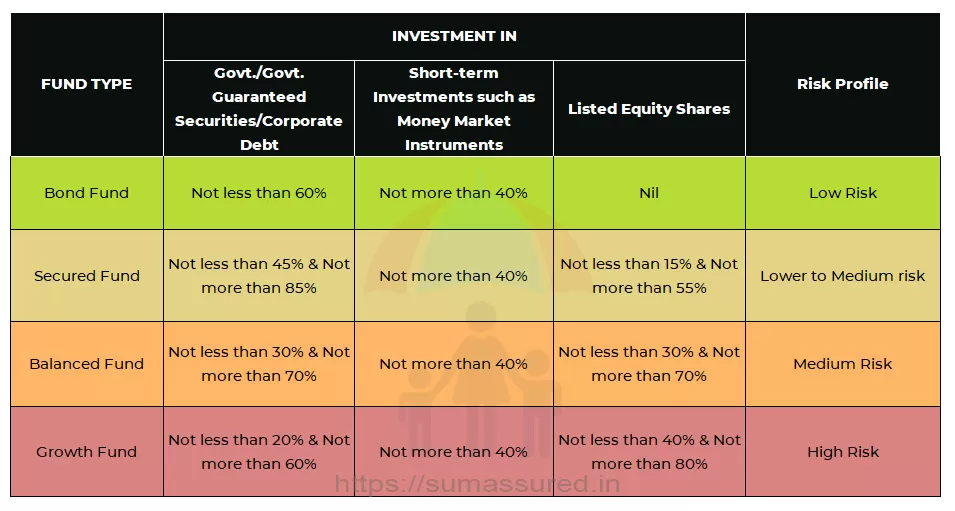

Investment Fund Types and NAV

Just like almost all other ULIP plans of LIC of India, LIC’s Nivesh Plus has four fund types. These funds are namely, Bond Fund, Secured Fund, Balanced Fund, and Growth Fund. These funds are designed according to various risk profile individuals. In other words, despite taking a ULIP policy, an individual can choose a low-risk fund as per his choice and switch to other funds also. The table given below has summarised the details about these funds.

Discontinued Policy Fund: LIC of India has created yet another fund for discontinued policies. That means, this funds is for the policy which are lapsed and cannot be revived. This fund have investment pattern of 0% to 40% in Money market Instrument and 60% to 100% in Government securities.

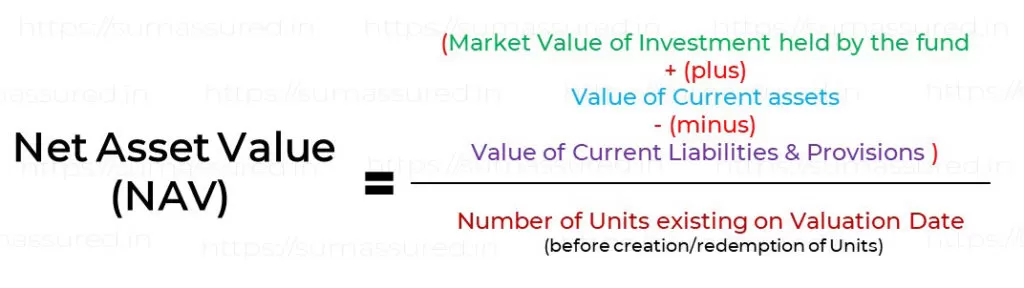

Computation of NAV

NAV or the Net Asset Value of all the funds will be calculated on a daily basis. NAV is basically based on the investment performance and fund management charges of that particular fund.

Charges in LIC’s Nivesh Plus & Frequency of Charges

- Premium Allocation of Charge: This charge is a percentage of the premium you pay in the policy. The Balance amount remains after the deduction of premium allocation charge is used to by units in the policy. The Premium Allocation charges in LIC’s Nivesh Plus is 3.30% of premium in the offline sale and 1.50% in online sale.

- Mortality Charge: Mortality charges are nothing but the cost of life insurance offered in the policy. At the beginning of each month, this charge will deduct from your unit fund. Monthly mortality charges are 1/12 of annual Mortality charges. If the risk has not started in the policy (in minor cases) then mortality charges will not be deducted. However, the deduction will start as soon as the risk cover starts in the policy. Since it depends upon the risk cover in the policy. It will be different for different age and risk covered ie 1.25 time the single premium or 10 times of the single premium.

