Term Insurance Plans are the best plans to cover risk of life. Term plans not only provide high risk cover but with less premium in return. With increase in the Insurance companies premium for term plans differ very much. Difference in the premium can be double between lowest to highest, this puts the person taking insurance in dilemma of which company is best to take Term Insurance Plans.

Key to choose the company to take Term Insurance Plan is not the premium is be paid, but the performance of the company toward claim settlement. Term plans do not provide any returns to policy holder if survives till the end of the term, it is only taken to provide the financial security to you loved ones. What if the claim is denied to you nominee?

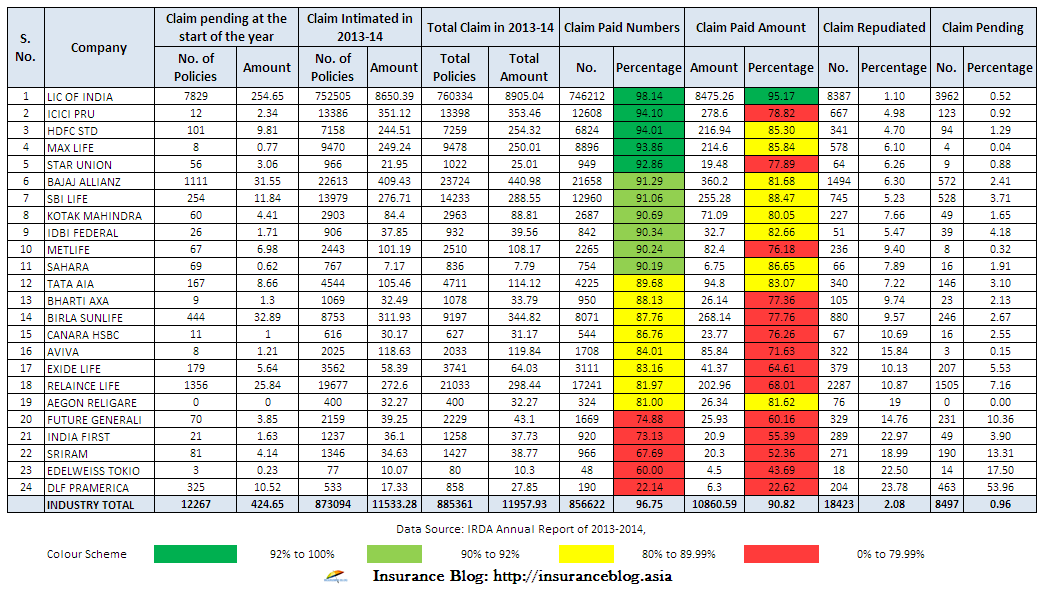

IRDA provides various data related to insurance companies which also includes Individual death claim data. This data provides the details related to no. of claim settled during a financial year, claim repudiated and claim pending for that year. It gives a good picture to choose a good company to buy term insurance plan.

Data given above was published in annual report of IRDA annual report of 2013-2014, and it is related to Individual death claim during financial year 2013-2014. Following things to be kept in mind before choosing right insurance company to buy term plan

- Claim paid percentage must be greater than 90% for both numbers and amount.

- Don’t see the number of claim settled, but also the amount of claim settled too. It shows whether higher sum assured plans are settled or not.

- See if higher amount is pending at the end of the year, means company is taking too much time to settle the higher sum assured plans.

- Above data do not show reason for rejection of claim, rejection can be due to genuine reasons, therefore data should be used wisely to arrive any final conclusion.

- Do not go for low premium only.

- Older an bigger companies have good claim settlement ratio and faster settlement process too.

- Choose a company with a better network.

- If you are planning to buy the plan online, then make sure the office of the insurer is in your town or very near to you to avoid any inconvenience later on.

- Read the terms and condition as soon as you get the policy bond.

Your decision to take the Term Plan is to secure the future of your loved ones when you will be not with them, so take right decision while taking the term plan so that they don’t have to suffer or denied to take the claim amount.

Please check claim settlement ration LIC has highest claim settlement and get policy from local agents only.

I will get policy Jivan saral .this policy annual primiyum 12010 I will surrender 2020 I will get this policy 25/10/2010 and mi bdate 31/07/1984