- Accidental Benefit Charge: This charge is for accidental cover in the policy. If you have not taken the accidental cover, then no charge deduction

Other Charges

- Policy Administration Charge: There are no policy administration charges in this policy.

- Switching Charge: If you switch from one fund to another ULIP policy, then you have to pay some charges. This is Switching charges. Although you will get 4 free fund switches in a year. After Four switches, you have to pay Rs. 100 per switch.

- Fund Management Charge: Fund Management Charge or FMC is for managing the fund in the policy. It is 1.5% of the Value of asset valuation day for Bond Fund, Secured Fund, Balanced Fund, and Growth Fund. For Discontinued Policy fund it is 0.5%.

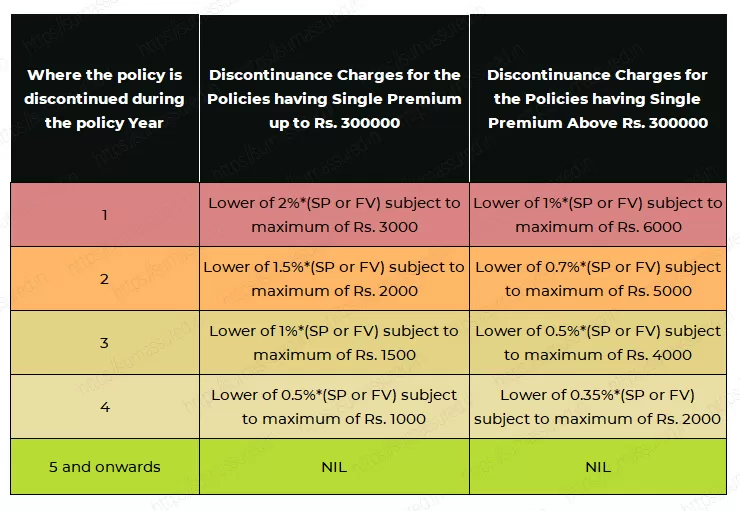

- Discontinuation Charges: If you discontinue your policy, then you have to pay these charges. You have to pay these charges if you discontinue this policy before 5 years. There are no discontinuation charges after 5 years These charges are as follows.

5. Partial Withdrawal Charge: Whenever you do a partial withdrawal in this policy. You have to pay a Partial withdrawal charge. This Charge is Flat Rs. 100 per partial withdrawal.

6. Miscellaneous Charges: This charge is for alteration in policy. If you wan to opt the Accidental Benefit Rider in between the policy term. You will this charge. This charge is flat Rs. 100.

Although LIC of India can change these charges at any time but they will not be greater than prescribed charges by IRDAI.

Options Available Under Base Plan

- Switching: As per risk appetite, you can change your fund type any time during the policy term. Although only the first four switches per year are free.

- Settlement Option: Policyholders have the option to choose the death claim settlement option. In other words, nominee will get the death claim in installments.

- Partial Withdrawal: Policyholders can withdraw a certain amount from policy funds without closing the policy. Maximum partial withdraw in policy is 15% during 6th to 10th year, 20% during 11th to 15th year, 25% during 16th to 20th year, and 30% during the 21st to 25th year.

- Top up: Top up is not allowed in this policy.

- Increase/decrease in benefits: No change in Basic Sum Assured. You can only take or discontinue Accidental Rider during the policy term.

Other conditions in LIC’s Nivesh Plus

- Lock-in Period: This policy have five year lock-in period.

- Surrender: Surrender is allowed only after 5 years. If you discontinue your policy before 5 years. The unit value amount will be transferred to the discontinuation policy fund. You will get the amount only after completion of 5 years. If you surrender your policy after 5 years, the surrender value will be paid immediately.

- Loan: Loan is not available in this policy

- Compulsory termination: If there are no sufficient Unit fund in the policy to deduct the charges, then the policy will be terminated (only if policy have run 5 years).

- Freelook period: Policyholder will get 15 days free look period. 30 days in case of online sales. There will be some deductions according to LIC rules.

- Back Dating: Not allowed

- Assignment and Nomination: Assignment and Nomination are allowed as per section 38 and 39 of the Insurance Act 1938.

If you have any other questions related to LIC servicing then just mail us at [email protected]. You can also comment below. Share if you liked this information useful because Sharing is caring!.

Pingback: How to switch funds online in LIC ULIPs? - Sum Assured